Gold (XAUUSD) Analysis: Is a Price Squeeze Signaling Volatility Ahead?

In this comprehensive analysis, Ultima Markets take a closer look at the XAUUSD price action for November 6, 2025, as tightening ranges and shifting momentum suggest an important move may be on the horizon.

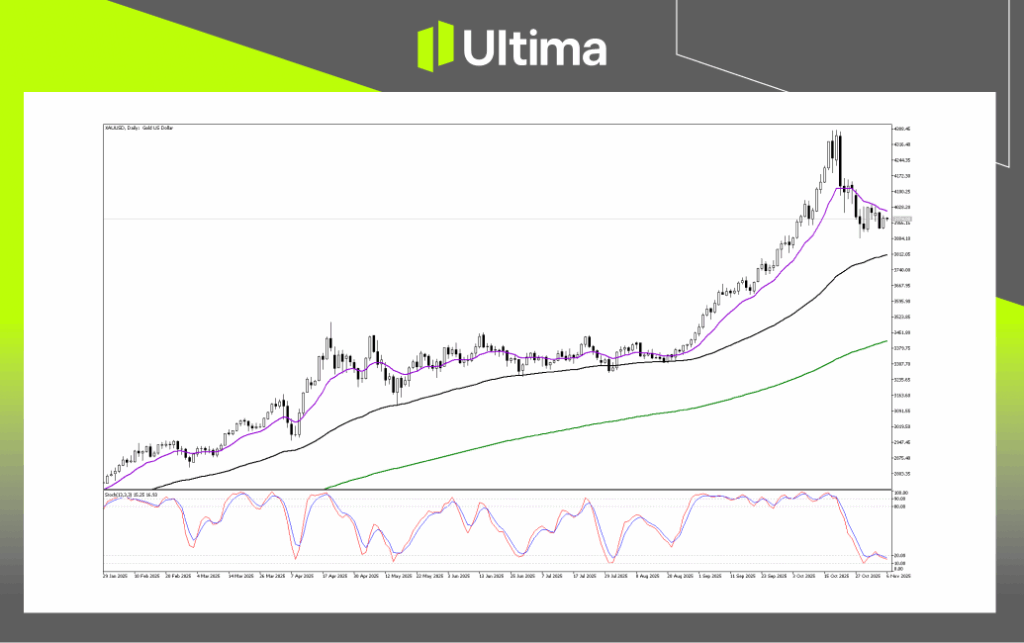

Is Gold’s Daily Chart Indicating a Deeper Correction?

With the Stochastic oscillator deeply oversold below 20, bearish momentum remains strong but potentially overstretched. This often signals that a relief rebound or short-term consolidation could take place before any further downside. While the short- to intermediate-term bias leans cautiously bearish, the broader uptrend structure is still intact. The key uncertainty is whether the current correction will stay shallow or develop into a more pronounced retracement toward major support zones.

With the Stochastic oscillator deeply oversold below 20, bearish momentum remains strong but potentially overstretched. This often signals that a relief rebound or short-term consolidation could take place before any further downside. While the short- to intermediate-term bias leans cautiously bearish, the broader uptrend structure is still intact. The key uncertainty is whether the current correction will stay shallow or develop into a more pronounced retracement toward major support zones.

Key Levels: Immediate support sits around 3950.00, marking the lower boundary of the current consolidation range. A decisive break below this level would confirm renewed bearish strength. The next significant support zone lies near 3800.00, aligning with the medium-term moving average and representing a critical inflection point for the broader trend. In a deeper pullback scenario, the 3400.00–3500.00 range, corresponding with the long-term moving average and a prior consolidation zone from August, would likely serve as major support.

