Daily Global Market Update

Pound's Minor Rise Against the Dollar

The GBP/USD pair experienced a slight increase, rising 0.2% in the last session. The Stochastic indicator is currently signalling a negative trend.

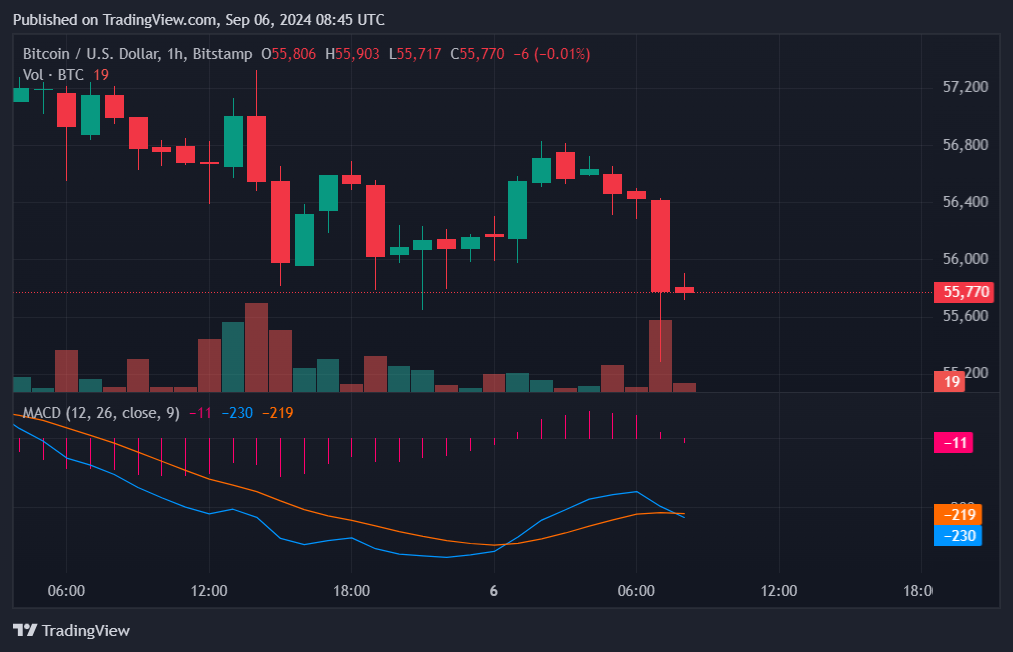

Bitcoin's Significant Drop

The BTC/USD pair plummeted by 3% in the last session. The MACD is currently giving a negative signal, aligning with the recent price action.

Oil's Slight Increase

Oil experienced a marginal increase of 0.1% against the dollar in the last session. The Rate of Change (ROC) indicator is currently giving a negative signal.

Australian Dollar's Upward Movement

The AUD/USD pair gained 0.3% in the last session. However, the Ultimate Oscillator is currently giving a negative signal, suggesting potential caution.

Global Financial Headlines

Crypto lobbying has seen a significant increase over the past few years, with key companies like Coinbase driving advocacy efforts to influence US legislators. Coinbase has increased its lobbying expenditure by 3,475% over the past 7 years. In Europe, shares of major luxury goods companies have fallen sharply due to growing concerns over slowing demand in the key Chinese market, following signs of weakening in the world's second-largest economy. OPEC+ has agreed to delay a planned oil output increase for October and November after crude prices hit their lowest in 9 months, adding that it could further pause or reverse the hikes if needed.

Upcoming Economic Highlights

Key economic events to look out for include:

• Japan's Coincidence Index - 0500 GMT

• Japan's Leading Economic Index - 0500 GMT

• UK's CFTC GBP Non-Commercial Net Positions - 1930 GMT

• Eurozone's Gross Domestic Product - 0900 GMT

• US Non-Farm Payrolls - 1230 GMT

• US Average Hourly Earnings - 1230 GMT