The Kiwi Dollar flies down

The Kiwi Dollar flies down

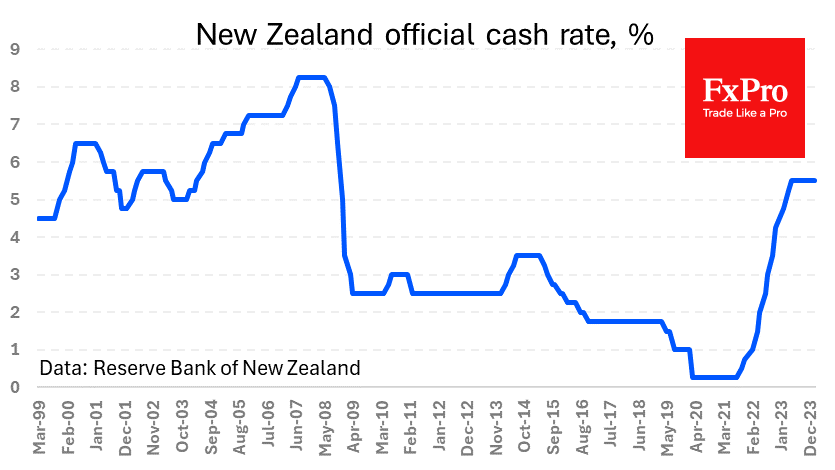

The New Zealand Dollar is down 1.2% since the start of the day on Wednesday due to disappointment with the RBNZ's actions and comments. The country's central bank left its key interest rate unchanged at 5.5% and signalled its willingness to keep it at current levels. This is much softer than expected, as markets had been pricing in some chance of a hike at this meeting. To meet such expectations, the RBNZ would have had to at least warn that it was ready to do so in the near future.

In the accompanying commentary, however, the central bank merely indicated that it was prepared to keep interest rates at current restrictive levels for longer than the bond markets expect. One can understand the RBNZ's reluctance to tighten at a time when the central banks of the major developed countries are discussing the start of rate cuts.

It is also worth remembering that New Zealand has raised rates by 525 basis points this cycle, which is comparable to the Fed's tightening, while most other central banks have not tightened as much.

The RBNZ's current decision has implications beyond small New Zealand, but it shows a definite change in tone from the central bank despite inflation running above the target. This RBNZ dovishness is, in our view, a key driver of the USD's strength against its peers on Wednesday afternoon.

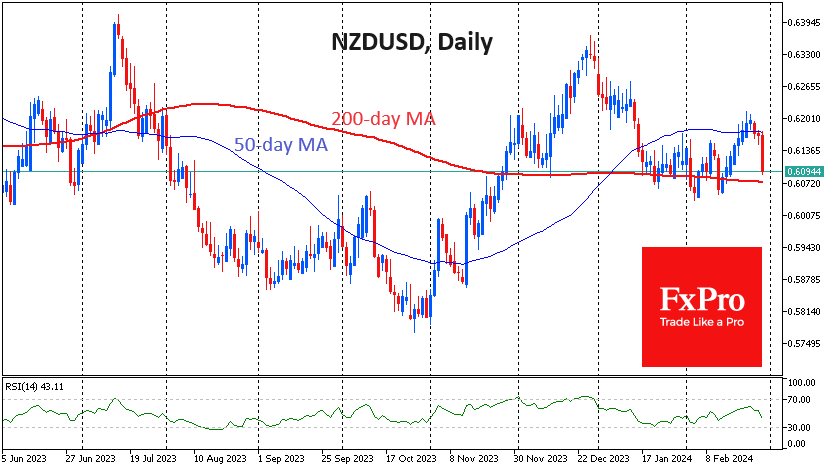

Separately, it is worth considering the implications of the Kiwi's current failure for the technical picture. The NZDUSD reversed to the downside at the end of last week, failing to break above the 50-day moving average. Today, the bulls finally capitulated, creating a solid move. Such momentum is often the start of a longer trend.

However, the bears' willingness to keep pushing the market lower is about to face a significant test in the form of the 200-day moving average. It passes 0.6070 against the current price of 0.6090 and 0.6170 earlier in the day. The pair has crossed from the bottom to the top of this curve since the second half of January and has found buying support on dips below it. A revised view on monetary policy seems to be reason enough to break below a vital trendline, but we will have to wait for a break of the 200-day moving average from top to bottom first.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)