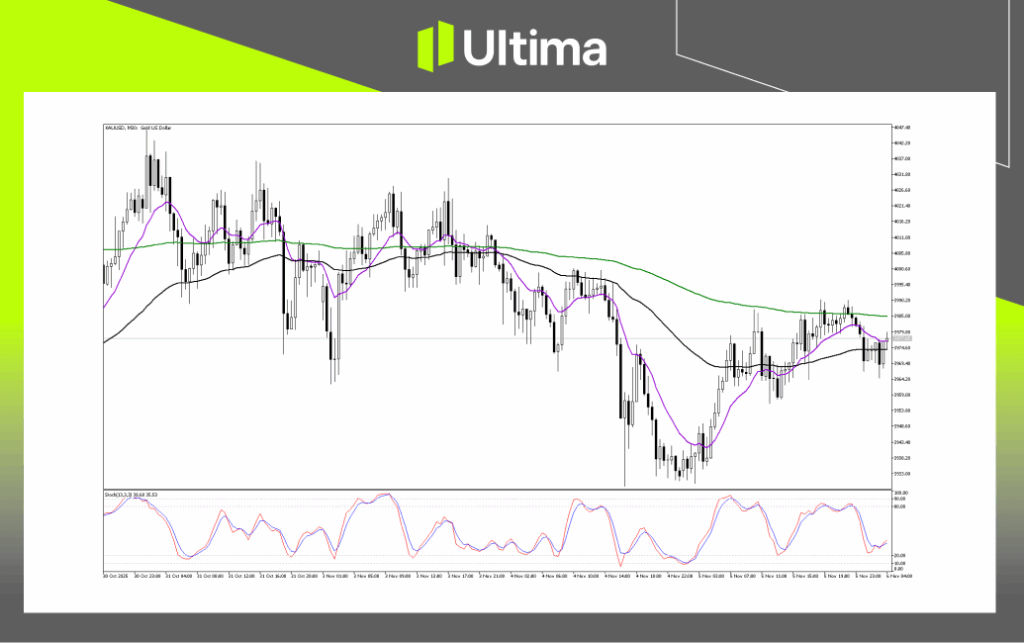

Could Short-Term Momentum Trigger a Bearish Breakdown? On the 2-hour chart, the Stochastic oscillator surged from oversold territory below 20 to above 80, indicating that short-term bullish momentum may soon fade. The market now faces an important test of resistance, with the broader structure maintaining a bearish tilt unless these levels are convincingly breached.

On the 2-hour chart, the Stochastic oscillator surged from oversold territory below 20 to above 80, indicating that short-term bullish momentum may soon fade. The market now faces an important test of resistance, with the broader structure maintaining a bearish tilt unless these levels are convincingly breached.

Breakout Scenarios: The more probable outcome remains a bearish continuation. A rejection within the 3980.00–4015.00 resistance zone, accompanied by the Stochastic turning lower, would reinforce downside momentum, with a break below 3920.00 confirming a move toward 3890.00. Conversely, if gold sustains a close above 4000.00–4015.00, the bearish setup would weaken, opening the door for a potential reversal toward 4040.00. However, this remains a less likely scenario unless supported by a strong fundamental catalyst.

Is Gold’s Pivot Indicator Pointing to a Breakout?  At present, XAUUSD appears to be coiling within a narrowing range, a classic setup that often precedes increased volatility. The subtle downward slope of the longer-term moving averages introduces a slight bearish bias, but momentum remains neutral until price breaks decisively in either direction.

At present, XAUUSD appears to be coiling within a narrowing range, a classic setup that often precedes increased volatility. The subtle downward slope of the longer-term moving averages introduces a slight bearish bias, but momentum remains neutral until price breaks decisively in either direction.

Bearish Breakdown: A clean move below 3965.00–3970.00, where key support and the black moving average converge, would confirm renewed selling pressure and likely reestablish the downtrend, with 3930.00 as the next key target.

Bullish Breakout: Alternatively, a breakout above 3985.00–3990.00 would indicate improving strength and could extend the short-term recovery toward the 4010.00 resistance level. This scenario would suggest growing market conviction that the recent dip has found a floor.

What Should Traders Watch in the Coming Sessions?

Gold remains in a phase of compression, where price action is tightening ahead of a likely expansion in volatility. Traders should monitor price behavior near the noted support and resistance levels for clues on the next directional move. A confirmed breakout, either above the 4000 area or below 3950, would set the tone for the rest of the week’s trading bias. Until then, XAUUSD remains range-bound with momentum building beneath the surface, a typical setup seen when trading commodities.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.