UK inflation: below expectations but above target

UK inflation: below expectations but above target

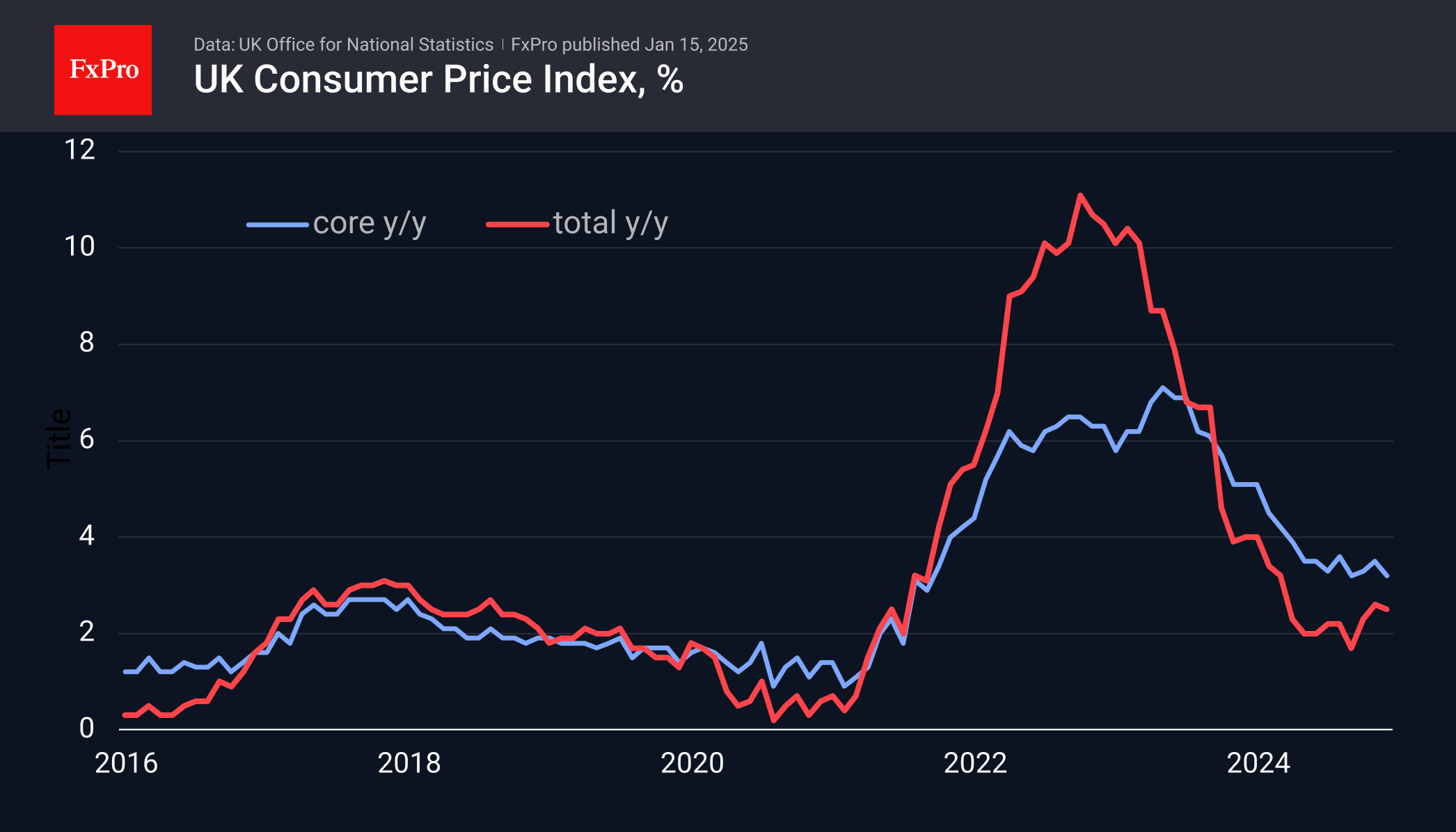

The UK Consumer Price Index (CPI) added 0.3% m/m in December, slightly below the average expectation of 0.4%. Annual inflation eased to 2.5%, having remained mostly in the 2.0-2.5% range for the past nine months. This is quite a long period without a significant decline and with some upward bias.

Core consumer inflation was 3.2% y/y in December, having remained in the 3.2-3.5% range for the past eight months. This figure is well above the 2% target and without a clear downward trend. As a higher reading was expected, the report probably stirred the bears, but did not allow them to play up to their full potential due to US inflation expectations.

