America cuts drilling activity due to weak prices

America cuts drilling activity due to weak prices

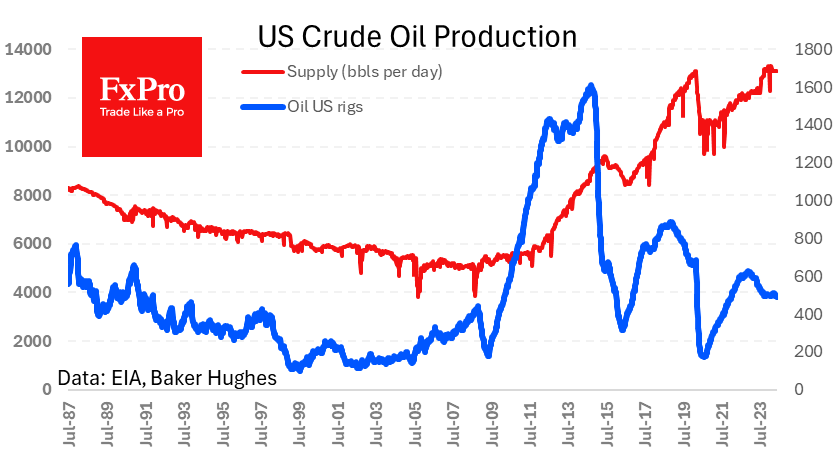

Low oil prices are not attractive to producers in the US, where the number of active drillers has fallen to its lowest level since early 2022.

Drilling activity in the US has been falling since early May after a relatively long period of stagnation—a new round of declines in a long-term downward cycle. Notably, production has declined from 13.3m bpd to 13.1m in recent months, rejecting the hypothesis of efficiency gains, something we have seen for most of the story since 2014.

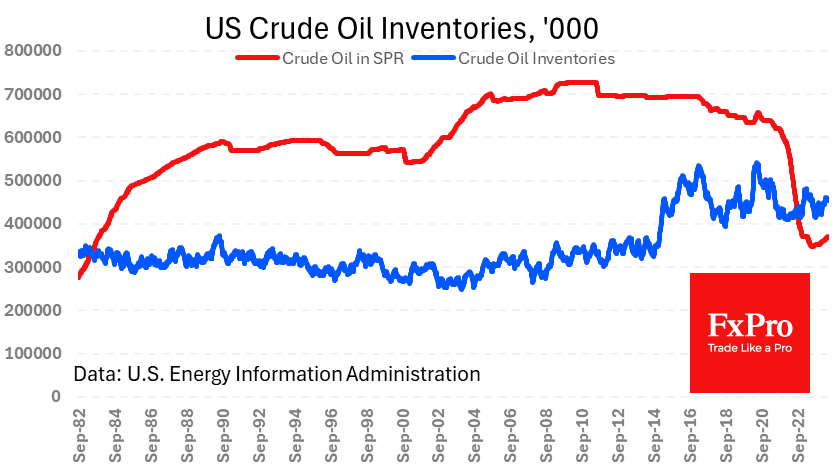

US producers appear to have lost interest in growing production and output. This can be attributed to the simultaneous effect of two factors: a rising inventory trend and a falling price. The upward trend in Strategic Petroleum Reserve (SPR) inventories has been in place since August and in commercial inventories since September. In both cases, this is a rebound from the "bottom", but it is an important signal that there is no shortage of oil in the US.

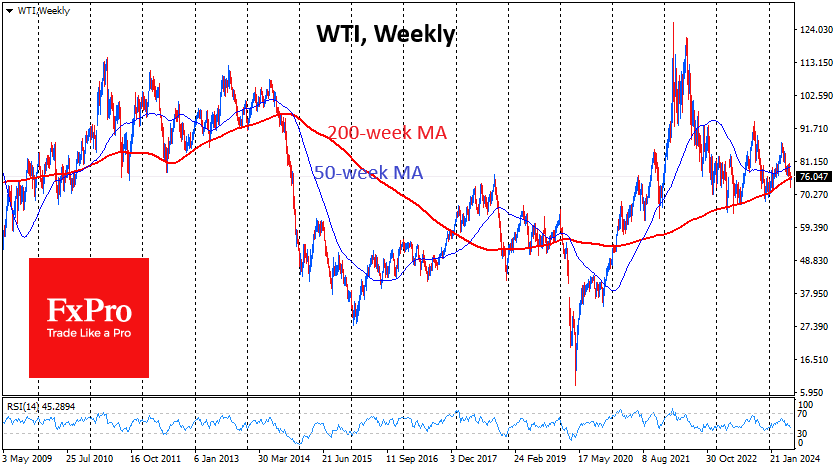

Oil price dynamics are also giving oil producers little encouragement. Over the past ten weeks, the price has fallen more than 12%, reaching 17% early last week. The price of a barrel of WTI is testing the 200-week moving average - clearly separating bull and bear markets for the past five years. However, this largely applies to previous years as well.

Last week, the bulls managed to stop the sharp increase in the sell-off, but perhaps only this week's results will tell us whether oil has managed to push off the bottom or whether the market is on the verge of a similar regime switch as in Q1 2020 or Q3 2014.

The current decline in oil prices may accelerate the filling of the SPR, allowing something of a "price floor" to form. But such a turn of events is a positive risk, not a fact. It is also worth being prepared that the US government would prefer to leave the price of oil and gas unsupported, improving the inflationary picture ahead of the November elections.

Also playing on the side of the bears in oil is OPEC+'s recent intention to increase production after some time, for which investments in production are already being made. The head of Russian oil giant Rosneft said that these "shadow barrels" that have not yet been produced are already putting pressure on the price.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)