Gold looks heading towards $1800

Gold has gained 0.3% since the start of the day on Friday, marking only its third session of gains since the beginning of August. Despite signs of local oversold conditions suggesting a bounce, the ultimate downside target looks to be the $1800 area, said Alex Kuptsikevich, the FxPro Analyst.

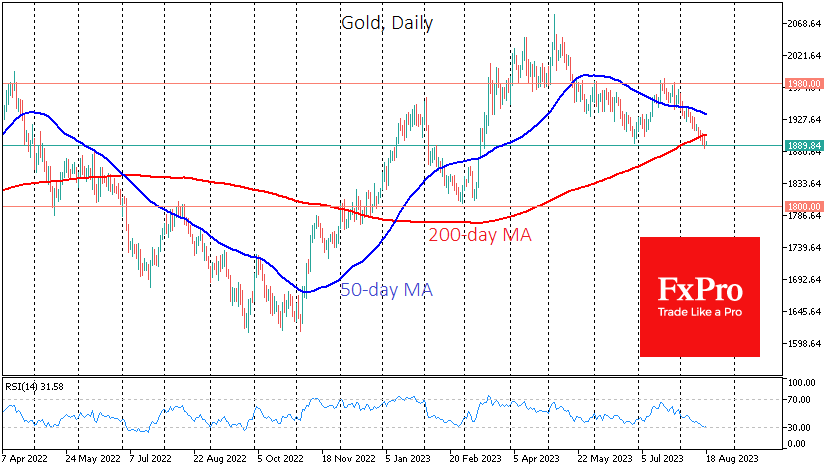

Gold's sharp decline began a month ago when the bears once again prevented the metal from consolidating above $1980, a critical resistance level since May.

On the way down in August, gold first broke below the 50-day moving average, and two days ago, it sank below the 200-day MA. Both curves act as medium and long-term trend indicators. Gold failed to rally higher after a drop below the 50-day MA, but the failure only intensified the sell-off.

Tuesday and Wednesday saw a battle for the 200-day, which the Bears also won. Since the beginning of 2021, at least a month of sustained pressure on prices has followed such a signal.

This week, gold also broke below previous local lows - another signal of a downtrend formation in addition to lower local highs: $1985 in July vs. $2080 in May.

A crucial fundamental factor putting pressure on gold is the rise in government bond yields in developed countries with falling inflation. It is becoming increasingly difficult for gold to compete on yield.

We also expect China's attempts to protect its currency from depreciation to lead to US government bonds and gold sales.

And we must consider the possibility that other major emerging market reserve holders will do the same as they face diminishing returns from the economic slowdown.

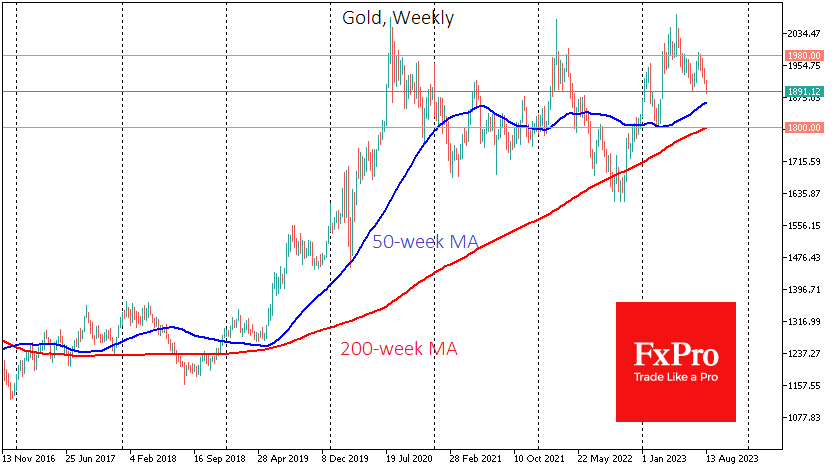

If there is no strong rally above $1905 today or Monday, confidence will grow that gold's downtrend is already established. The $1800-1810 area is a potential technical target. This is where gold has been supported or surrendered many times over the past three years.

The 200-week moving average, which has attracted buyers for the past six years, passes through these levels, and we expect the battle to be much more intense at these levels.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)