Slowing inflation puts the franc on a downward path

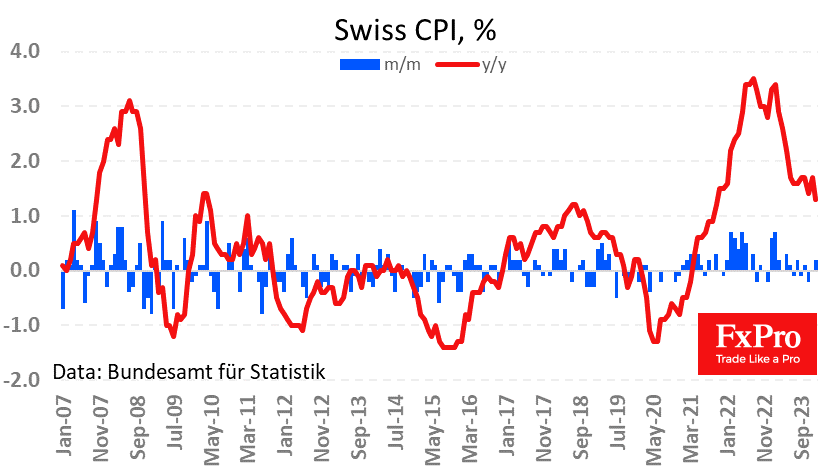

Consumer inflation in Switzerland slowed to an annual rate of 1.3% in January, the lowest since October 2021. This is significantly lower than the 1.7% recorded in the previous month and was expected on average by analysts.

The current level is slightly above the local peaks seen in 2018 and 2010. However, throughout the period from 2009 to 2021, Switzerland has been actively easing policy to boost rather than dampen inflation.

An important driver of lower inflation has been the appreciation of the franc through the systematic sale of foreign exchange reserves by the Swiss National Bank. Now, there is clearly no need for such active measures. Moreover, the impending monetary policy reversal by the Fed, the ECB and the Bank of England sets the stage for a similar reversal by Switzerland, with consequences for the currency market.

The Swiss franc hit multi-year or all-time highs against many of its peers in the final days of last year, and since then, a reversal has been imminent. The USDCHF, for example, has risen 5.7% since the beginning of the year on the back of a simultaneous dovish shift in expectations from Switzerland and a hawkish shift from the US.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)