Dollar battles to maintain recent gains

Are tariffs a panacea?

With the clock running down to the August 1 deadline when the updated tariff levels will probably come into force, US President Trump is now using tariffs as leverage to end the Ukraine-Russia conflict. His previously positive stance towards Russian President Putin took a 180-degree turn yesterday, as he threatened to impose 100% tariffs on Russian exports and secondary tariffs on countries buying Russian oil, if no peace deal is reached within 50 days. At the same time, more weapons will be sent to Ukraine, including Patriot missiles aimed at Russian aircrafts.

Only time will tell if Trump’s efforts prove fruitless once again, but this is the first time he is considerably upping the pressure on Russia. While we have yet to hear from the Kremlin, it is almost certain that Trump’s rhetoric has angered the Russian President. A peace deal within 50 days is a tall order, particularly as oil prices remain at decent levels, despite the overnight dip to $66.70.

Risk markets remain dauntless

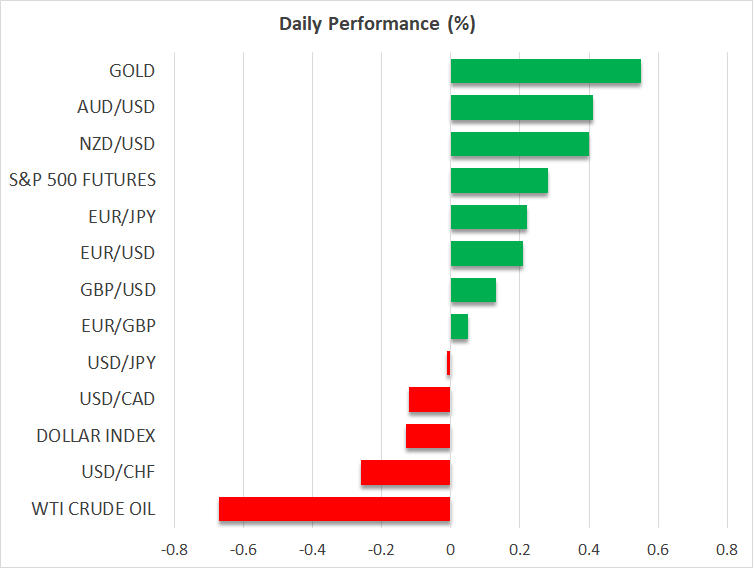

The market has mostly ignored these developments, with the US dollar being slightly on the back foot at the time of writing. Euro/dollar is currently hovering around the 1.1680 area, quite close to its recent lows and just 150 pips below the July 1 peak of 1.1829. That said, it has been a relatively good period since early July for the greenback, outperforming its main competitors. More specifically, dollar/yen and pound/dollar have moved by 2.5% and 2.2%, respectively, in July, in favour of the dollar.

Meanwhile, both the S&P 500 and Nasdaq 100 indices recorded new all-time highs on Monday, as investors continue to ride the AI curve, with the next earnings round already underway. Several US banking institutions are set to announce their results today and tomorrow, followed by the critical tech sector next week, with Alphabet’s earnings announcement scheduled for July 23.

Notably, the cryptocurrency market appears to be taking a breather after bitcoin hit its new all-time high of $123,104 on Monday morning, fueled by institutional demand and the GENIUS Act, which is expected to be approved by the House this week. Bitcoin is trading at $117k, at the time of writing, up 9% in July and a sizeable 25% in 2025. Interestingly, despite the recent rally, both Ethereum and Solana are still well below their 2024 highs.

The Fed is worried about everything

With the Fed still resisting calls for immediate rate cuts, the US President continues to criticize and name-call Jerome Powell in an apparent effort to discredit the Fed Chair and even force him to resign well ahead of his May 15, 2026 term expiration. While Trump is unlikely to pause his current strategy, the Fed remains focused on meeting its dual mandate, while navigating through the tariff saga.

