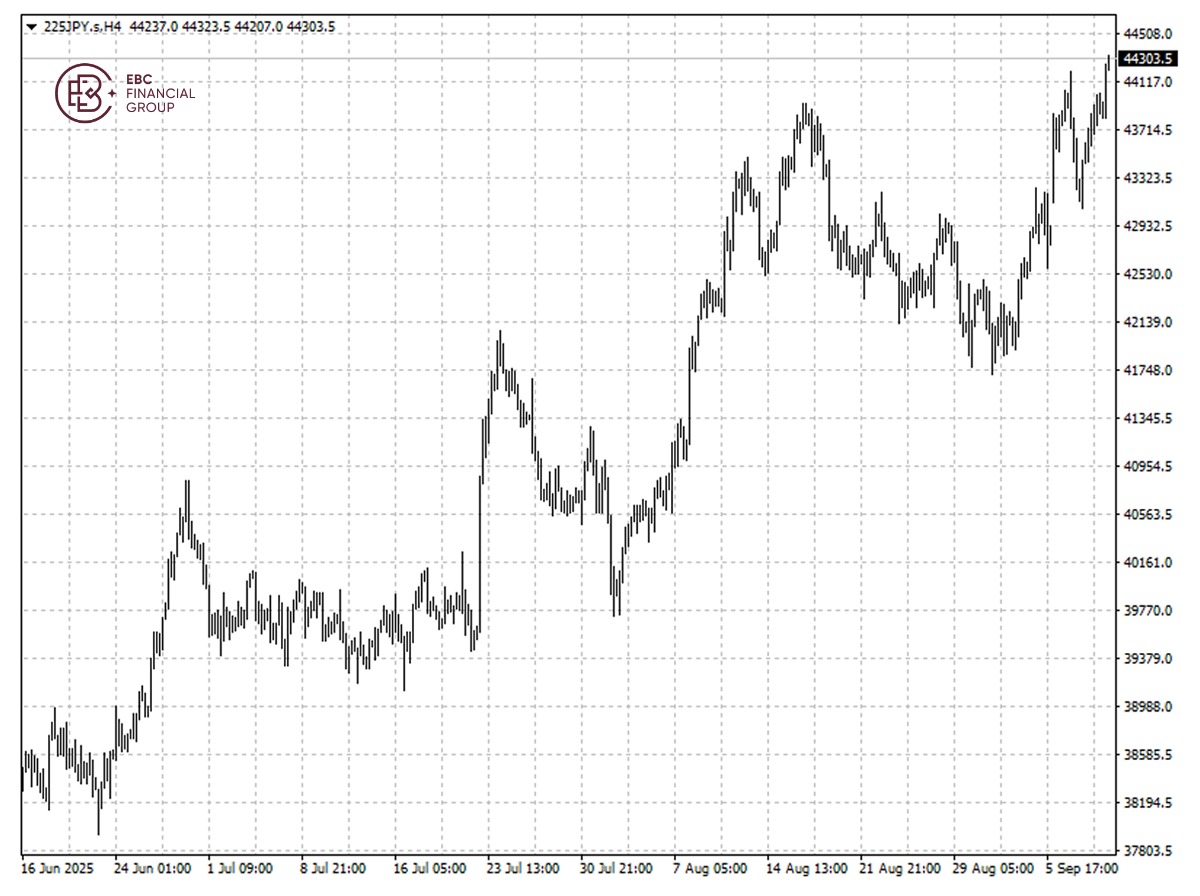

EBC Markets Briefing | Japanese stocks climb to fresh peaks

Japan's benchmark Nikkei 225 notched a record high on Thursday, mirroring gains on Wall Street overnight on Fed-rate cut hopes and positive inflation data.

SoftBank Group, jumped nearly 10% to notch a second straight day of gains after a Wall Street Journal reporting that OpenAI struck a roughly $300 billion, five-year cloud-computing deal with Oracle.

Berkshire Hathaway holding company raised its holdings in five Japanese trading houses by more than 1 percentage point each, to stakes ranging from 8.5% to 9.8%, according to a regulatory filing.

The strategy involves hedging currency risk by selling Japanese debt and then pocketing the difference between dividends from the investments and the bond coupon payments he has to make to service the debt.

It marks a resurgence of optimism in the market. Foreign investors were net sellers of Japanese stocks in the week to 20 August, for the first time in nine weeks, as they moved to lock in profits.

US tariffs on Japanese goods including cars and auto parts are set to be lowered by September 16, tariff negotiator Ryosei Akazawa said on Tuesday. But he added trade talks have not been "settled".

The Nikkei index has breached the major threshold of 44,000, which could pave the way for further gains. We view 45,000 as the next potential psychological resistance level.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.