NFP: Deceleration in US Job Growth

ADP PRIVATE PAYROLLS REPORT SHOWS DECELERATION IN US JOB GROWTH

On Wednesday, the ADP Private Payrolls report for the US was released, revealing a deceleration in job growth in March compared to the previous month. The report indicated that 145,000 private sector jobs were added in March, which is significantly lower than the Dow Jones estimate of 210,000. This has raised concerns about a potential slowdown or even a recession in the US economy.

The ADP Private Payrolls report provides an early indication of the job market's performance, making it an essential factor in shaping economic forecasts. The lower than expected job growth could suggest that companies are becoming more cautious about expanding their workforce amid global economic uncertainty and the ongoing COVID-19 pandemic.

SECTORAL BREAKDOWN

The report showed that there was a loss of 51,000 jobs in the financial activities sector in March, while the professional and business services sector saw a decline of 46,000 jobs. However, there was job growth in other sectors such as leisure and hospitality, which added 98,000 employees, trade transportation, and utilities, which rose by 56,000, and construction, which grew by 53,000. The sectors that recorded losses outweighed those that experienced growth.

NON-FARM PAYROLLS REPORT ANTICIPATES JOB GROWTH IN MARCH

The upcoming Non-Farm Payrolls (NFP) report for March is expected to provide a clearer picture of the job market's performance. Analysts are anticipating the creation of 240,000 new jobs in the US, a significant accomplishment compared to the previous month. The Average Hourly Earnings (MoM) are projected to rise to 0.3%, while the Unemployment Rate is expected to remain unchanged at 3.6%.

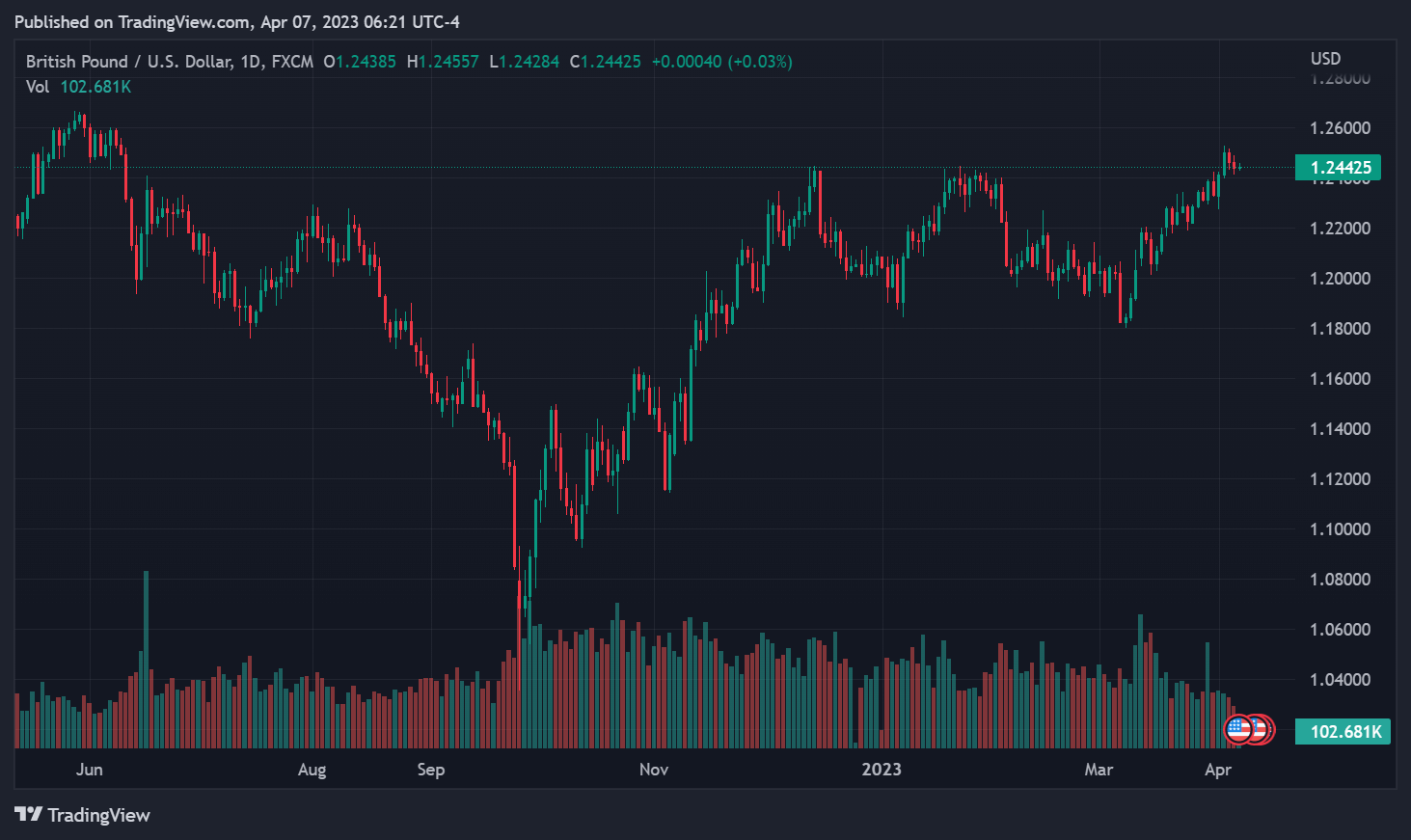

As usual, the final NFP data will play a crucial role in determining the direction of USD currency pairs. The report's outcome could affect market sentiment and trigger price movements in the forex market, leading to high volatility. The US dollar tends to strengthen in response to positive NFP data, while a weaker-than-expected report could lead to a decline in the currency's value.

CONCLUSION

The ADP Private Payrolls report's release indicates a deceleration in job growth in March, with some sectors experiencing job losses. However, the upcoming NFP report for March is expected to show an increase in job growth. The report's outcome will be crucial in shaping the economic outlook and market sentiment, particularly in the forex market.