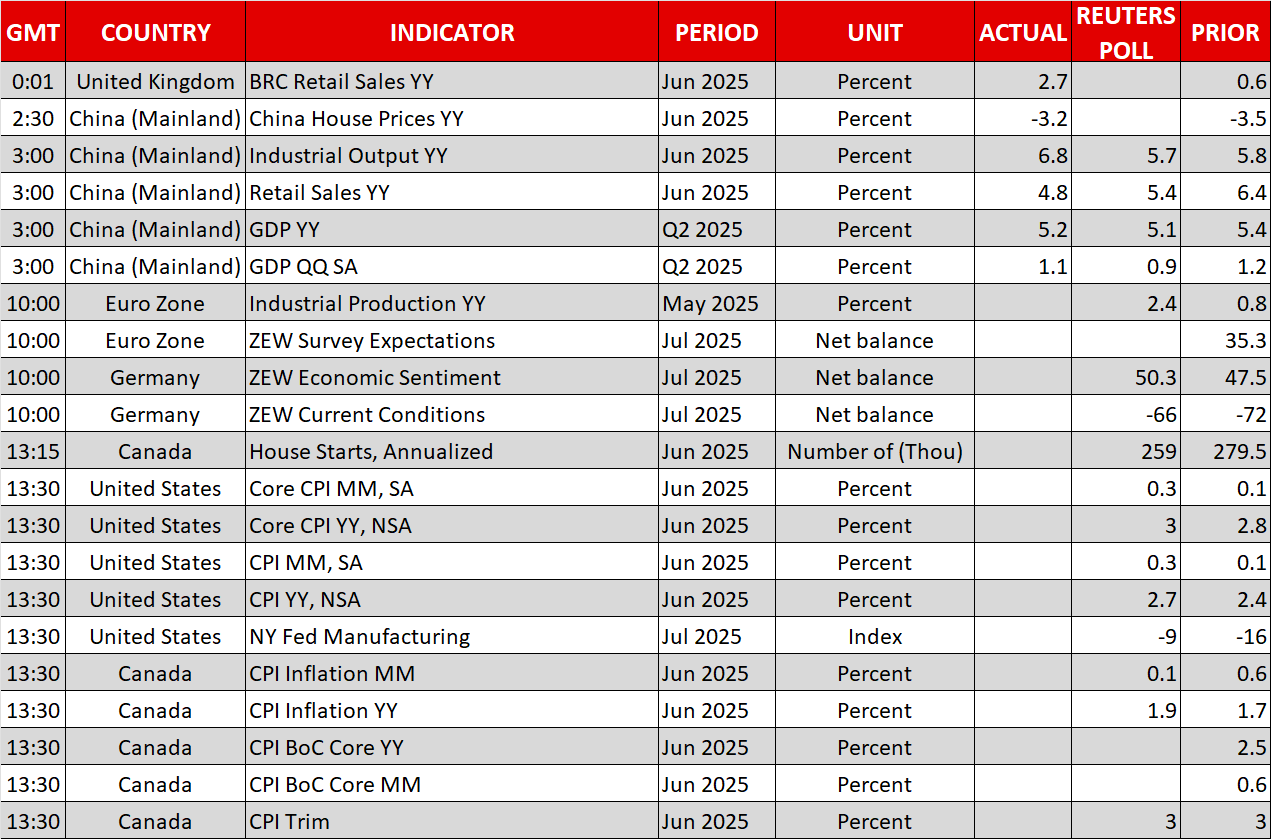

Crucially, the June CPI report is due today at 12:30 GMT, with economists forecasting an acceleration in both the headline and core inflation rates to 2.7% and 3% YoY, respectively, with a non-negligible chance of a small downside surprise. Confirmation of these consensus figures could give a short-term boost to the dollar and should diminish any expectations for a July 30 rate cut. Notably, Fed voters and doves Bowman, Barr and Collins will be on the wires after the inflation data.

Finally, there is some positive news from China. GDP for the second quarter of 2025 expanded by 1.1% QoQ and 5.2% YoY, slightly above expectations but a tad below the Q1 figures. Considering the tariff shenanigans and the lingering domestic issues, one could argue that the results are satisfactory, particularly considering the weak June retail sales and industrial output data. Aussie/dollar is slightly in the green day, battling with a key resistance level.

.jpg)