Crypto goes up after a rest

Market picture

Crypto market capitalisation rose by 2.9% in 24 hours to $2.63 trillion. Among the top coins, BNB is up an impressive 11%, and Solana is up 5%. Altcoins have steadily been gaining strength over the last few days of downtime.

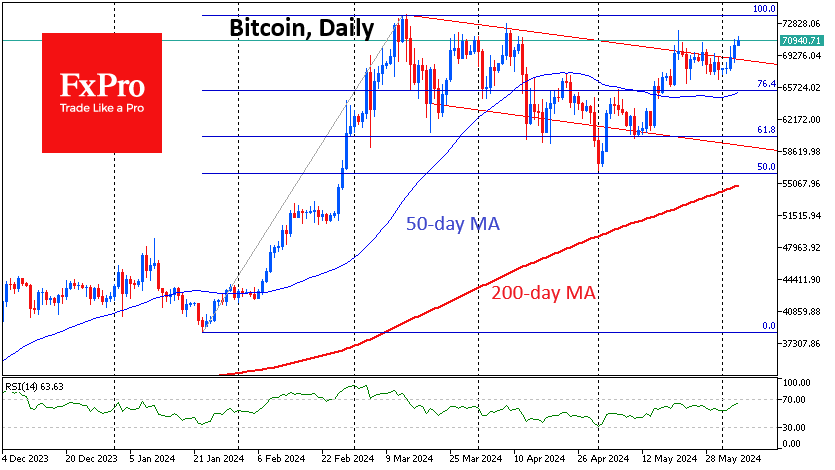

Active buyers came to Bitcoin, raising the price by 4.4%. The price of the first cryptocurrency again exceeded $71K, returning to the area of last month's highs and the pivotal area of the last three months. Technically, Bitcoin has already broken the resistance of the descending channel and is testing horizontal resistance. The ability to go above $71K opens the way for a renewal of historical highs, which could happen very quickly.

Interestingly, Bitcoin's positive dynamics did not help Ethereum to get out of its triangle. The price has already reached its top at $3800, which promises an imminent burst of volatility but does not give a direct indication of the direction.

News background

According to BitcoinTreasuries, the total volume of bitcoin products held by the ETF reached 1,035,233 BTC ($71.4bn), equivalent to 4.93% of the digital gold issue.

After bitcoin crossed the $70K level, more than half of the coins remained inactive, indicating long-term confidence in the asset, CryptoQuant noted. Long-term holders' sales have driven Bitcoin's decline since March. According to Bitfinex's on-chain analysis, the trend has slowed, with investors shifting to hoarding coins.

Deribit noted that the current values of the implied volatility of Bitcoin and Ethereum options indicate expectations of a calm situation in the cryptocurrency market in the coming weeks.

According to The Block, 455,000 new coins appeared on the Solana blockchain in May. The figure reached a one-month high due to low barriers to entry and hype around meme tokens. According to CoinGecko, the segment has a market capitalisation of $9.4bn, with dogwifhat (WIF) and Bonk (BONK) being the largest assets.

Tether co-founder Brock Pierce is convinced that the Chinese government will lift the 2021 ban on cryptocurrency mining and trading. According to him, it is a matter of when, not if.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)