- Accueil

- Education Center

- Triple Candlestick Patterns

Changer de mot de passe

Triple Candlestick Patterns

What are Triple Candlestick Patterns?

Triple candlestick patterns are chart formations that consist of three consecutive candlesticks. These patterns are crucial tools in technical analysis for forex traders, offering insights into potential market trends and price movements.

Types of Triple Candlestick Patterns

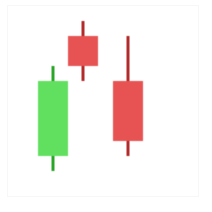

Three Advancing White Soldiers Candlestick

The Three Advancing White Soldiers Candlestick Pattern is a bullish reversal pattern consisting of three consecutive bullish candles that occur after a downtrend. Each candle in the pattern opens within the previous candle's real body and closes above its high. The pattern's name comes from the fact that each candle looks like a white soldier marching upward, with the closing price of each candle higher than the previous candle's close. The pattern signals a shift in market sentiment from bearish to bullish, and traders use it to enter long positions.

Is the Three Advancing White Soldiers Candlestick Bullish or Bearish?

The Three Advancing White Soldiers Candlestick Pattern is a bullish reversal pattern. It occurs after a downtrend and signals a shift in market sentiment from bearish to bullish. The pattern's three consecutive bullish candles indicate that the bulls have taken control of the market, and a bullish trend reversal is imminent. Traders often use this pattern to confirm a trend reversal and enter long positions.

The Three Black Crows Candlestick Pattern

The Three Black Crows is a candlestick pattern that can predict a reversal of a market uptrend. Traders frequently use this pattern with other technical indicators, such as the relative strength index (RSI) or chart patterns, to confirm the potential of a trend reversal. The opposite pattern of Three Black Crows is Three White Soldiers, which indicates a possible reversal of a market downtrend.

Is the Three Black Crows Candlestick Bullish or Bearish?

The Three Black Crows candlestick pattern is a bearish reversal pattern, which indicates that a change from an upward trend to a downward trend is likely to occur soon. The appearance of the three lengthy bearish candlesticks reflects the bearish sentiment in the market, which is exerting downward pressure on prices and canceling out any past gains gained during the preceding rising trend. This pattern is a reliable warning sign that a downward trend is about to start and should be carefully taken into consideration by traders.

Evening Star Candlestick

The Evening Star candlestick pattern is a three-candle pattern that occurs at the end of an uptrend. The pattern consists of a long bullish candle, a smaller candle that gaps away from the first candle, and a final candle that closes below the midpoint of the first candle. The Evening Star pattern is used by traders to identify potential trend reversals, as the gap between the first and second candles and the bearish close of the third candle can signal the end of an uptrend and the beginning of a downtrend.

Is the Evening Star Candlestick Bullish or Bearish?

The Evening Star candlestick pattern is considered to be bearish, as it signals the potential end of an uptrend and the beginning of a downtrend. This pattern occurs when the market is transitioning from a bullish market to a bearish market, and traders use it as a signal to prepare for potential market changes.

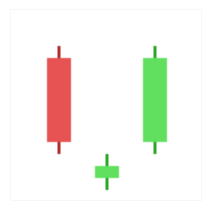

Morning Star Candlestick

The Morning Star is a candlestick pattern that consists of three candles. The first candle is a long bearish candle, indicating strong selling pressure in the market. The second candle is small, either bullish or bearish, with a small real body that gaps down from the first candle. This small candle represents indecision in the market and may indicate that the bears are losing control. The third candle is a long bullish candle that closes above the midpoint of the first candle, indicating that the bulls have taken control of the market.

Is the Morning Star Candlestick Bullish or Bearish?

The Morning Star Candlestick Pattern is generally considered to be a bullish pattern, as it can indicate a potential reversal of a downtrend. However, it's important to note that the pattern is not a guarantee of a bullish reversal, and traders should always look for confirmation of the pattern before making trading decisions.