Bitcoin and Ethereum have further correction potential

Market picture

The cryptocurrency market cap has fallen 1.6% over the past 24 hours to $1.10 trillion, back to the levels from which the market rebounded almost two weeks ago. At the same time, bitcoin is down 2%, Ethereum is down 2.2%, and the top altcoins are losing between 0.5% (Solana) and 3% (Cardano). Polygon (+0.8% in 24 hours) and Tron (+10% in 7 days) beat the headwinds.

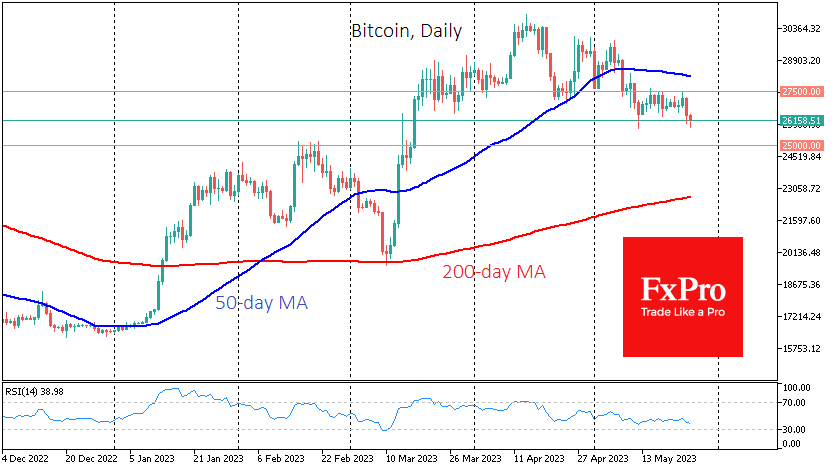

The price of Bitcoin dipped below $26K at the start of trading on Thursday, a level it has been consistently above since March 17th. Bitcoin enjoyed a strong rally in March and April amid fears over the safety of funds held by regional US banks. As this issue has faded from the headlines, cryptocurrencies have reversed into a correction.

On the technical analysis front, the $25K level is seen as a critical stop on the way down, with little support found on the journey to that level.

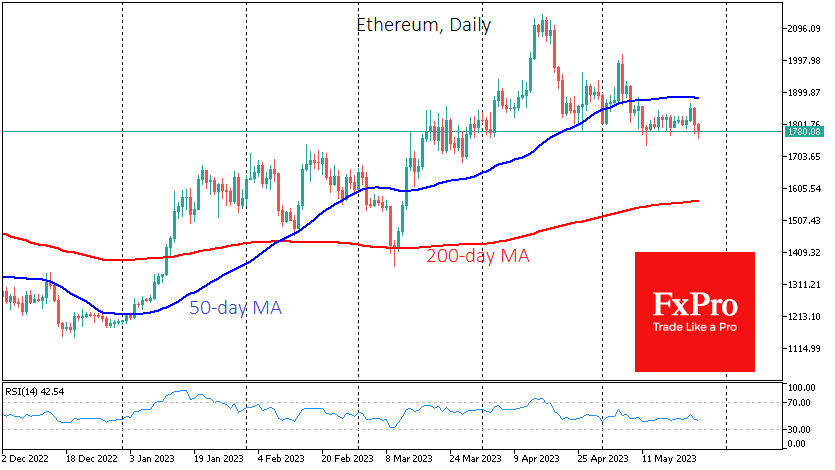

Ethereum has rolled back to the lower end of the last two months' range at $1777. A further move lower opens the door to $1700.

News background

The popular ChatGPT predicted that Bitcoin's 2024 halving would be the catalyst for a "massive bull run", explaining that the value of the limited resource is increasing with unchanged or rising demand.

The International Organisation of Securities Commissions (IOSCO) said that cryptocurrencies should be treated similarly to stocks and bonds because of their similarities.

Reuters reports that cryptocurrency exchange Binance failed to keep separate corporate and customer balance sheets in 2020 and 2021, violating US financial regulations. Binance has denied the information.

Elon Musk urged people "don't bet too much" on Dogecoin and not put all their money into the asset, yet he still said that DOGE is his favourite coin.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)