Crypto Near August Bottom

Market Picture

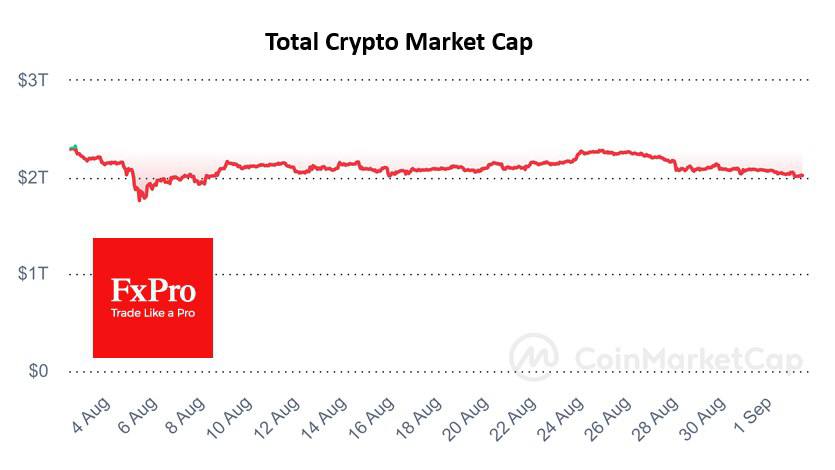

Crypto market capitalisation has fallen to $2 trillion, hitting lows since 8th August and losing almost 10% over the past seven days. The decline has slowed since the second half of last week, but the downtrend persists. The Cryptocurrency Fear and Greed Index fell to 26 (fear).

Bitcoin is trading around $57.5K, having been near the lower end of its trading range since 12th August. A break of this support, which has repeatedly attracted buyers since May, could accelerate the sell-off. The next important support in case of a decline will be the area of the lows of the trading range since March, around $54K.

Bitcoin ended August down 8.7% to $58,950, making it the cryptocurrency's worst month since April. In terms of seasonality, September is considered the worst month of the year for BTC. Over the past 13 years, Bitcoin has ended the month up only four times and down nine times. The average decline was 12.7%, and the average rise was 9.5%.

News Background

According to SoSoValue, outflows from spot bitcoin-ETFs in the US totalled $277.1 million last week, the highest in 10 weeks. Cumulative inflows since BTC-ETFs were approved in January have fallen to $17.60bn.

The Ethereum-ETF saw negative performance for the third consecutive week, totalling $12.6m against $44.5m a week earlier. Net outflows since product approval rose to $477.3 million.

According to Kaiko, authorities in the US, China, the UK, and Ukraine may begin selling their Bitcoin holdings in September, which could bring the first cryptocurrency down to $53K.

According to CryptoQuant, the aggregate Bitcoin balance on centralised exchanges has updated the year's lows. Experts believe this may indicate a reduction in selling pressure and the prerequisites for a resumption of the bull market if demand strengthens.

Bitcoin's hash price (an indicator of mining profitability) is at an extremely low level. CryptoQuant analysts note that the hash price to asset price ratio is reminiscent of the period before the 2020 rally.

El Salvador Nayib Bukele said that a monetary experiment with legalising Bitcoin as a legal tender has had mixed results. According to him, BTC ‘has not received the widespread acceptance we had hoped for.’

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)