Bitcoin may be near the bottom

Market picture

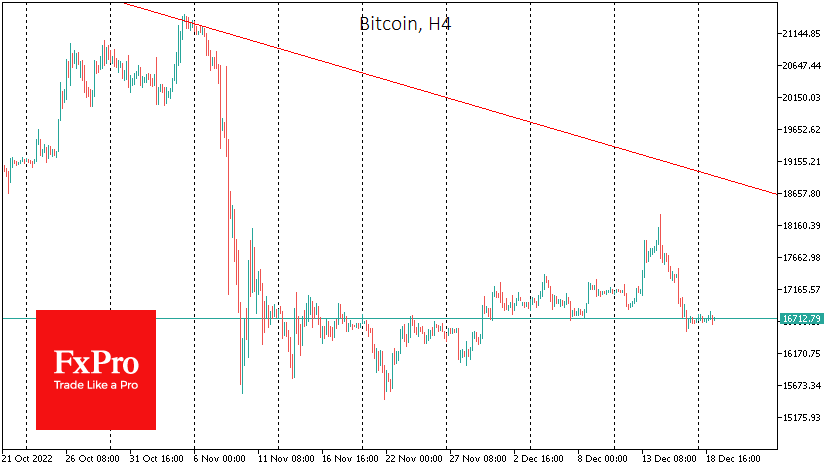

Bitcoin is down 1.3% over the past seven days, remaining just below $17K since Saturday. Ethereum lost 5.3% to $1180. Other leading altcoins in the top 10 fell 8.8% (XRP) to 17.1% (Dogecoin). The intensified selling at the end of the week clearly showed that the market remains in the clutches of bears, capable of stopping the rise and sending the price lower.

Total cryptocurrency market capitalisation, according to CoinMarketCap, fell 5.2% for the week, approaching $800 billion. The Cryptocurrency Fear and Greed Index was unchanged for the week, remaining at 26 points ("fear"). By Monday, the index was up 3 points to 29.

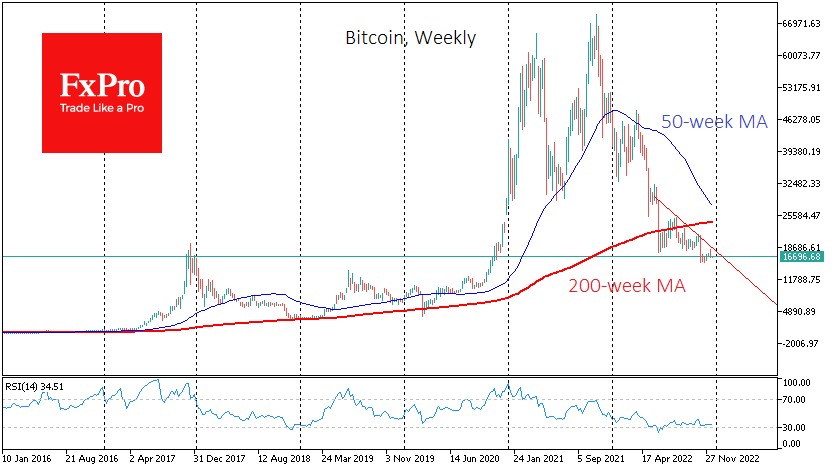

Bitcoin ends the year near the same levels where it traded two years earlier and where it was at the end of 2017, raising doubts that the coin's limited supply is enough for a permanent bull market.

Higher interest rates also raise the bar for other asset classes for new investors. Nevertheless, the currently reduced volatility after a sell-off of more than a year often serves as a good starting point for long-term investors, although it has yet to promise them quick profits. We are probably years away from a new wave of FOMO for cryptocurrencies, not days and months.

News background

According to a Huobi report, investments in metaverse and GameFi have increased 300% over the past year. Meanwhile, investment in the crypto industry's primary market exceeded $27.7bn in 2022, while the crypto market cap has fallen by more than $2.2 trillion. So far this year, authorities in 42 countries have approved 105 "regulatory measures and guidelines" for the industry.

Analytics platform CryptoQuant analysed a report by auditing firm Mazars on cryptocurrency exchange Binance's reserves and confirmed its relevance. Mazars has since removed links to previously published reports and said it is discontinuing service to all cryptocurrencies.

The Basel Committee on Banking Supervision of the Bank for International Settlements (BIS) has recommended a cap on the share of crypto assets in commercial banks' core capital of 2%. A compromise between BIS’s initial proposal of 1% and banks’ 5%.

The Raydium decentralised finance protocol on the Solana network reported a hack. A hacker gained access to the protocol's administrative account and withdrew assets worth $2.2 million.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)