EBC Markets Briefing | Oil traders wager on recurring supply jolt

Sentiment in the crude oil market has shifted to expecting prices to decline at the annual APPEC where the least-sighted animal was a bull in a sea of bearish participants.

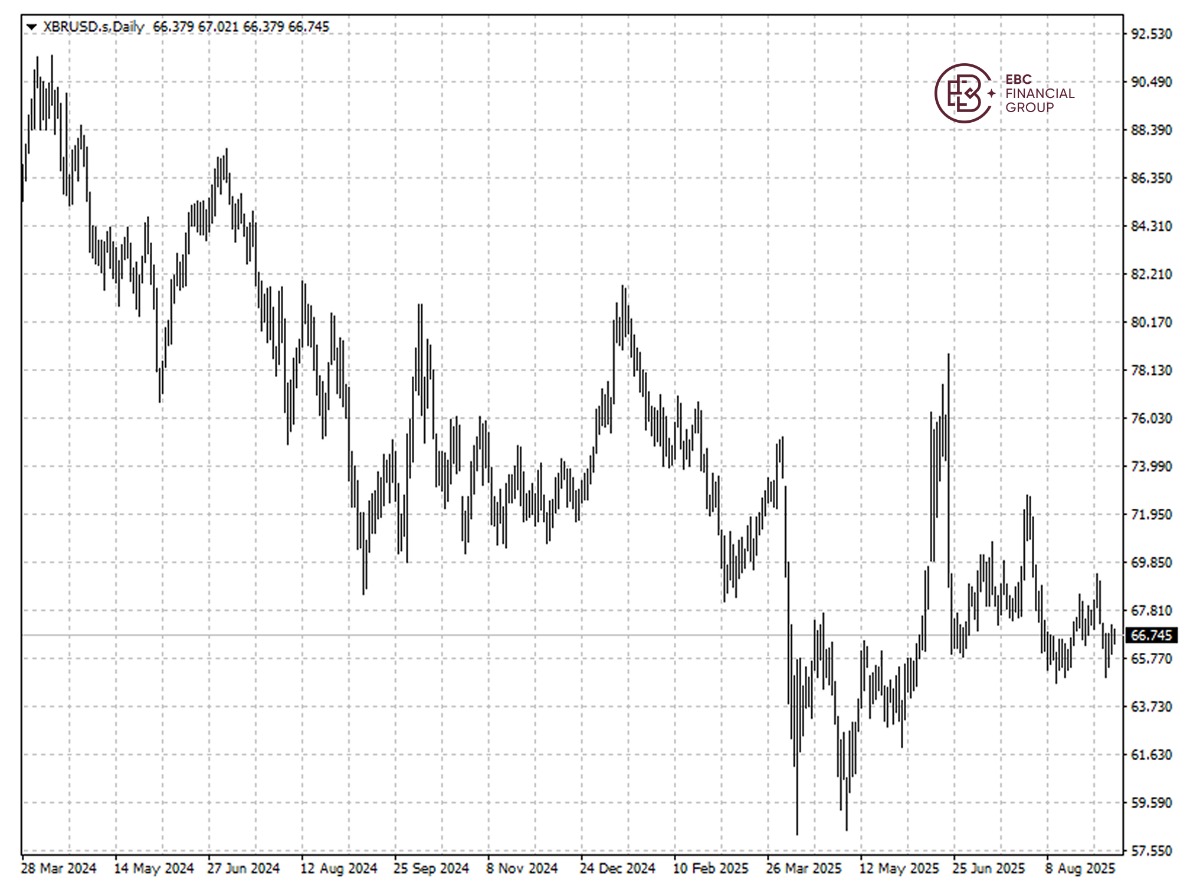

Brent crude prices are likely to fall to around $55 per barrel by year-end as OPEC continue to unwind production into the market, an S&P Global executive said at the conference on Monday.

The OPEC+ oil cartel has agreed to raise output again in October to regain market share. That signals Saudi Arabia's strategic pivot to revenue as output cuts can no longer ramp up prices.

The cartel is expected to continue to increase output into the first half of 2026 and completely unwind the 1.65 million bpd of cuts from April 2023, which could be enough to swamp the increase in demand.

US crude production will hit a record 13.41 million bpd in 2025 due to increases in well productivity, though lower oil prices will prompt a fall in output in 2026, the EIA forecasted in a monthly report.

Trump might keep a risk premium in the market, and help to keep global benchmark prices anchored around $65 a barrel. The path ahead will basically revolve around the president's agenda.

Oil is heading for its third consecutive year of decline. Investors have been awakened to structural challenges such as renewable energy development and AI's potential to boost logistics efficiency.

