Trump backs down on EU tariffs but dollar at one-month low

Relief as Trump agrees to delay EU tariff hike

President Trump has postponed plans to hike the levy rate on goods from the European Union to 50% just days after announcing it. Following talks with European Commission President Ursula von der Leyen on Sunday, Trump agreed to delay the move until July 9, which is the original deadline of the reciprocal tariffs if a deal by then isn’t reached.

Von der Leyen said the EU needed more time to reach an agreement and appears to have succeeded, at least for now, in diffusing tensions with Washington, with Trump being pleased about the “very nice call”.

Whilst there was little doubt that this was a typical Trump negotiating tactic to apply some pressure on the EU, as the US President has a tendency to become impatient when talks drag on for too long, Friday’s decision was nevertheless unexpected and an unwanted reminder to investors about his erratic nature.

Dollar’s woes worsen, European stocks cheer tariff delay

What’s also becoming apparent is that the US dollar is increasingly finding itself in a ‘lose-lose’ situation, as negative trade headlines are viewed as damaging for the US economy, while positive developments are seen as paving the way for more Fed rate cuts.

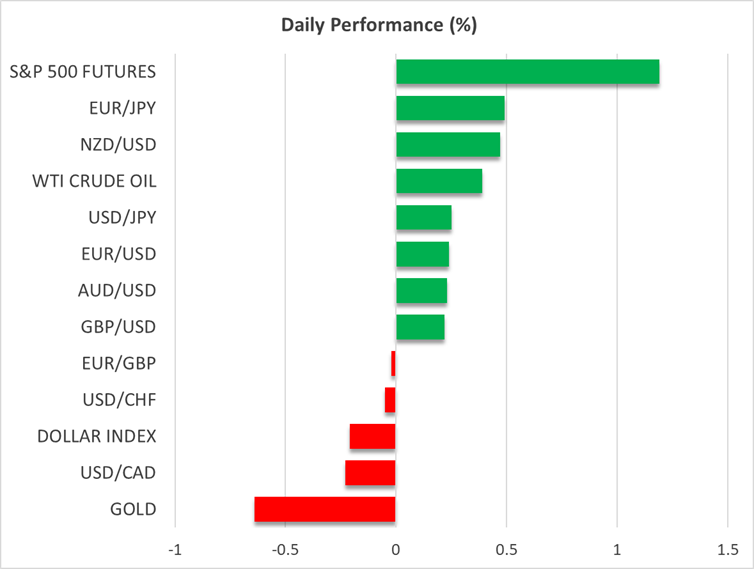

Against a basket of currencies, the dollar is trading at one-month lows today, with both the euro and pound extending last week’s solid gains.

The euro is attempting to recapture the $1.14 handle but may need some further upside momentum before being successful. European stocks on the other hand are surging on the news, and US futures are up too, more than reversing Wall Street’s losses on Friday. Even Apple, which faces a 25% tariff if it doesn’t shift production of its iPhones for the US market onshore, rose slightly in afterhours trading.

But despite the relief rally, the market tone is somewhat subdued today as it’s a Bank Holiday in both the US and UK and trading in Asia was mixed.

Trade deals become elusive, yen slips

Many investors remain cautious as there are still too many unknowns about the outlook even as there is some reassurance that Trump does not want to ramp up trade tensions to the levels seen immediately after ‘Liberation Day’.

Yet, the absence of new deals since the UK and China agreements is making traders a bit anxious, as markets are potentially headed for a long summer of deal making.

Trump’s constant back-and-forth with tariffs is already causing major disruptions in shipping, pushing up costs and leading to congestion at some ports.

It was hoped that the White House would have announced deals with India, South Korea and Japan by now, but the slow progress suggests an extension to the extensions is very likely.

Still, it seems that negotiations with Japan are on the right track again following Friday's talks between Trump and the Japanese prime minister, with a deal in June being eyed. In a further sign of softening his stance, Trump has approved the merger of US Steel with Japanese giant, Nippon Steel.

The yen, however, was broadly weaker on Monday, and its safe-haven rival, the Swiss franc, edged lower too, as the mood improved on the back of Trump’s EU tariff climbdown.

Fed speakers eyed amid fears of a long pause

Today’s bounce back in risk appetite would probably have been stronger, though, if it hadn’t been for the Fed’s Kashkari setting a hawkish tone for the other Fed speakers that are on the agenda this week.

Speaking to Bloomberg TV earlier today, Kashkari didn’t sound too optimistic that the trade uncertainty would ease substantially over the summer, casting doubt on whether or not the Fed would have enough clarity by September to lower rates.

There’s a risk that markets will go into consolidation mode again until Friday’s PCE inflation data, with the Fed minutes on Wednesday possibly being sidelined.

In addition to Fed policy, uncertainty about fiscal policy is also weighing on risk assets, particularly on Wall Street, as Senate Republicans indicate they will not back the budget bill that was narrowly passed by the House last week without first pushing for deeper spending cuts.

Oil climbs but gold suffers another setback

In commodities, oil futures traded higher as the positive market sentiment offset the downside pressure from the news that Iran and the US made some progress in talks on Friday over Tehran’s Nuclear programme.

Gold, however, started the week in selling mode, as apart from the easing trade tensions, Trump’s latest mission is to negotiate a ceasefire deal between Israel and Hamas in Gaza, and this is likely also weighing slightly on the precious metal.

.jpg)