Switzerland may exert more pressure on the franc to bring back inflation

Switzerland may exert more pressure on the franc to bring back inflation

Data released on Monday showed that Switzerland's producer and import price index fell by 0.5% in May, against an expected increase of 0.1%. The decline in this leading inflation indicator was the strongest in six months, accelerating the year-on-year decline to 0.7% from 0.5% previously. This marks 25 months in negative territory, with the index itself at its lowest level since February 2022.

The consumer price index published earlier returned to negative territory for the first time in more than four years.

An important driver of the price decline was the strengthening of the franc, which acts as a safe haven for global capital. The SNB has been easing its policy since the beginning of 2024, lowering the rate by 150 points during that time. However, the ECB has cut its rate by 210 basis points, making Switzerland's policy comparatively tighter.

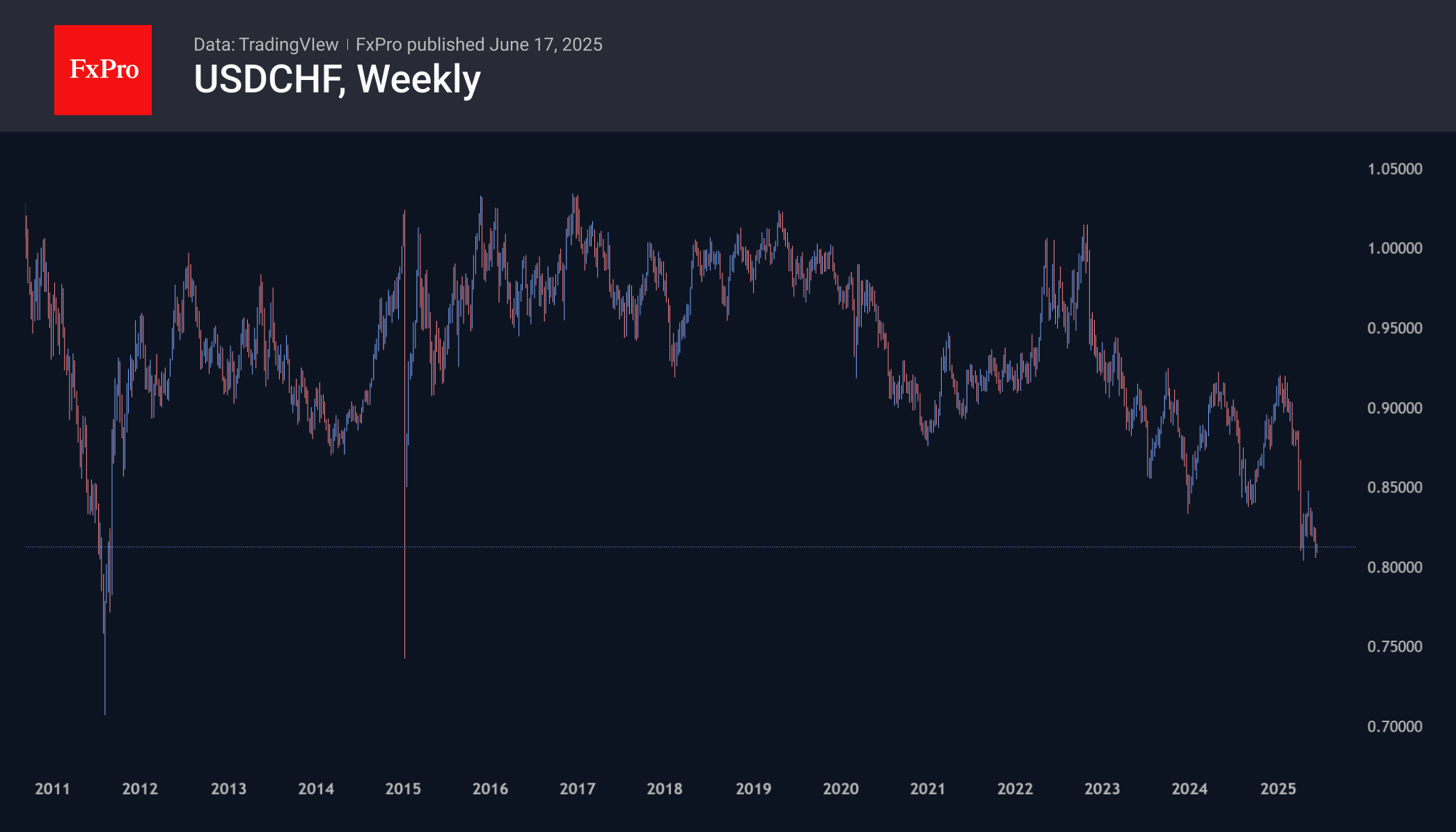

In addition to the threat of deflation and the ECB's lagging behind in easing policy, the third factor putting pressure on the Swiss National Bank should be the franc. Last week and at the end of April, USDCHF fell to 0.8050, below which it had been for a few hours in January 2015 and four weeks in the summer of July and August 2011.

EURCHF looks no less problematic, not far from its historical lows near 0.9250. The pair has been methodically reversed by the SNB's verbal or actual actions. At the same time, declining inflation and the franc's wanderings near its historical ceiling against the two major currencies point to the need for more fundamental measures.

Thus, at its upcoming quarterly meeting on Thursday, the SNB is likely to lower its key rate. On average, markets expect a 25-basis-point cut and another such move before the end of the year. However, we do not rule out more decisive steps, including increased currency interventions and a declaration of readiness to return the rate well below zero to weaken the inflow into currency deposits and force money to work for the economy.

As in previous similar episodes, a change in the SNB's policy could lay the foundation for a months-long trend of franc weakness and cause the EURCHF and USDCHF to rise by 10-20% in the next 2-4 quarters to previous consolidation areas.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)