Why Nvidia surpassed the value of the UK stock market

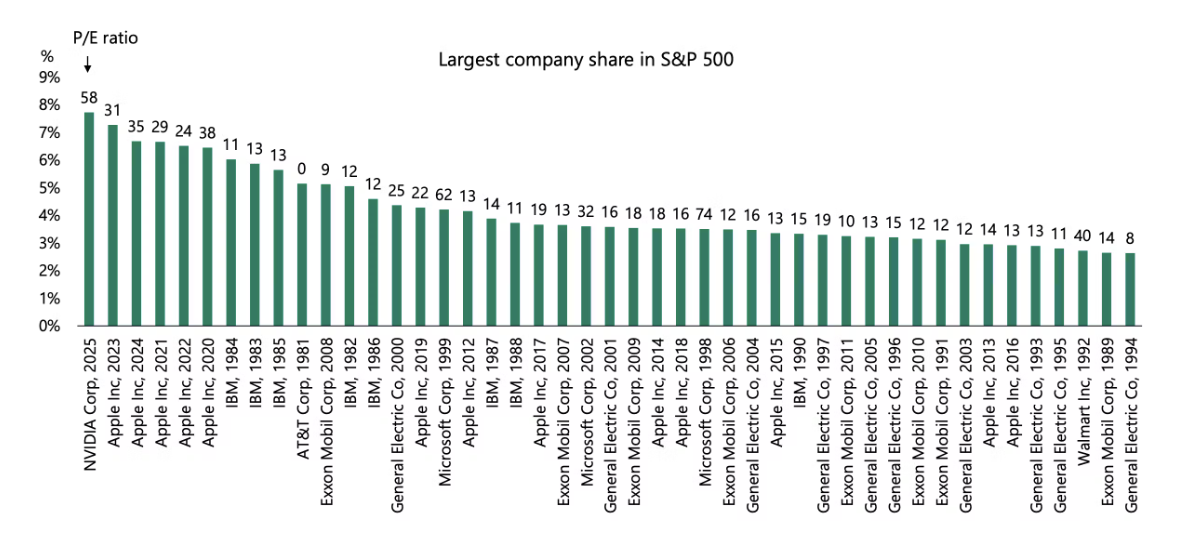

According to LSEG data, Nvidia’s market capitalisation has climbed above $4 trillion, surpassing the combined value of every listed company in the United Kingdom. The company’s near-total dominance in high-performance graphics chips and accelerating demand for AI infrastructure have made it the most valuable public company in history. At 7.3% of the S&P 500’s weighting, Nvidia now wields more influence over U.S. equity benchmarks than any single stock in decades.

Key takeaways

Nvidia’s market cap now exceeds the total value of the UK equity market.

Holds 92% share of the discrete GPU segment, supplying AI hardware to Microsoft, Amazon, and Google.

A key driver of the S&P 500’s surge above 6,400 for the first time.