China stockpiling

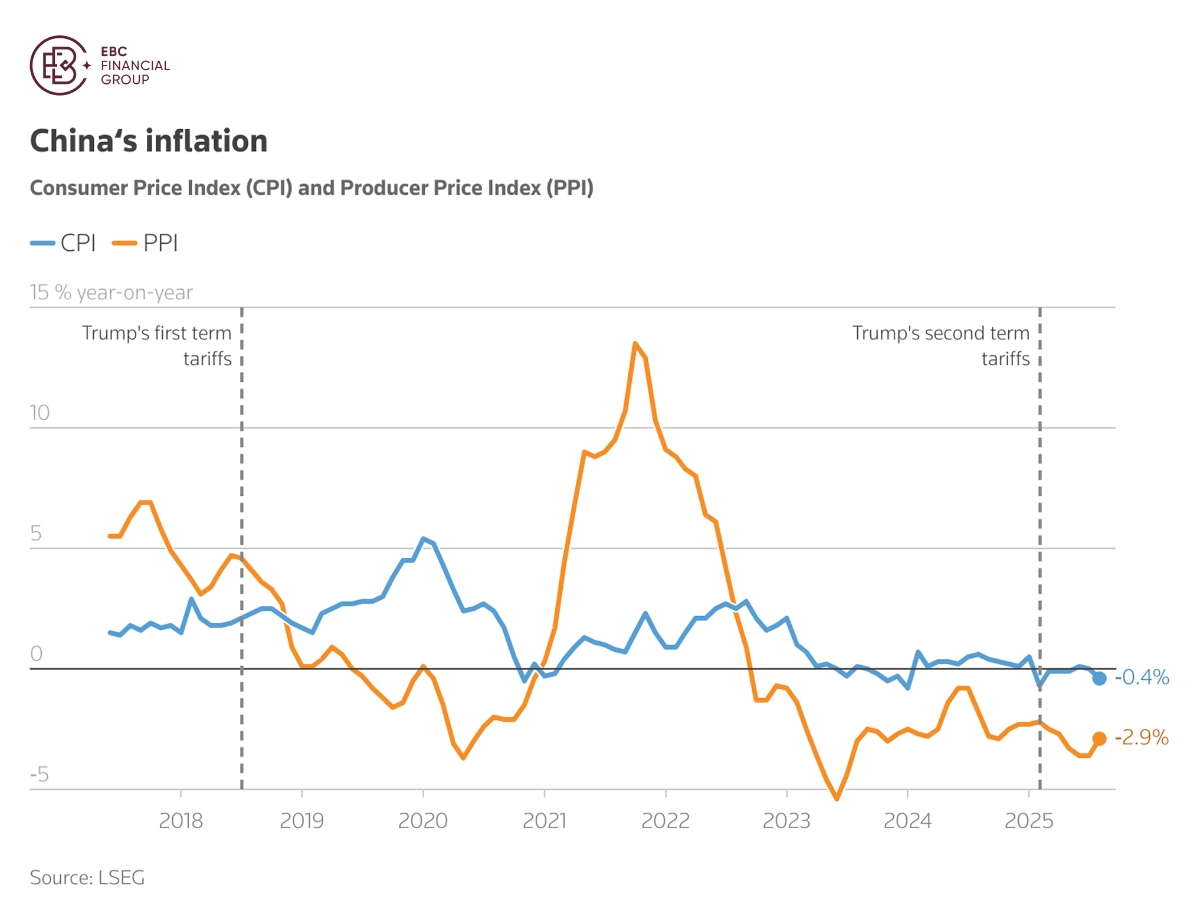

China's producer deflation eased in August, suggesting Beijing's "anti- involution" push started to bear fruit, though analysts say manufacturers remain some way off from a reflationary cycle.

Trump has asked the EU to hit China and India with tariffs of up to 100% over the countries' Russia oil purchases, in a move aimed at turning up the heat on Moscow to end the war in Ukraine.

However, those sanctions are controversial and would require unanimous backing by the EU's 27 members — with Hungary and potentially Slovakia likely to oppose the move given their neutral stance.

Chinese refiners have been storing vast quantities of crude this year, with some estimates as high as 600,000 bpd, and their total storage is now estimated at between 1.2 billion and 1.4 billion barrels.

But they may be swinging towards the view that oil should be priced more in a range between $50 and $60 currently, and may start to cut back on imports in order to encourage lower prices.

