Crypto Market Touched by Fear

Crypto Market Touched by Fear

Market Picture

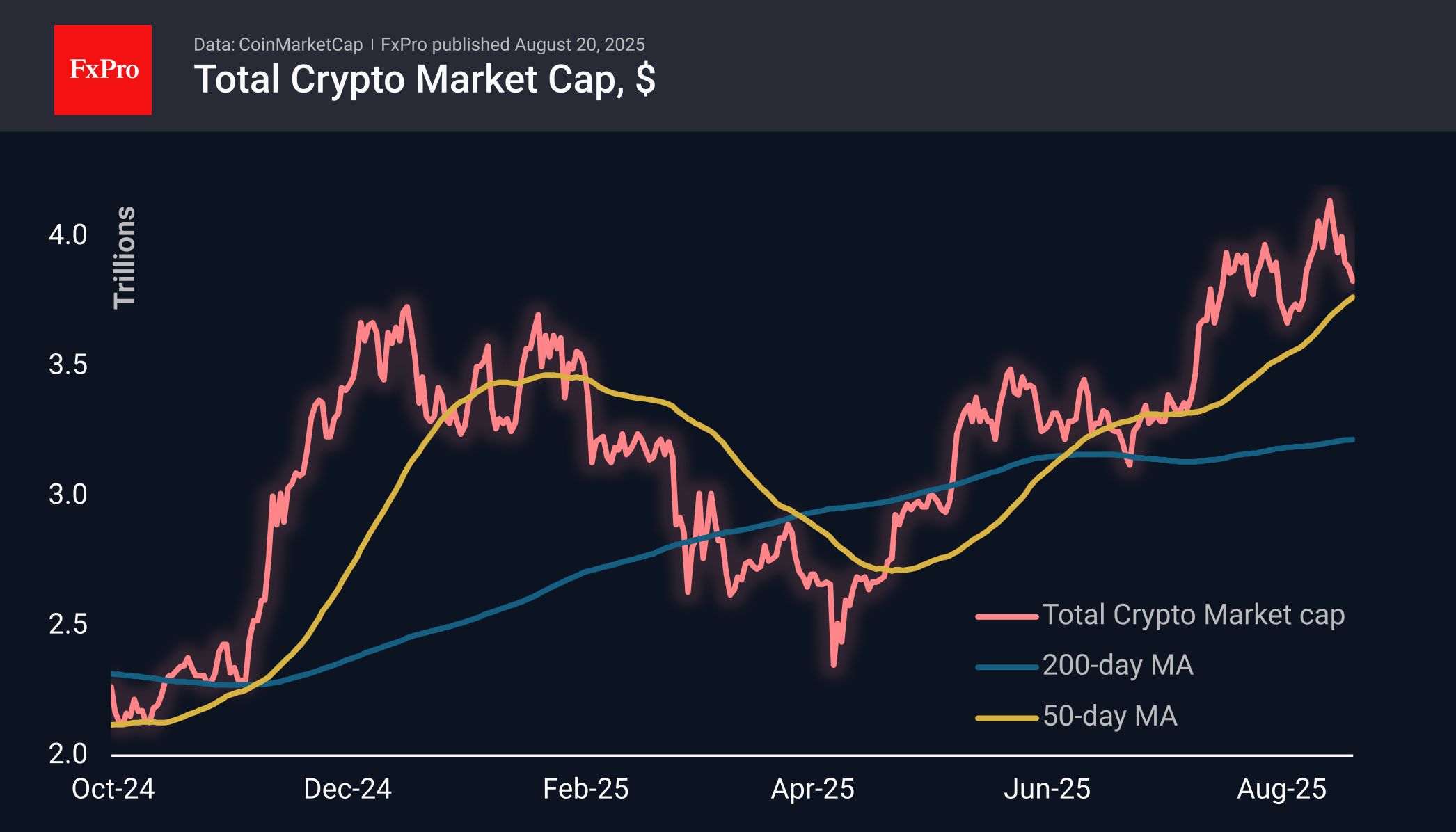

Crypto market capitalisation continues to melt, falling another 1.4% to $3.83 trillion. At its lowest point this morning, it dropped to $3.79 trillion, which is 9% below the peak of $4.17 trillion. The crypto market lost momentum earlier than Nasdaq100 stocks, regaining its reputation as a more sensitive indicator of investor sentiment.

The sentiment index fell to 44 (fear) — a nearly two-month low. This is a sharp change in sentiment after 75 (on the verge of extreme greed) six days ago.

Bitcoin fell to $112.5k in the morning, receiving temporary support when it touched the area of recent lows at the start of the month. At the same time, the day before, sales increased after a decline below the 50-day moving average — a bearish signal. Now, all attention is focused on whether there will be a pullback to a potentially stronger support area near 108. If there is no support there, a straight road to $100K will open.

News Background

According to CryptoQuant, Short-term Bitcoin holders have started selling assets at a loss for the first time since January. The last time such a situation was observed was in January of this year, when the market experienced the deepest correction in the previous crypto cycle.

Santiment highlights several key on-chain metrics that indicate a possible market overheating. The main signal is that BTC's new high in August was reached on lower trading volume than in July. Another sign is a sharp increase in retail investor activity, usually associated with FOMO, which typically precedes corrections. The situation with Ethereum looks even more risky.

Presto Research believes that Bitcoin's recent records may be a consequence of the dollar's depreciation rather than a reflection of real value growth. For a more accurate assessment, it is better to express the value of Bitcoin in gold. With this calculation, the BTC rate will be lower than the 2021 peaks and the levels after the 2024 elections.

Ethereum has recorded the largest queue for withdrawals from staking — more than 910,000 ETH out of $3.7 billion. The current withdrawal queue will be processed in 15 days due to the PoS architecture on which Ethereum operates. The increase in the number of requests is related to profit-taking but is not equivalent to selling pressure.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)