GPU dominance underpins valuation

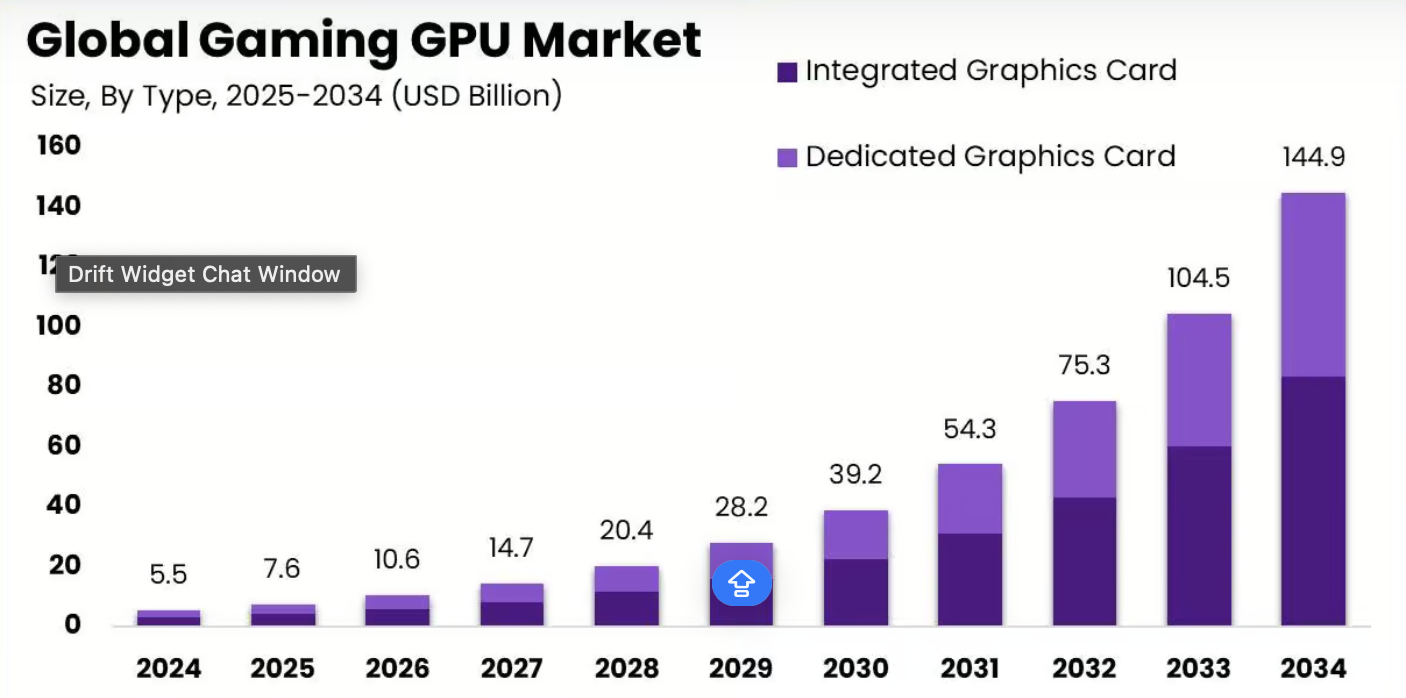

Nvidia’s position at the top is built on its control of the GPU market - essential hardware for building and operating large-scale AI systems. Statista’s 2025 data shows the company holds a 92% market share in discrete GPUs, with its chips running AI data centres worldwide.

