EBC Markets Briefing | Oil prices up as investor weigh car tariffs

Oil prices nudged higher on Thursday on concerns about tighter global supply after the US threat on Venezuelan oil buyers, while market players also grappled with the impact of tariff on car imports.

That could drive car prices up, potentially impacting demand for oil, but also slow down the switch to greener cars. The full details of the measure remain unclear, as most cars consist of parts from various countries.

Crude inventories fell by 3.3 million barrels in the week ended March 21, the EIA said, a deeper draw than the 956,000 barrels that analysts had expected in a Reuters poll.

Energy executives were pessimistic about the sector's outlook, a Dallas Fed survey showed, as separate Trump tariffs on steel and aluminium could drive up costs for drilling and pipeline construction.

The US is a major buyer of Venezuelan oil, as a result of exemptions from economic sanctions granted to US oil firm Chevron. But Trump has previously signalled intention to end those exemptions.

Elsewhere, the US reached deals with Ukraine and Russia to pause attacks at sea and against energy targets, with Washington agreeing to push to lift some sanctions against Moscow.

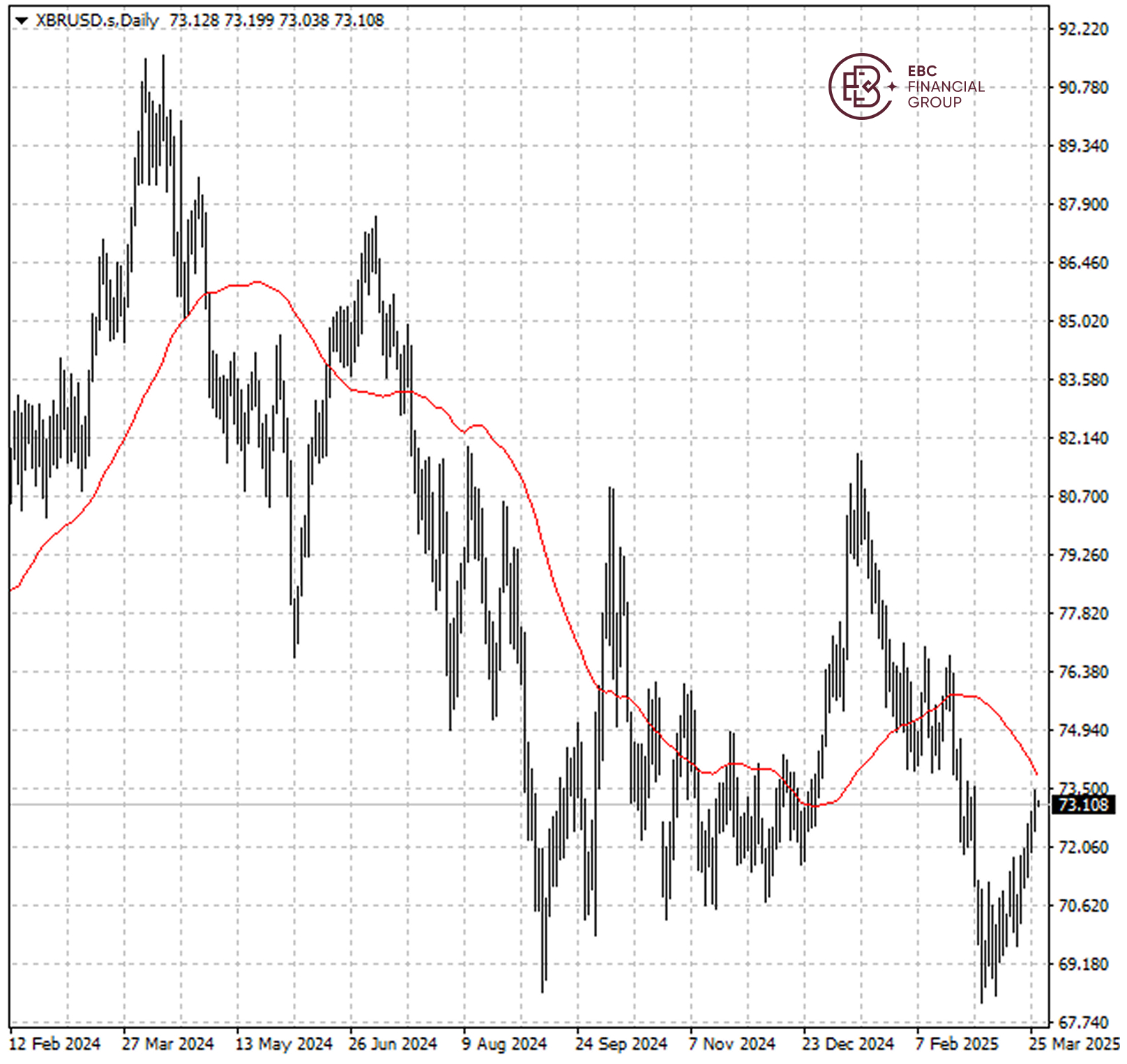

Brent crude bottomed out in mid-March before a sustainable rally. Looking ahead, 50 SMA around $74 seems a major resistance, and the price may need to break above $77 to reverse the medium-term downtrend.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.