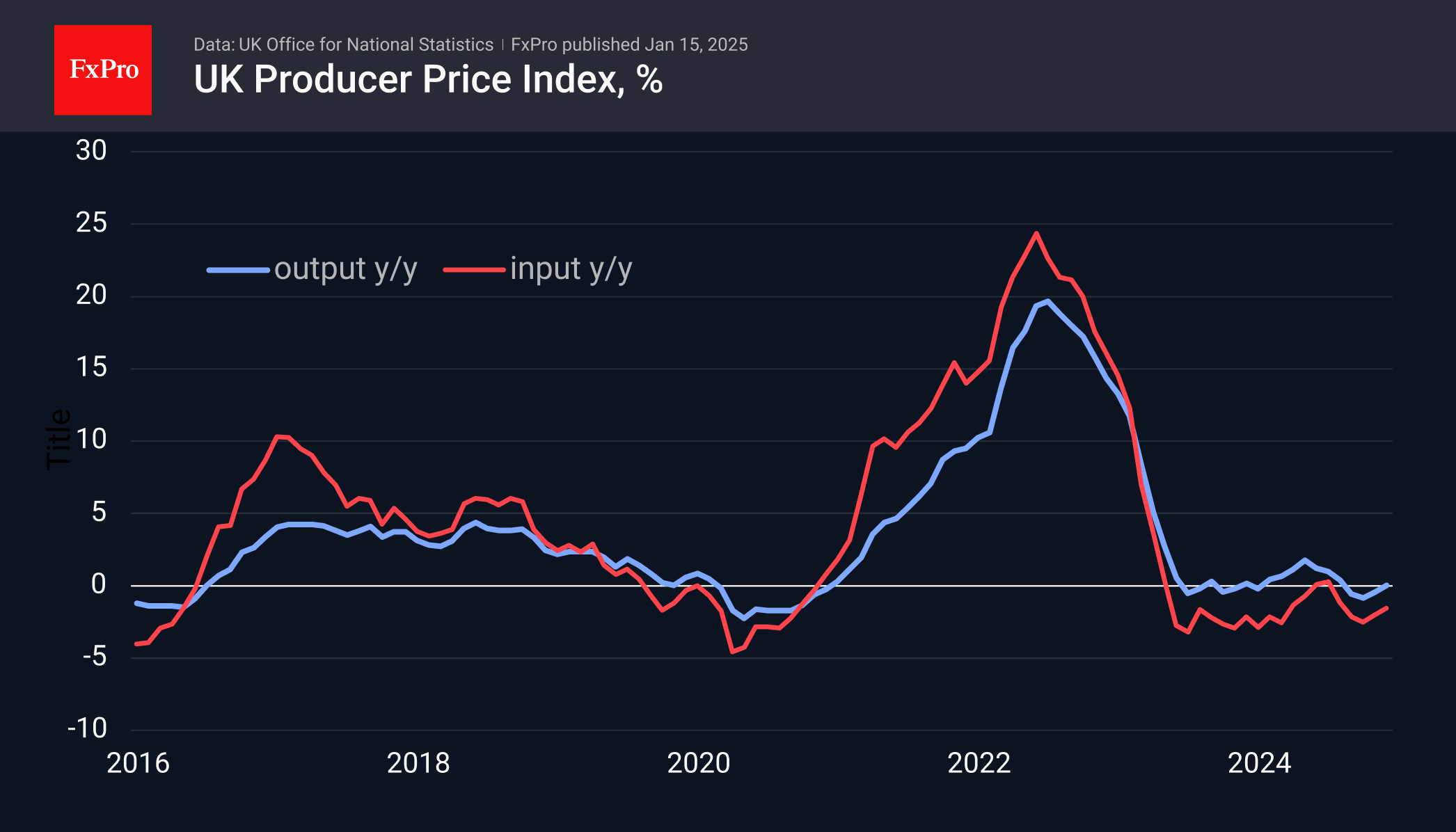

Input producer prices have barely been out of negative territory for the past year and a half, recording the latest data at -1.5% y/y. Producer prices ‘on the way out’ have shown near-zero momentum for the past 18 months, hitting 0.0% y/y in December.

Producer prices work to suppress inflation, while the rising cost of services raises the final price tag for consumers, suppressing their activity. The Bank of England is likely to use the weakness in producer prices and low economic activity as an excuse to cut rates. However, this support for the economy has its own negative effect in the form of higher inflation expectations. If inflation picks up again, rates will need to be raised for longer and more aggressively than they were when expectations were anchored at 2.0%.

GBP/USD has been hovering around the 1.22 level for the fifth trading session, finding solid buying on dips towards 1.21. This local bottom roughly coincides with the 2023 year-end pivot area, which further fuels bullish hopes. Short-term, they have the accumulated oversold pound on their side after a 5.5% failure in the last five weeks. The start of growth of GBP/USD is well within the framework of technical correction with the potential of increase up to the area of 1.24-1.26. And only a confident exit to higher levels will allow us to speak about a global reversal in this pair.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)