Dollar extends slide despite solid GDP print

Dollar stays wounded despite strong data

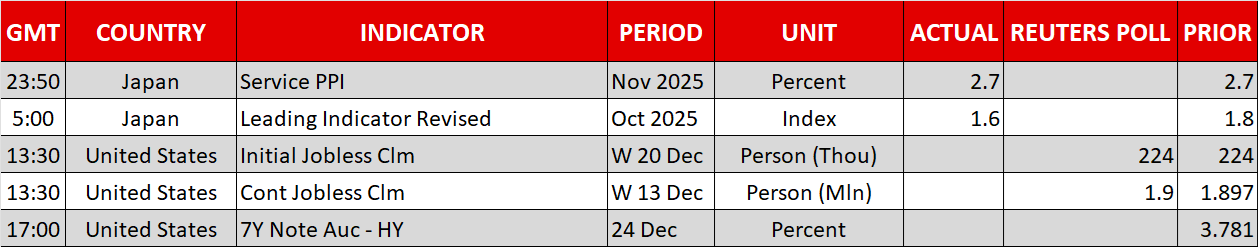

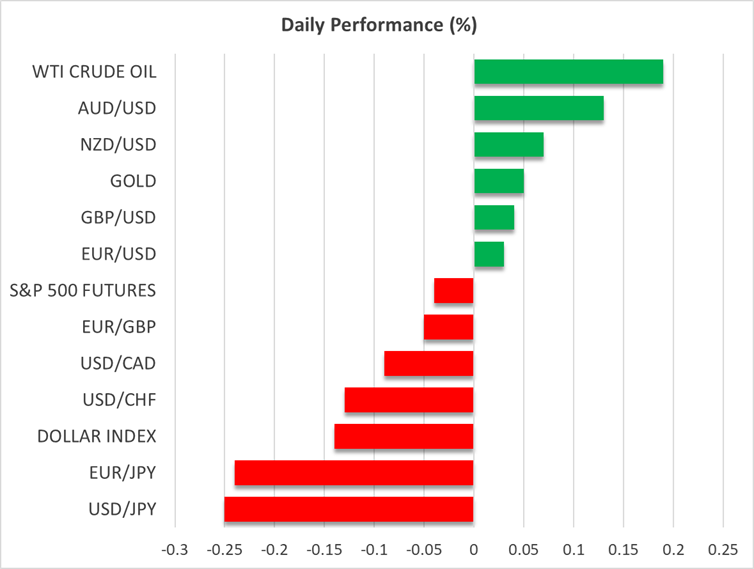

The US dollar extended its decline against all its major peers on Tuesday, remaining on the back foot today as well, even after the better-than-expected GDP data for Q3 prompted traders to remove some basis points worth of rate cuts by the Fed for 2026.

The US economy accelerated to 4.3% q/q SAAR from 3.8% in Q2, confounding expectations of a slowdown to 3.3%, with the GDP price index jumping to 3.7% q/q from 2.1%.

This has prompted investors to somewhat scale back their Fed rate cut bets and pencil in 53bps worth of reductions for next year. Ahead of the release they were anticipating 60bps. Yet, the US dollar continued falling, perhaps as the divergence in monetary policy expectations between the Fed and other major central banks, which are expected to start or continue raising interest rates in 2026, remains well entrenched.

What may have also allowed traders to take off the table some basis points worth of expected rate reductions was the weekly ADP release, which revealed a four-week moving average of 11.50k jobs gain. That is a slowdown from the upwardly revised 17.50k for the previous week, but still a solid print pointing to some sort of recovery in the labor market.

Today, dollar traders may pay attention to the initial jobless claims for last week to confirm whether the labor market has indeed entered a recovery path.

Yen shorts covered due to intervention concerns

The yen continued to outshine its major peers as the latest round of intervention warnings by Japanese officials, especially comments by Finance Minister Katayama, prompted traders to cover their short yen positions.

With liquidity becoming thinner during the Christmas holidays, investors turned extremely cautious as any action by Japanese authorities during these days could result in higher-than-usual market volatility.

Wall street gains, gold hits new record, oil extends rebound

Wall Street indices extended their gains yesterday, despite the rise in 2-year Treasury yields and the pushback in Fed rate-cut expectations. The S&P 500 climbed to a new record high, perhaps as the robust GDP print and the decent ADP report may have sparked enthusiasm about the performance of the world’s largest economy. Still, with the forward price-to-earnings ratio of the S&P 500 remaining near its 2020 highs, the risk of a decent correction in 2026 remains high.

The New York Stock Exchange will close early today and remain closed tomorrow in celebration of Christmas.

Gold and silver extended their rallies to fresh record highs, while oil recovered more ground, supported by the risk of supply disruptions from Venezuela and Russia. The metals may be attracting safe-haven flows as the latest escalation in the war between Russia and Ukraine dented chances of an imminent truce.