EBC Markets Briefing | HK stocks’ blistering rally may be stretched

The long-awaited rejuvenation in the Hang Seng index looks in the in the making. After its first yearly gain in 2024 in five years, the benchmark index has been outperforming its major peers in 2025.

Chinese mainland investors bought HK$22.4 billion worth of Hong Kong stocks - the biggest daily purchase since early 2021- on Tuesday, as they continued to drive a DeepSeek-spurred tech rally in the city.

But the inflows have reduced the premium between onshore and Hong Kong shares to around 34%, close to a base that has historically triggered a rebound in the premium level.

A looser financial condition and the government’s push to revive the economy are outweighing concerns over Trump’s tariffs. A high-profile symposium this week further spurs hope of Beijing’s stance shift.

The valuation of the tech index appears frothy, given that the Hang Seng Tech gauge is trading at a multiple of 46.71. From a technical perspective, RSI well above 70 also points to market complacency.

Some prominent entrepreneurs took part including Alibaba Group co-founder Jack Ma and DeepSeek founder Liang Wenfeng. The attendee make-up underscored the strategic focus on the tech sector.

All eyes will be on an annual legislative meeting in March, where the nation’s top leaders are expected to unveil the economic blueprint for 2025 and may discuss concrete support measures for the private sector.

Alibaba leads the charge

Alibaba Group shares surged to the highest since 2022 last week on a report that it will partner with Apple to support iPhones' AI services offering in China.

In an attempt to gain an edge, the company has invested in a clutch of China’s most promising startups including Moonshot, and prioritised the expansion of the cloud business that underpins AI development.

Alibaba published benchmark scores last month showing its Qwen 2.5 Max edition scored better than DeepSeek’s V3 model in various tests. The contract from Apple also warrants its leading position.

Nevertheless, a key hurdle facing Chinese AI firms has been the slower adoption and lack of willingness to pay for services among domestic consumers and businesses.

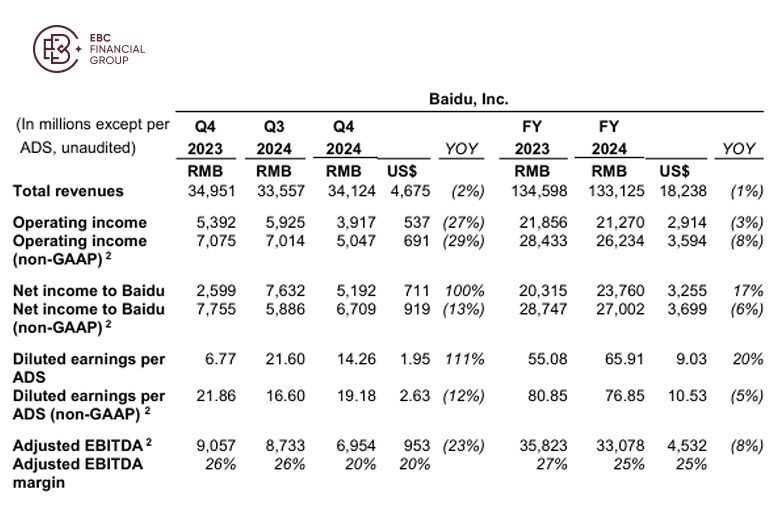

Baidu, the first among to roll out large language models in China, will make its advanced AI chatbot services free, as competition heats up following the surging popularity of DeepSeek’s models.

The company reported its third straight quarterly revenue drop, with the move to set to worsen monetization challenges. A good business model for AI remains in the dark across the industry.

“While AI chatbots represent an important but early phase in AI application development, the killer app today has not yet emerged,” interim CFO Junjie He told analysts on a post-earnings call.

Mainland market muted

CSRC head Wu Qing has said this month big state insurers are to invest 30% of their new policy premiums in China-listed shares and mutual funds to grow stock holdings by 10% a year for the next three years.

Though the amount is a pittance for a $12 trillion market, that could potentially benefit stocks with high dividends. The market rife with pump-and-dump speculation on small-cap firms with poor earnings.

Chinese companies are enticing investors with record dividend payouts and share buybacks amid rigorous corporate governance reform. Goldman Sachs saw cash distribution hit a new high this year.

The average dividend yield climbed to around 3%, the highest level in nearly a decade, according to the bank. In contrast, 10-year government bond yield is trading around 1.7%.

Strategists from Morgan Stanley, JPMorgan and UBS expect stock gains to continue. But Morgan Stanley warns there will be a divergence in performances between tech and non-tech names.

That view has been reflected in the A50 index which is largely flat in the year. Chinese tech giants mostly float in Hong Kong or the US, so the Hang Send looks like a better choice.

However, we reiterate that the surging tech stocks could face correction in the near term. The mainland market’s risk reward profile is more attractive.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.