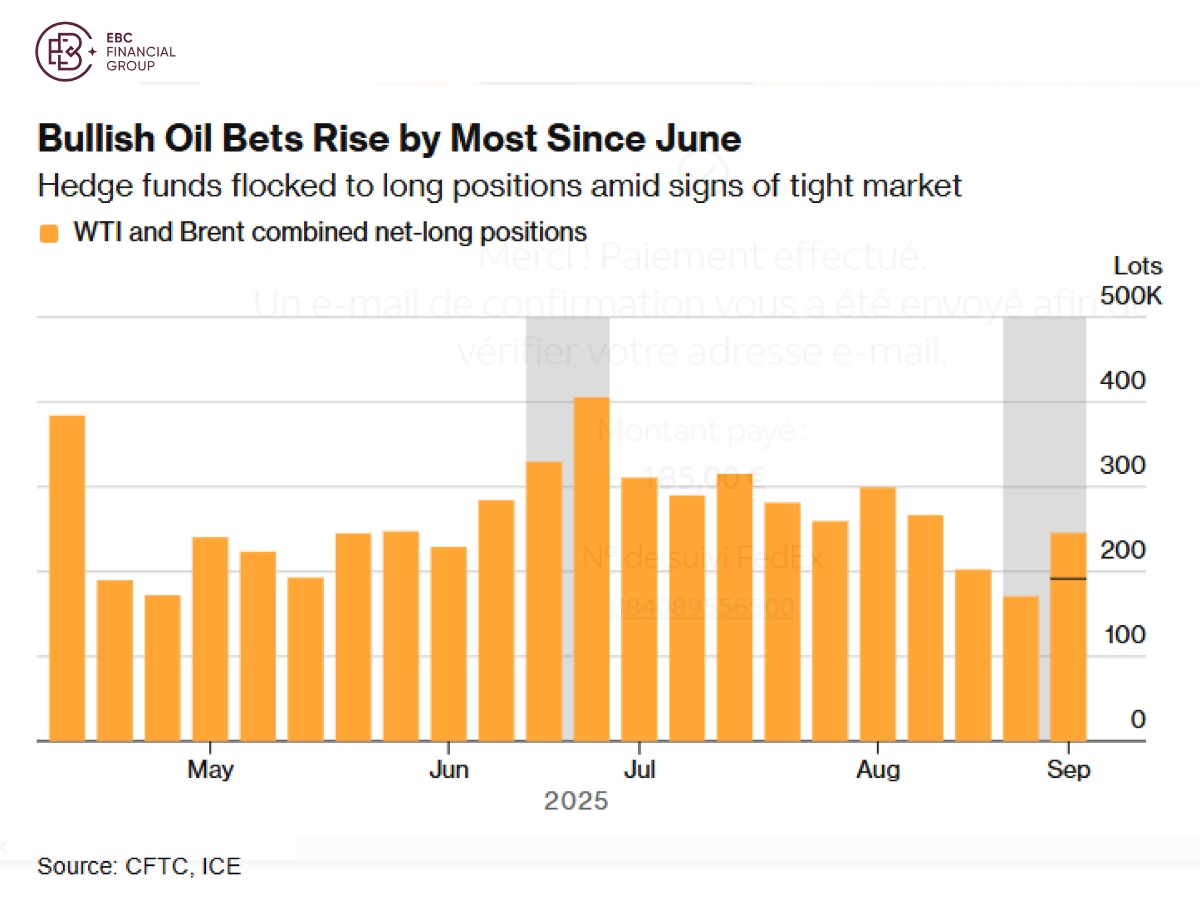

All the signs lay bare headwinds confronting major oil producers. On the other hand, tangled conflicts in the rest of the world add to upside risks, which prompted buying the dip.

Hedge funds boosted bullish bets on crude the most since June amid tightness in US markets and geopolitical issues, just before OPEC+'s latest decision of production hike.

Supply squeeze

Venezuela pledged on Sunday to sharply boost troops in coastal states to tackle drug trafficking after the US ordered the deployment of an additional 10 fighter jets to Puerto Rico to carry out operations against drug cartels.

Tensions between Venezuela and the US have escalated recently though Trump said that he was not attempting a regime change. Washington t is weighing options for further strikes.

Iran is ready to form a real and lasting agreement that includes strict monitoring and limits on its domestic uranium enrichment in exchange for the lifting of sanctions, its foreign minister said.

But another official on Monday ruled out any possible negotiations on its defense capabilities to reach a nuclear agreement with the US that has drawn a hard line on nuclear proliferation in the Middle East.

Israel attempted to kill senior members of Hamas in an airstrike on Tuesday in Qatar, bringing the Mideast war to a close US ally. Around 10,000 American troops are stationed at an airbase just outside Doha.

Trump issued a rare rebuke of Netanyahu, saying Israel's strike on Hamas targets in Qatar "does not advance Israel or America's goals", adding that he feels "very badly" about the location of the attack.

Also the Israeli military has issued an evacuation order covering the entirety of Gaza City for the first time during the current round of fighting, ahead of a planned offensive to take over and occupy the city.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.