Yen continues to sink, stock markets power higher

Yen drifts lower

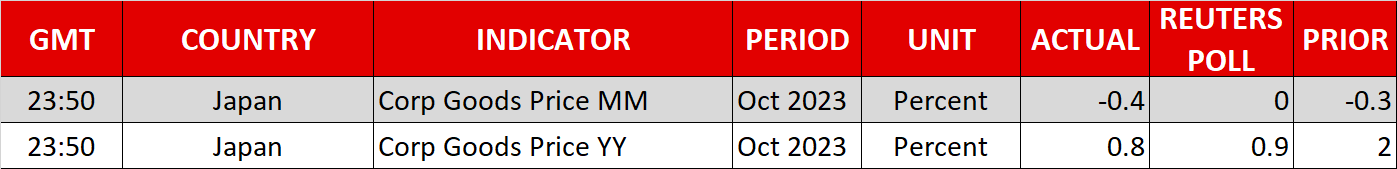

It’s been another devastating year for the Japanese yen, which has lost nearly 14% of its value against the US dollar so far, crumbling under the weight of interest rate differentials. The yen has now fallen back to the levels that forced Tokyo to intervene in the FX market last year.

The striking part is that the yen could not get any relief this month even as US yields declined from their cycle peaks and oil prices drifted lower - both favorable developments for the low-yielding and oil-importing Japanese currency.

It appears that the interest rate gap with other economies is still much too wide, leading to consistent capital outflows from Japan despite the spread narrowing somewhat recently. Similarly, the risk-on mood in equity markets continues to dampen demand for haven assets like the yen.

Looking ahead, the question is whether Tokyo will step into the FX market again to defend the sinking yen, and if so, at what levels. If dollar/yen manages to pierce above the key 152.00 region, the spotlight would shift to 155.00 as a potential intervention threshold.

In the big picture, a full-scale trend reversal for the yen would probably require a rate-cutting cycle in foreign economies, which may be the story of next year.

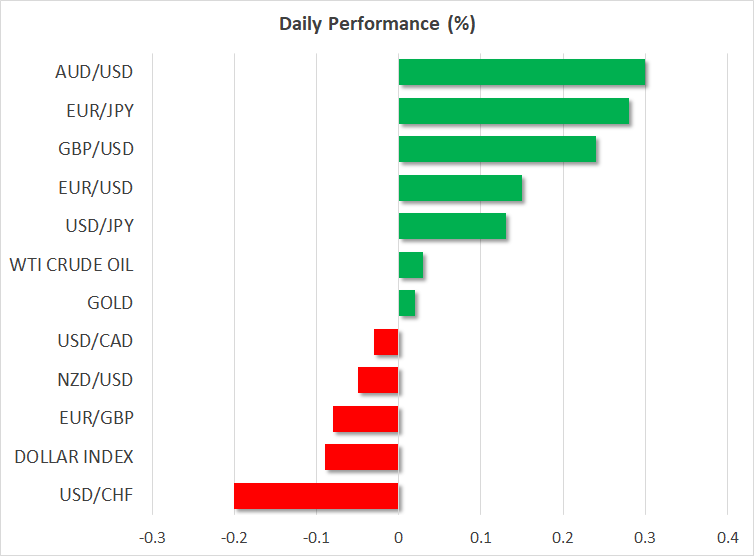

Dollar ignores Moody’s, equities scream higher

Another credit ratings agency has raised the alarm about the sustainability of the US debt trajectory. This time it was Moody’s, which maintained its top Aaa rating on the United States but lowered its outlook to “negative” from “stable”, citing the lack of any credible plans to rein in the deficit and political fragmentation in Congress.

With another US government shutdown looming on Friday, the timing of this move by Moody’s will serve as a warning to lawmakers unable to reach a deal on spending measures. That said, investors mostly ignored this ratings announcement, judging by the absence of any significant reaction in the US dollar or bond markets.

Meanwhile, stock markets raced higher on Friday. The S&P 500 rose nearly 1.6% while the tech-heavy Nasdaq gained more than 2%, without any clear catalyst behind this powerful rally. Valuations are already stretched, so the equity market seems to be pricing in a perfect scenario where interest rates fall next year as the economy slows, but earnings growth accelerates significantly.

Gold trades heavy, big data week ahead

In the commodity complex, gold prices are licking their wounds after a bruising week that saw the precious metal lose 2.8% of its value. The geopolitical demand that propelled gold prices higher last month has started to fade, as the tensions in the Middle East have not escalated into a broader regional conflict.

Hence, the geopolitical risk premium is being priced out, allowing gold to realign with its classic drivers - the US dollar and real yields. The yellow metal is currently testing its 200-day moving average at $1,935 and the outcome of this battle could be decided by tomorrow’s US inflation report.

It’s a huge week for the British pound as well. There’s a barrage of UK data releases on the agenda, starting with the latest employment stats tomorrow. The UK labor market has lost jobs for three consecutive months now as businesses are scrambling to slash costs in the face of weaker demand conditions and shrinking margins. One option is to fire workers.

Employment losses are how every recession begins, so a continuation of this trend would be extremely worrisome.

.jpg)