Frightened Crypto Market Chooses a Path

Market picture

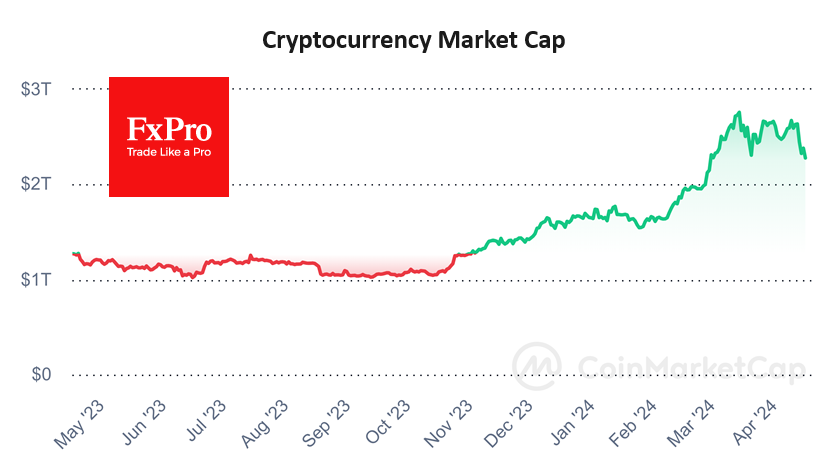

The sell-off in US stock markets affected global risk appetite late on Monday, reversing initial positivity. As a result, crypto market capitalisation fell 5.4% in 24 hours to 2.29 trillion, back near the weekend lows. The market is hovering near the lows of March. This is a key moment in choosing the market’s direction for the coming weeks. A bounce out of this area will allow for the expectation of an early recovery to the recent highs. A dip below would likely trigger a broader liquidation of positions.

Bitcoin has returned to the area of the lows of the past seven weeks, coinciding with the 61.8% retracement level of the rally from the January lows. Like the crypto market, Bitcoin is choosing between a loosely controlled deepening of the decline or a reversal to growth. On the negative side, the 50-day moving average triggered resistance on Monday.

According to CoinShares, crypto fund investments fell by $126 million last week after inflows of $646 million a week earlier; the small outflow came after two weeks of growth in the index. Bitcoin investments decreased by $110 million, Ethereum - by $29 million, and Solana - by $4 million.

News background

If Bitcoin falls below short-term holders’ support at $58,900, the market risks going into a bearish phase, said analyst and CMCC Crest co-founder Willie Wu. He noted that almost every cycle prior to halving has seen a bear phase due to the ‘overaccumulation’ of the first cryptocurrency.

As a result of the Bitcoin halving, only 20 per cent of the world’s mining companies will be able to maintain their revenues at levels comparable to the previous period, TheMinerMag calculated. As a result, the mining industry could lose around $10 billion a year of revenue.

After the halving, miners could potentially liquidate $5bn worth of Bitcoin inventory, putting pressure on the price, 10x Research warned. The overhang of this sell-off could last four to six months.

The Hong Kong Securities and Futures Commission (SFC) has approved applications to launch spot bitcoin and Ethereum-ETFs. Matrixport estimates that demand for Bitcoin-ETFs in Hong Kong will reach $25bn.

Bitcoin mining companies will try to mine the first block that appears after the halving to get an ‘epic’ satoshi with an estimated value of several million dollars, CoinDesk reported.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)