EBC Markets Briefing | Yen rally halts when stocks make a spectacular comeback

Japanese stocks jumped at the open on Tuesday, underpinning a recovery across battered Asian share markets and even triggering circuit breakers in some, after central bank officials said all the right things to soothe investor nerves.

The Japanese government will continue to monitor and analyse financial market moves and work closely with relevant authorities including the BOJ, Finance Minister Shunichi Suzuki said.

The Nikkei soared more than 8% to above 34,000 in the opening minutes of trading after its worst day since the 1987 Black Monday crash. Meanwhile, the yen was also reversing some of its earlier gains.

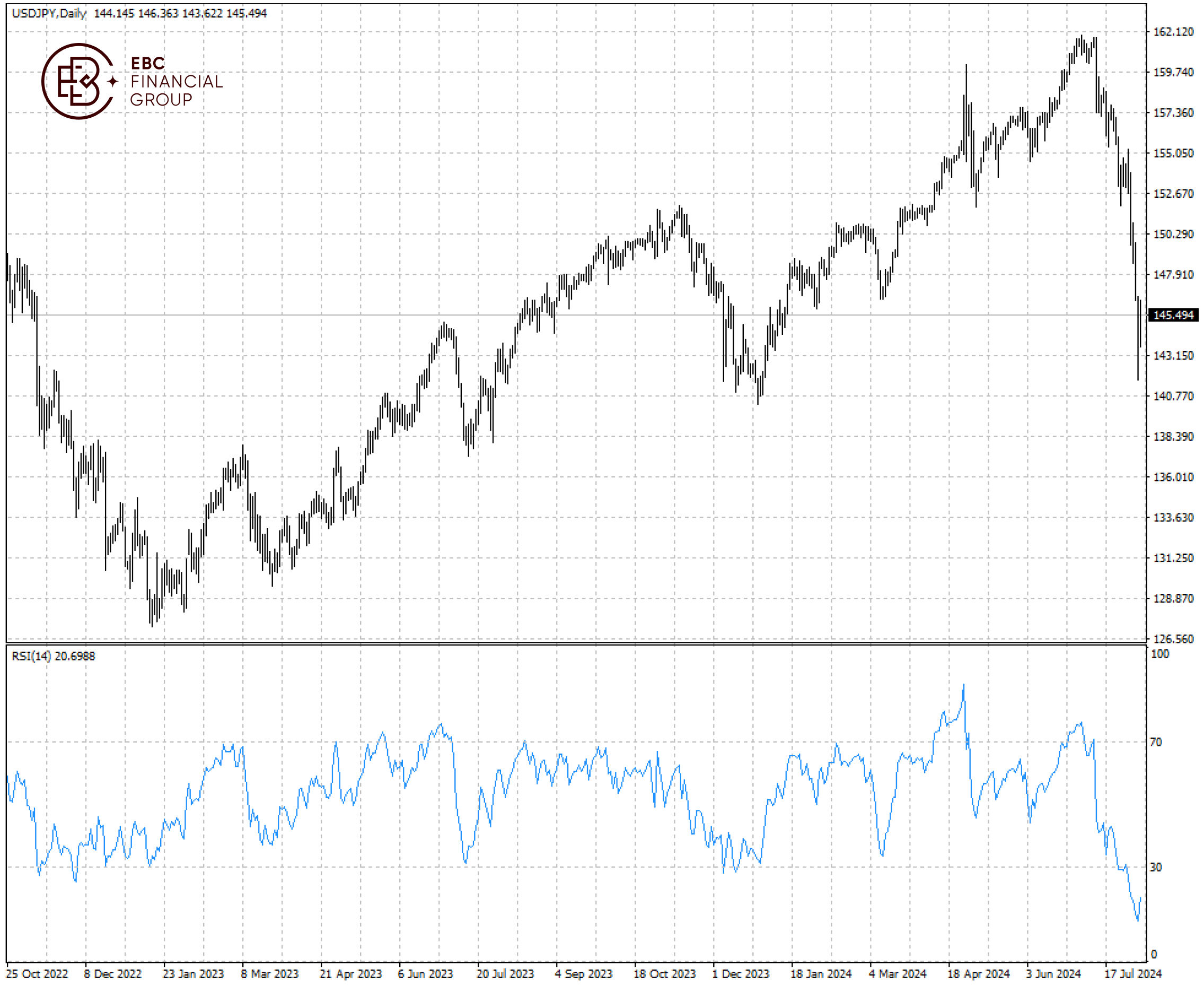

The currency rose 1.5% in the last trading session. It has shot higher in recent sessions as investors were squeezed out of carry trades, where they borrowed yen at low rates to buy higher yielding assets.

It remains uncertain if the uptrend will persist. Societe Generale said a push below 140 a dollar for the Japanese yen in the near term “would be unsustainable given the impact on equities and inflation.”

The yen weakened more than 1% this morning, halting a five-day surge. Hedge funds covered nearly all the short yen positions built up over the last year by late July, according to a UBS note.

The pair was deeply oversold so the rally may have further to go with the initial major resistance seen at 150 which is followed by 155.

EBC Trading Platform Security Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Online Trading Support or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.