Crypto takes a step back, ready for volatility

Market Picture

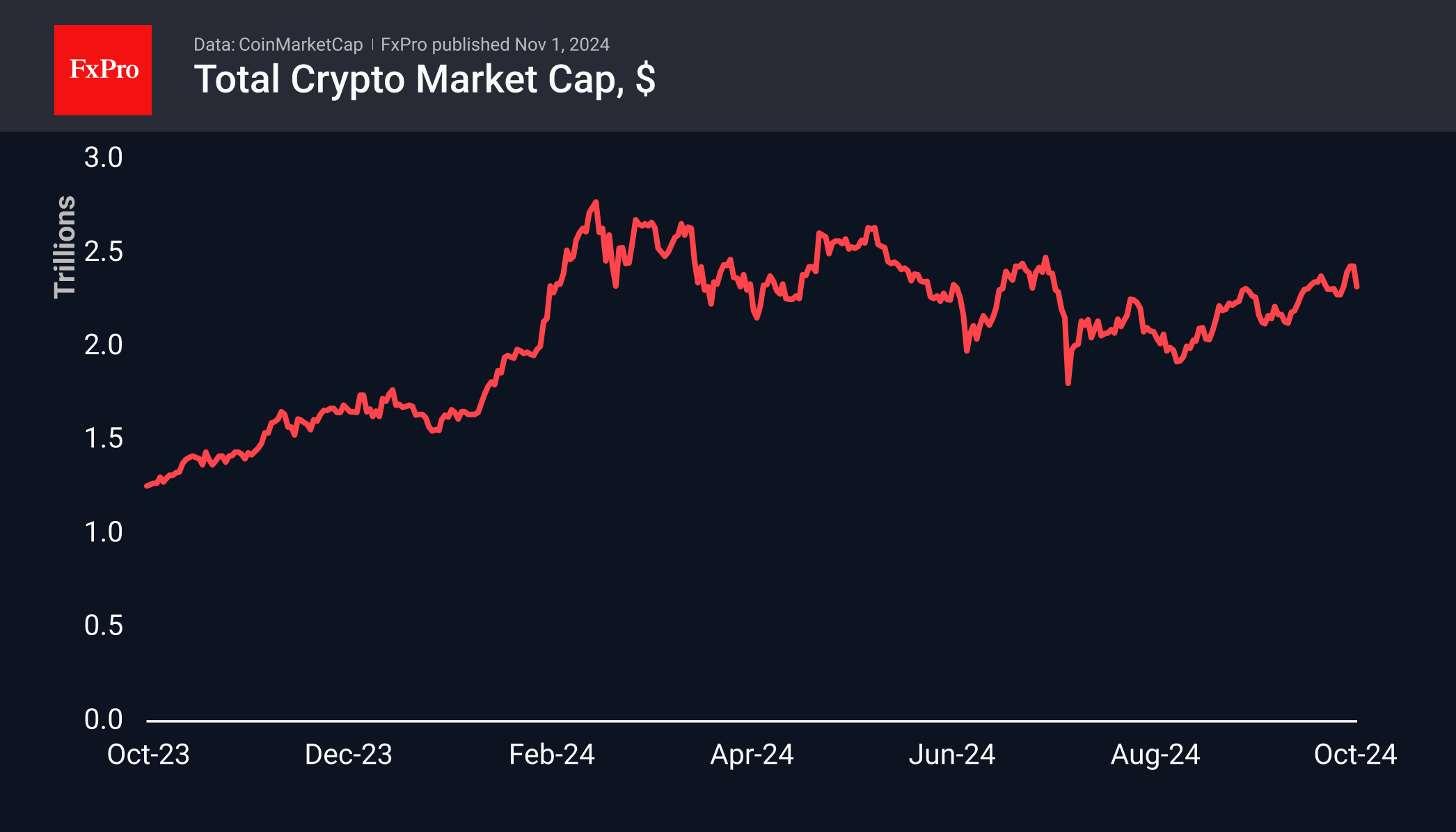

The crypto market stumbled on the last day of October, losing over 5.5% in 24 hours as investors turned to profit-taking. The drop coincided with the stock market entering a period of high uncertainty ahead of a mix of influential events: the NFP on Friday, the US election results on Wednesday and the Fed meeting on Thursday.

The total crypto cap rolled back to $2.33 trillion, where the market consolidated in the 10 days to 25 October. While painfully sharp, it fits well with the upward trend that has been building since early September.

Bitcoin has fallen back just below the $70K area, temporarily turning support into former resistance. After an impressive and rather unexpected attack on all-time highs, Bitcoin is now in news-waiting mode, ready to move either way from current levels. There will be no shortage of volatility and sharp reversals.

At the end of October, bitcoin was up 9.7% at $70K. In terms of seasonality, November is considered a successful month for BTC. Over the past 13 years, bitcoin has ended the month with a gain 8 times, with an average rise of 22% and an average fall of 17%.

News background

Crypto investment firm Canary Capital has filed an S-1 with the SEC to register a spot ETF based on Solana. Solana's advanced DeFi ecosystem ensures sustained on-chain activity, as evidenced by the number of daily transactions and active and new addresses while keeping user fees low, the company said in a statement.

In its Q3 report, MicroStrategy unveiled a plan to raise $42 billion to continue its bitcoin acquisition strategy. Since August 2020, the company has spent $6.9 billion to buy 252,220 BTC.

According to its quarterly report, social network Reddit sold nearly $6.9m of its BTC and Ethereum reserves in the third quarter. The company noted that fluctuations in crypto-asset exchange rates have negatively impacted its financial performance, as has the lack of a clear tax regime for cryptocurrencies.

The growth of the stablecoin market has led to increased demand for short-term Treasury securities, the US Treasury Department said in a report. The department estimates that stablecoin issuers have invested $120 billion in US debt.

31 October marked the 16th anniversary of the Bitcoin White Paper. The technical document described the working principles of the peer-to-peer payment system that went on to revolutionise the world of financial technology. Donald Trump congratulated the crypto community on the occasion.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)