Gold Bulls Pause as Intraday Correction Looms

Discover the latest XAUUSD insights for December 16, 2025, with Ultima Markets' in-depth analysis.

Is XAUUSD Ready to Smash All-Time Highs?

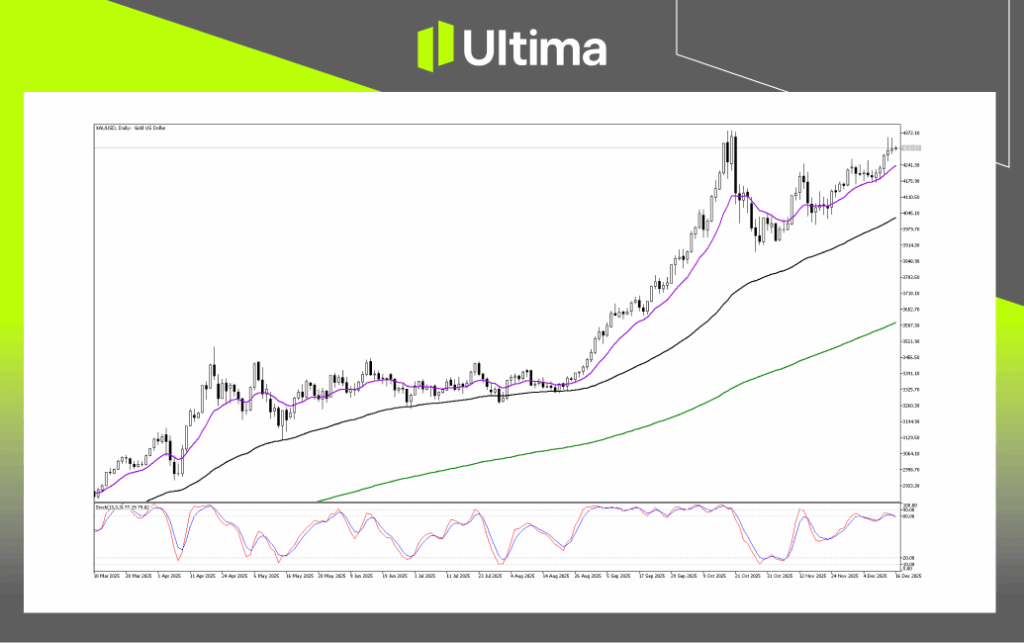

The daily chart indicates a critical juncture for gold, as the bullish momentum from October's correction is pushing the price to test historical highs. The Stochastic indicator is currently in the overbought zone, just hovering near the 80 level.

While it remains elevated, the lines have not yet reversed, suggesting continued buying pressure. However, if gold fails to break through resistance, a bearish crossover could occur, signalling a potential shift in market momentum.

Key Levels

The first major resistance is set at 4372.10, representing a key point where the previous peak occurred. A failure to break through this level could result in a bearish double top formation, while a breakout would confirm the continuation of the current trend. The next resistance zone lies between 4455.00 and 4500.00, where traders are likely to target round numbers or Fibonacci extensions in anticipation of further gains.

Will Gold Rebound or Fall Hard?

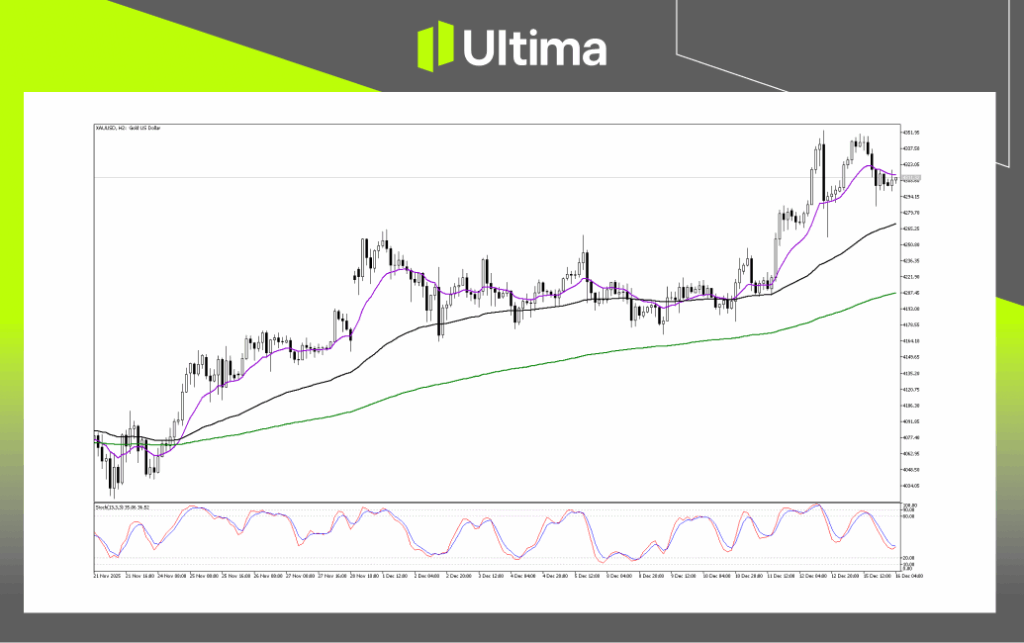

Despite the overall uptrend, the H2 chart indicates signs of temporary fatigue and profit-taking in the short-term.

