GBPUSD holds near September’s support zone after mixed jobs data

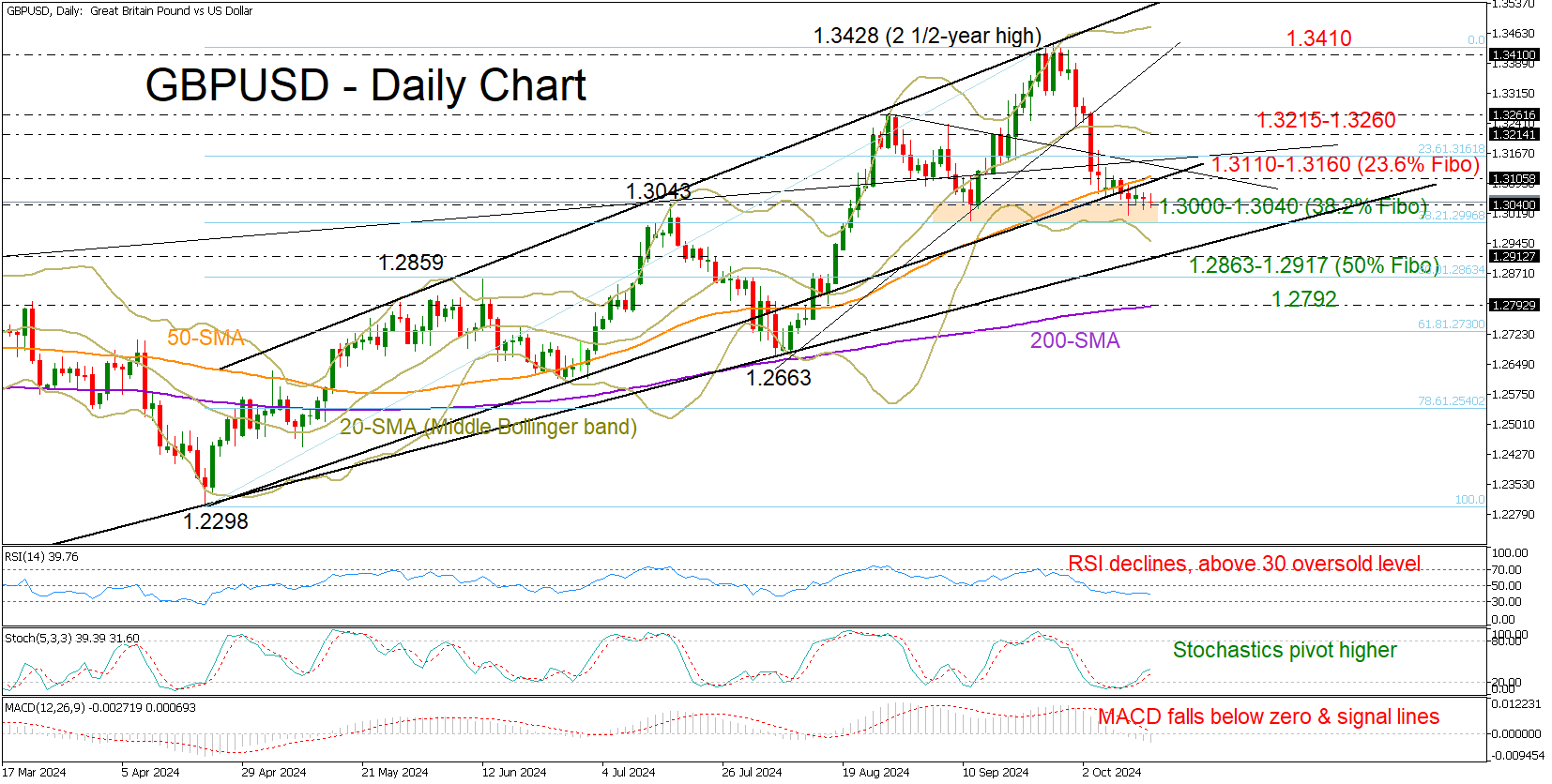

GBPUSD faced mild selling pressure but held its footing above September’s floor of 1.3000-1.3040 after the UK employment survey showed better-than-expected jobs data in August and an increase in the number of unemployed people in September.

The bears may have luck on their side as the technical indicators are not confirming oversold conditions yet. While the stochastic oscillator has dropped below 20, the RSI is still above its 30 oversold level. Likewise, the price itself has not touched the lower Bollinger band.

In the case the pair signals a bearish trend reversal below 1.3000-1.3040, it may seek shelter near the critical 2022 support trendline at 1.2917. Slightly lower, the 50% Fibonacci retracement of the April-September upleg at 1.2863 might encounter downside pressures too. If not, the decline may gain new legs towards the 200-day simple moving average (SMA), which successfully boosted the price back above the 1.3000 level in August.

The path could be rough if there’s an upside reversal. The bulls could initially experience congestion within the 1.3110-1.3160 zone. Then, the recovery could stall somewhere between 1.3215 and 1.3260. Breaking this range might be necessary for an advance back to the September ceiling of 1.3410.

Summing up, GBPUSD has not overcome downside risks despite approaching an important protective area. A step below 1.3000 could renew selling interest, whilst a bounce above 1.3260 could shift the bias back to positive.

.jpg)