Euro rises against German Business Climate decline

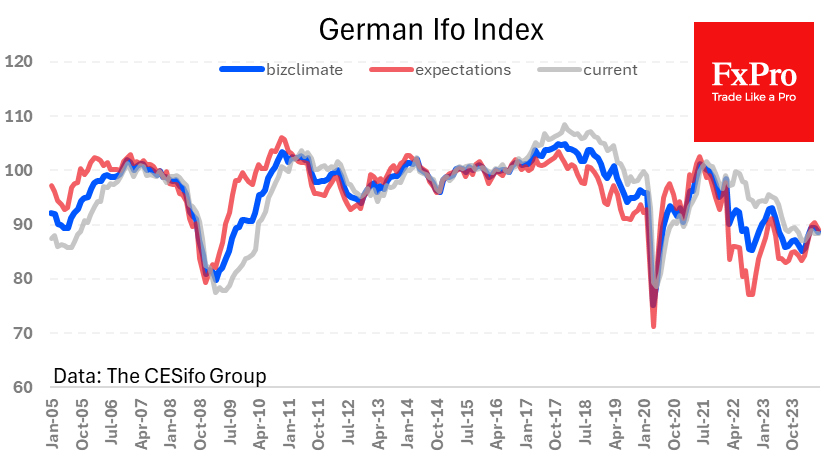

The Ifo German Business Climate Index declined in June as expectations worsened, confirming a reversal of the downward trend.

The Ifo index fell from 89.3 to 88.6 instead of the expected increase to 89.4, making it the second month of contraction, albeit a very modest one. At this point, it is correct to speak of a halt in growth, but it is hardly justified to mark the beginning of a decline.

The fresh figures complemented last week's unexpected and sharp plunge in PMIs.

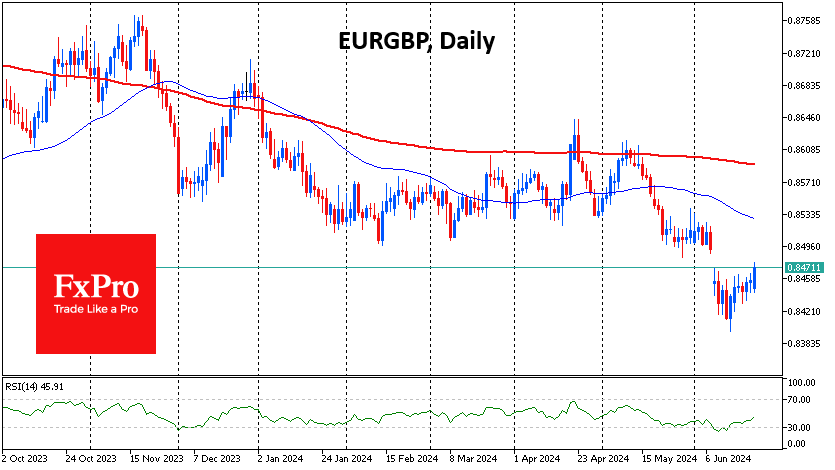

This potentially negative news did not prevent the single currency from recovering against its major peers on Monday, with EURUSD rising back above 1.0720. EURGBP has risen to 0.8470 and is actively closing the gap formed after the French election announcement. EURJPY surpassed 171, above which it traded for a few minutes on 29 April and before that in September 1992.

The euro's movement against the news on Monday looks like a pullback after the excessive negativity ahead of the French elections and more like a technical rebound, which worked out about half of its potential, forming resistance at 0.8500 in EURGBP and around 1.0770 in EURUSD.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)