Improving investor sentiment in Europe

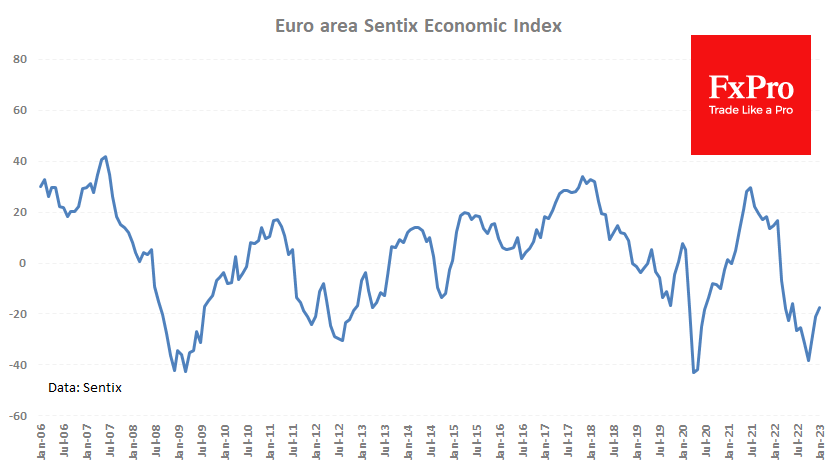

Europe is climbing out of its economic hole. At least, this applies to business and investor sentiment. A new assessment from Germany's Sentix marked a recovery of the investor confidence indicator from -21.0 a month earlier to -17.5 - a significant improvement from October's bottom at -38.9.

The indicator's recovery exceeded expectations for the third month, surprising analysts. The increase is supported by milder weather, which allows for lower gas prices and boosts business confidence that it will survive this winter. But it is also noteworthy that the recovery is by no means hampered by the harsh tone of the monetary authorities, raising interest rates, and the strengthening of the euro by more than 12% from the September lows.

The eurozone economy is recovering more strongly, despite the energy crisis and a tough reshaping of logistical links. It is more alive than it has been since the global financial crisis, which for the most part, has affected US and UK banks.

The outperformance of European equities and the rise of the single currency in recent weeks shows that investors realise that they were overly spooked by the start of the autumn, and expectations are now becoming a little rosier. A more rapid deceleration in inflation than previously feared is adding to the positive sentiment.

However, it may be too soon to celebrate a victory for the European economy as the full effect of the interest rate increases is yet to be felt. On the other hand, it is positive for the Eurozone and the Euro exchange rate that China is switched to active stimulus. EURUSD is trading near 1.0740, near the highs since early June, and continuing positive economic surprises are setting the pair up for further gains towards the 1.09 area by the end of the month and at 1.12 by the end of the first quarter.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)