Source: Market.US

Source: Market.US

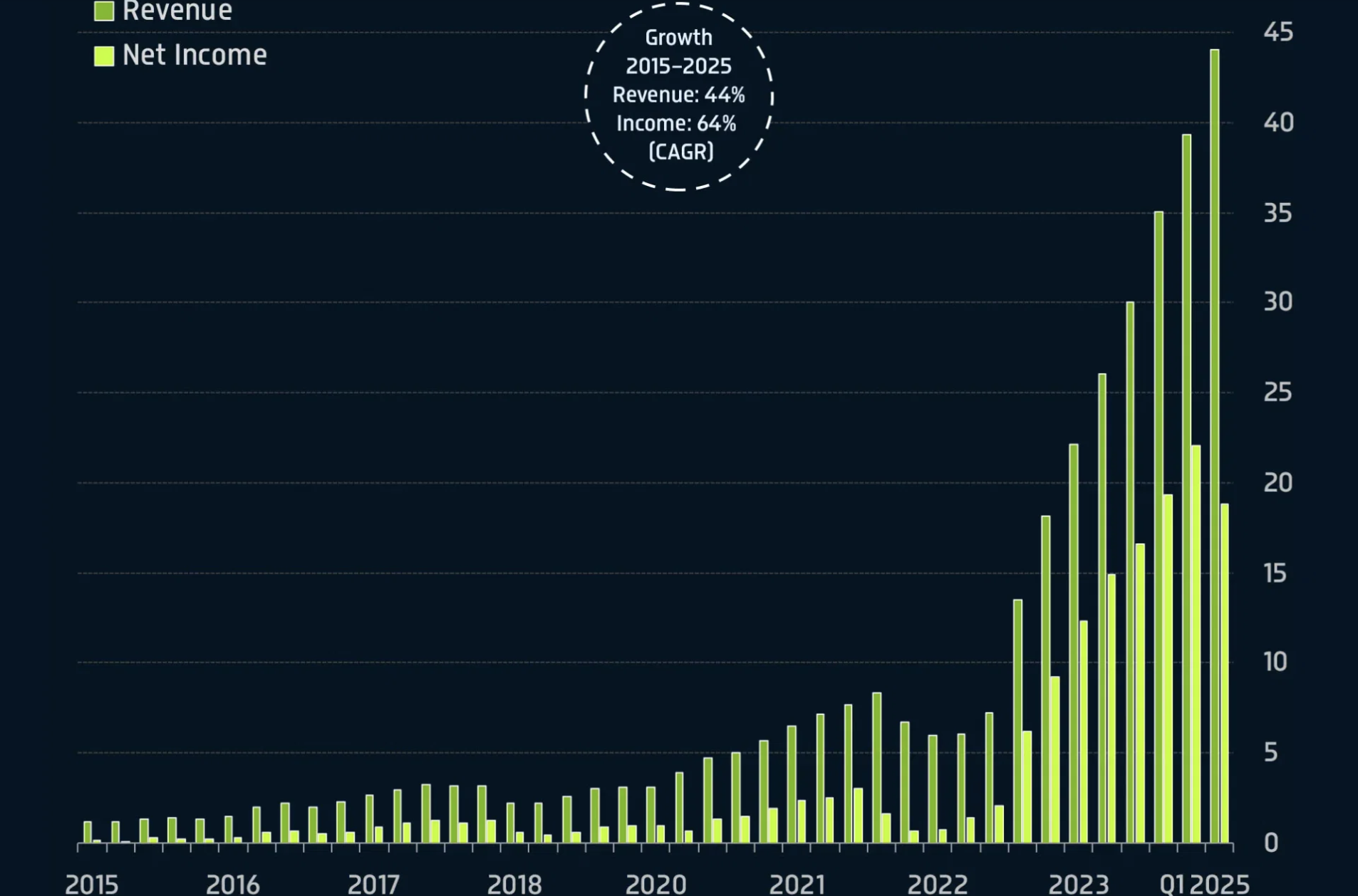

The financial results reflect this demand surge: Q1 2025 revenue hit $44.1 billion, up 69% year-on-year, with Q2 guidance at around $45 billion ± 2%.

Source: Visual capitalist

Nvidia’s CUDA software ecosystem has become the industry standard for AI development, creating a deep lock-in effect among developers and enterprise customers.

This scale now means a single company is worth more than an entire national stock market that includes multinationals like Shell, HSBC, AstraZeneca, and BP - underscoring investor conviction in AI as a long-term growth engine.

Driving the S&P 500 higherNvidia’s rally has been a key factor in lifting the S&P 500 to record levels. On 12 August 2025, the index closed above 6,400 for the first time, completing a four-month climb that added $13.5 trillion in market value.

Source: Deriv MT5

Source: Deriv MT5

Moderating U.S. inflation and a strong rotation into technology have provided the backdrop, but Nvidia’s outsized weighting means its price movements often dominate daily index changes. For instance, an 8.2% jump in Nvidia’s shares once accounted for 44% of the S&P 500’s entire daily gain.

Policy shifts and geopolitics

In April 2025, the U.S. blocked exports of high-end AI chips to China, including Nvidia’s H20, cutting off billions in potential revenue. A later agreement allowed Nvidia and AMD to resume sales in exchange for paying 15% of Chinese revenues to the U.S. Treasury.

Analysts estimate combined sales of Nvidia’s H20 and AMD’s MI380 in China could reach $35 billion annually, with about $5 billion going to the government. While this reduces margins, it restores access to the world’s second-largest GPU market and limits the risk of China replacing U.S. technology with domestic alternatives.

CEO Jensen Huang argues that controlled sales are better for U.S. national security than pushing China to develop rival hardware, a view the White House currently supports.

Concentration risk in markets

Nvidia’s influence is now without precedent in the modern S&P 500 era. Even at the height of the dot-com boom, no single stock exceeded 6% of the index’s weighting. At 7.3%, Nvidia has the ability to move the market independently.

The top 10 S&P 500 companies now account for 38% of the index’s total value, increasing both potential returns and systemic risk. For bullish investors, Nvidia’s leadership confirms its position in a high-growth sector. For more cautious traders, it signals vulnerability - any slowdown in AI spending or geopolitical shock could ripple across the broader market.

