Risk markets jittery as expectations for soft US data mount

Yields and gold in the spotlight

It has been a tumultuous start to September, with bond yields and gold catching the market’s attention. Unsurprisingly, European and Japanese long-end government bond yields rose to multi-year highs, reminding investors of the impact of a looser fiscal stance and the rising inflation threat, largely due to tariffs gradually becoming the norm.

For nearly the same reasons, gold reached a new all-time high of $3,578 on Wednesday. It is trading lower at the time of writing, surrendering most of Wednesday’s gains, but the bullish trend remains intact and indicative of investors’ concerns about the US inflation outlook and the continued attempts by US President Trump to control the Fed and push for a looser monetary policy stance going forward.

Despite a plethora of Fed speakers appearing relatively calm about the impact of tariffs – with Fed Board member Waller stating that “you are going to have a surge in inflation from tariffs but it's not permanent” – investors remain concerned when examining the latest CPI and PCE reports. With next week’s August US CPI and the March 2025 employment revision set to provide the final pieces of the puzzle ahead of the critical Fed meeting on September 16-17, the focus now falls squarely on today’s and tomorrow's labour market data.

Busy data calendar today

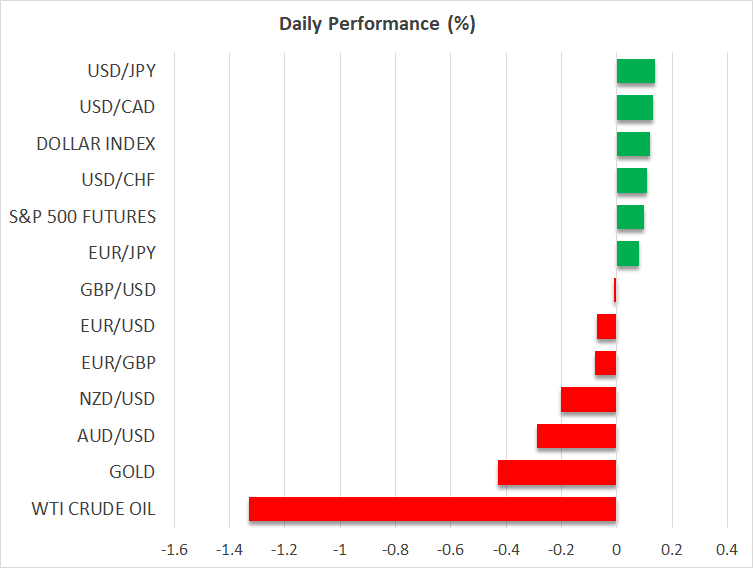

With euro/dollar trading mostly sideways and equities trying to find their footing amidst reports that Beijing is attempting to temper speculation in Chinese stock indices, today’s weekly jobless claims, ADP employment report, and the ISM Services PMI survey will be in the spotlight.

Following the mixed ISM Manufacturing PMI - where the prices paid index fell again, new orders increased but employment remained stuck in contraction territory - and the weakening JOLTS job openings, jobless claims might fail to deliver a surprise. These have been relatively stable lately, although this trend has not translated into sizeable NFP increases. Meanwhile, the ADP employment report is expected to attract extra attention today as investors are skeptical about the quality of the Current Employment Statistics (CES) dataset that produces the nonfarm payrolls (NFP) figures. Following the first negative ADP print since 2010 in June 2025, and the strong 104k increase recorded in July, economists are looking for a 65k jump in private payrolls in August.

Then, at 14:00 GMT, the ISM Services PMI is seen climbing to 51, most likely pausing the downtrend that started in November 2024. It would be extremely interesting to see whether the employment subindex continues its dive below 50, and how high the prices paid subcomponent rises – potentially jumping above the 70 level for the first time since 2022.

Fed rate cut expectations remain well supported

With the market pricing in a 98% probability of a 25bps rate cut on September 17, the public bras de fer between FOMC members continues. Fed Board member Waller is openly supporting the cut, while St. Louis and Minneapolis Presidents Musalem and Kashkari are focusing on the current elevated inflation rate and the risk of tariffs fueling price pressures. Interestingly, Atlanta Fed’s Bostic continues to emphasize his preference for a single quarter-point rate cut this year, positioning in the middle ground between ultra-doves and die-hard hawks.

Fedspeak is expected to intensify over the next two sessions, as the usual blackout period commences on Saturday, September 6. Notably, New York’s Williams and Chicago's Goolsbee – both voting this year – will be on the wires later today.

But the highlight of the day regarding Fedspeak will probably be the Senate Banking Committee hearing on the nomination of Stephen Miran, the proposed replacement for Adriana Kugler. The hearing is scheduled to start at 14:00 GMT, with the White House aiming for Miran’s approval to come through in October, in time to participate in the October 29 Fed meeting.

.jpg)