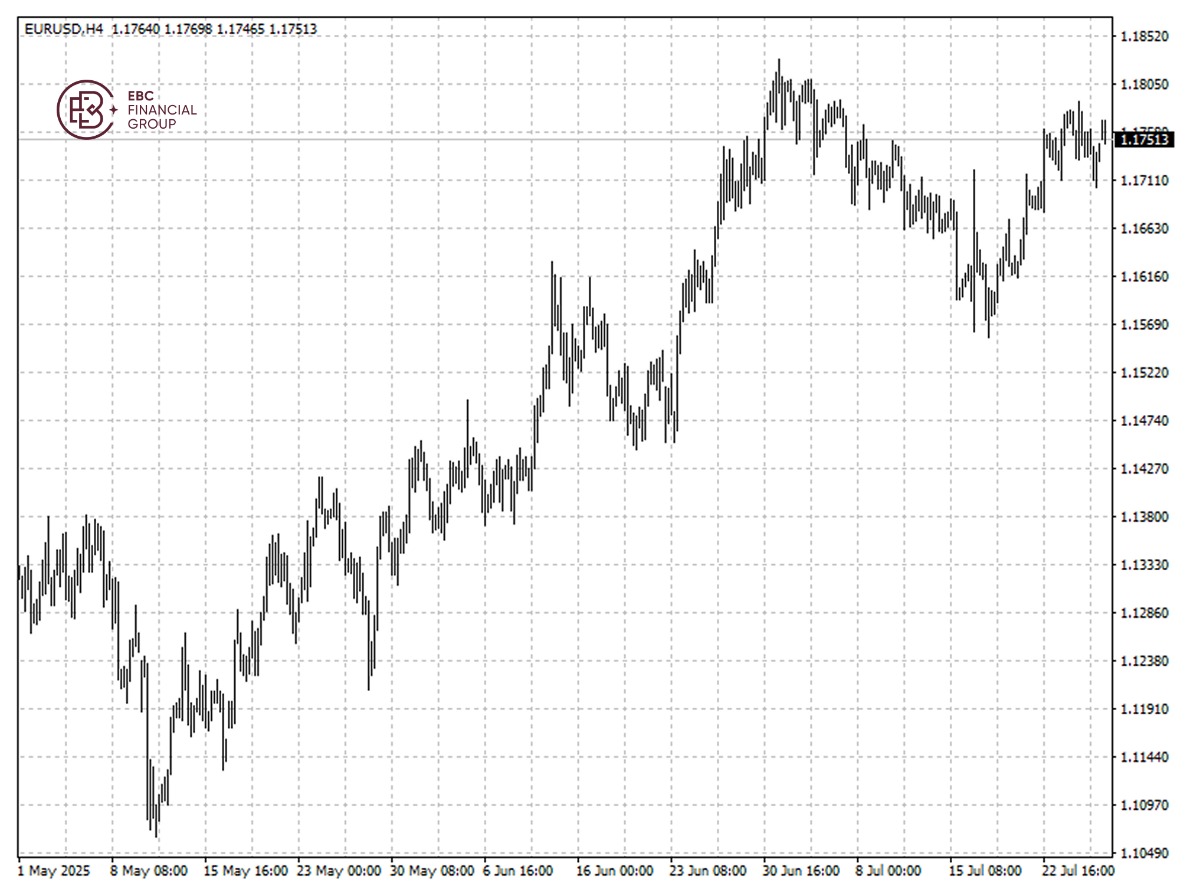

EBC Markets Briefing | Euro inches up amid positive signs

The euro gained on Monday following the announcement of a framework trade agreement between the US and EU, the latest in a flurry of deals to avert a global trade war.

Trump said that the deal imposes a 15% tariff on most European goods., including cars. But it would not be added to any tariffs already in effect and some products would not be subject to tariffs.

Many in Europe view the deal as a concession, compared with Europe's initial hopes to secure a zero-for-zero tariff deal. The bloc was running a €50 billion trade surplus with the States last year.

Eurozone economic growth picked up in July, driven by services and stabilising factory activity, suggesting a stronger start to Q3, likely due to a temporary boost from front-running of higher tariffs.

With price pressures at a subdued level consistent with the central bank's target, there is the scope for a further lowering of interest rates should the growth trajectory turns out to be too soft.

Senior US and Chinese negotiators are due to meet in Stockholm later, discussing extension of a trade truce. Meanwhile, investor attention is shifting towards corporate earnings and central bank meetings.

The single currency has nearly pared its earlier gains in the session, but the upside bias remains in place. The high of 1.1780 it hit last week could act as a potential resistance.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.