Breakout Possibilities

With the price currently under the Purple Moving Average, a drop below 4294 could signal further bearish movement, aiming for the Black Moving Average at 4265. Short-term sellers may target the gap between 4300 and 4265 until the Stochastic indicator hits the Oversold zone (20 level).

On the other hand, a bullish reversal requires the Stochastic to dip below 20 and cross back upward, while the price finds support near 4265 with a rejection candle (such as a hammer or pin bar), setting potential targets at 4323 and 4351. Alternatively, a strong close above the Purple Moving Average at 4323 would invalidate the bearish outlook, suggesting that the correction was simply a brief pullback.

Will Gold Break Out or Break Down?

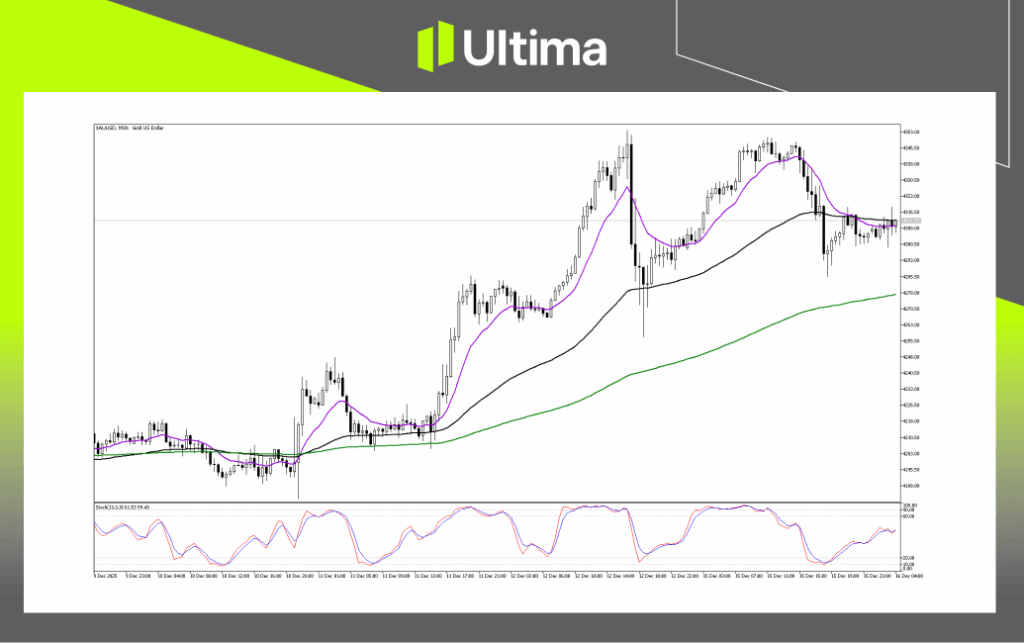

The price is currently stuck beneath the cluster of the Purple and Black MAs near 4315, acting as a barrier to further upward movement. The Stochastic oscillator sits around 60.00, hovering between oversold and overbought, indicating indecision in the market. This neutral position suggests that the market is in a waiting phase, holding off on making a clear directional move.

Bearish Scenario

A bearish move would be confirmed with a 30-minute candle close below 4300.00, triggering the "Dead Cross" and breaking the range to the downside. This could lead the price to test the recent low at 4285, followed by the Green Moving Average at 4278. This scenario is favourable for short-term sellers targeting quick moves to key support levels.

Bullish Scenario

A bullish move would require a solid candle close above the MA cluster at 4318.00, reversing the current bearish pressure. This breakout would suggest that the consolidation phase is over and buyers are taking control, with a potential retest of highs between 4345 and 4350. Confirmation would come if the Stochastic moves above 80 and maintains the level, signalling a return of strong upward momentum.

Navigating the Forex Market with Ultima Markets

Success in the trading world relies on staying up-to-date and making informed, data-backed choices. At Ultima Markets, we are committed to providing valuable insights to enhance your trading journey. For personalised advice tailored to your unique financial needs, don’t hesitate to contact us.

Join Ultima Markets today and gain access to a comprehensive trading ecosystem, including UM Academy, where you’ll find the tools, resources, and expert guidance needed when it comes to forex, commodities, indices, and shares. Stay tuned for more updates and expert analysis from our team.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.