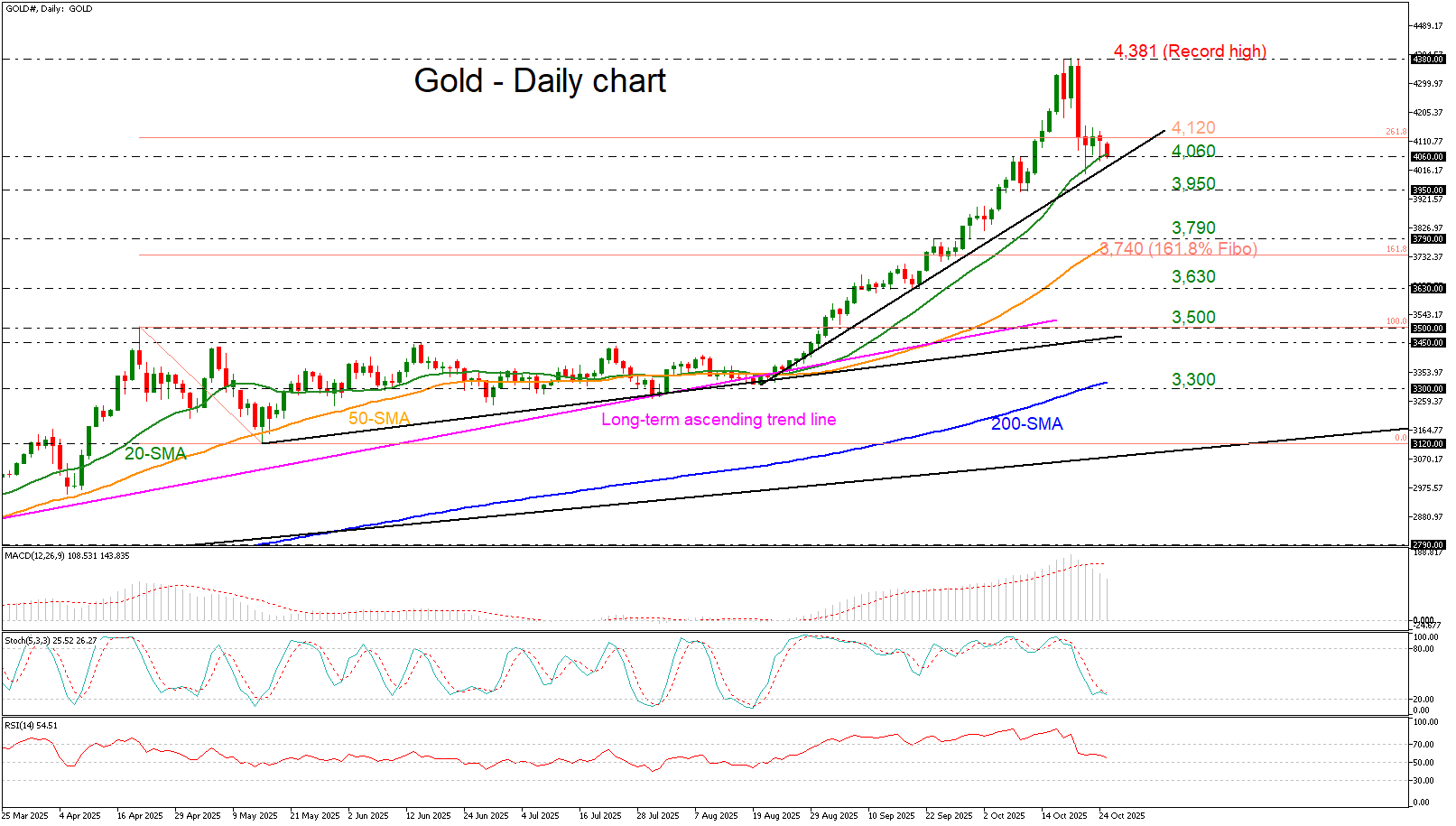

Gold slips as trade talks advance; support at 4,060

Gold is currently testing the 4,060 support level and the 20-day simple moving average, as easing geopolitical tensions, particularly progress in US–China negotiations, have dampened demand for safe-haven assets.

Should the precious metal decline further, immediate support may be found near the steep uptrend line just below the 4,000 psychological threshold, with a potential rebound around the 3,950 level.

Alternatively, a recovery from recent losses could pave the way for a retest of the all-time high at 4,381, followed by resistance at round numbers such as 4,400 and 4,500.

From a technical perspective, momentum indicators suggest a cautious outlook. The MACD is weakening below its signal line, the stochastic oscillator is nearing oversold territory, and the RSI is hovering close to the neutral 50 mark, indicating indecision in the market.

To sum up, gold’s near-term trajectory remains uncertain. While downside risks persist, a rebound remains plausible if key support levels hold and market sentiment improves.

.jpg)