Source: Bloomberg, Apollo, Sherwood

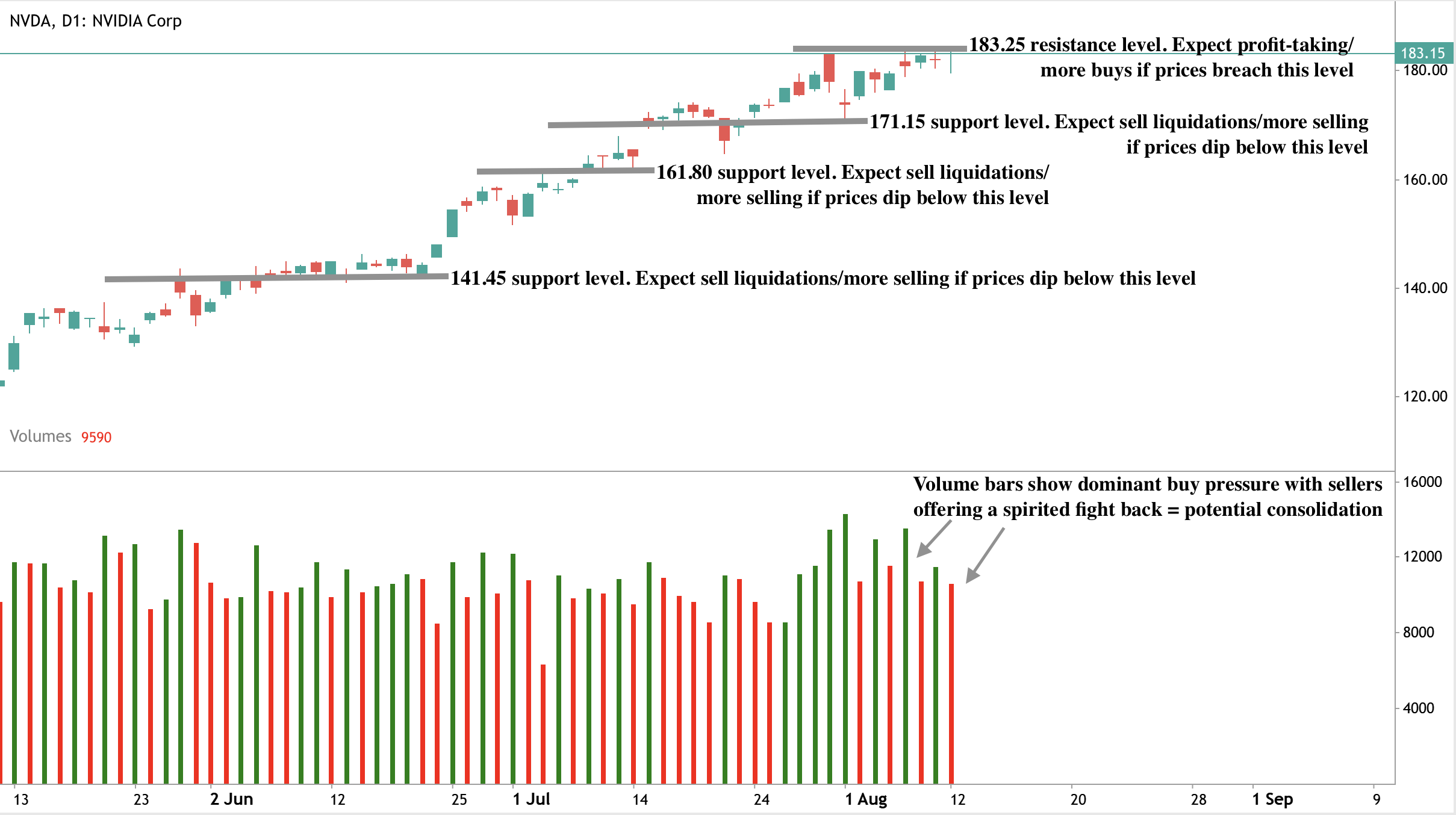

Nvidia stock technicals

At present, Nvidia is trading around $183.15, with neither bulls nor bears taking clear control. Strong seller resistance at $183.25 suggests consolidation. If prices decline, key support levels sit at $171.15, $161.80, and $141.45.

Source: Deriv MT5

Source: Deriv MT5

Frequently asked questions

Why is Nvidia worth more than the UK stock market?

Its leadership in AI chips, rapid revenue growth, and entrenched developer ecosystem have created a valuation greater than all UK-listed companies combined.

How important is China to Nvidia?

China made up 13% of 2024 sales. Regaining access through the export deal could restore billions in annual revenue, despite the 15% levy.

What risks could impact Nvidia?

Geopolitical friction, rising competition from AMD and Huawei, power limits on data centres, and the potential slowdown of AI infrastructure spending.

Can Nvidia maintain its lead?

Its CUDA dominance, integrated hardware offerings, and partnerships give it a strong competitive moat, but its high valuation leaves little room for execution missteps.

Investment implications

Nvidia’s valuation milestone has coincided with the S&P 500’s breakout above 6,400, cementing its role as the market’s most influential stock. With unmatched market share, strategic policy alignment, and renewed access to China, the company appears positioned to extend its leadership.

However, its scale means it is now deeply tied to the direction of U.S. equities overall. For investors, Nvidia represents both the biggest AI growth opportunity and one of the largest single-stock risks in modern market history.