Fed Chair Powell pushes the dollar off a cliff

Powell appears in dovish suit

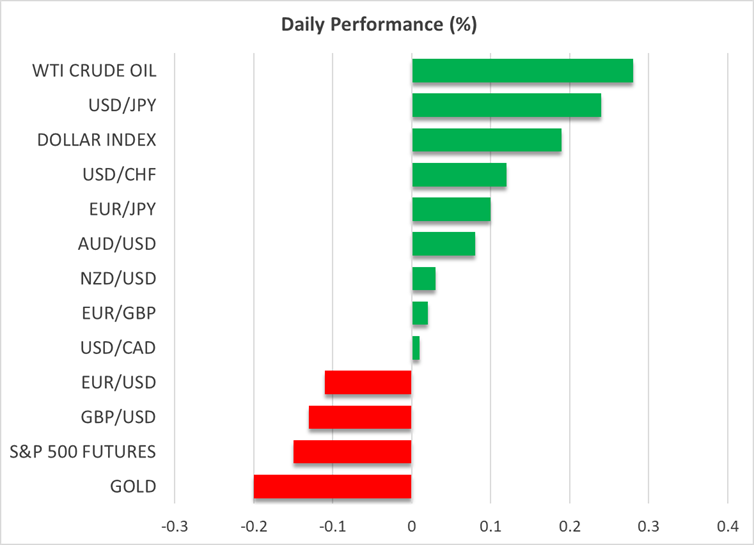

The US dollar fell against all its major peers on Friday, losing the most ground against the Australian dollar. Today, the slide seems to have slowed somewhat, with the greenback staging minor recoveries against the yen and the franc.

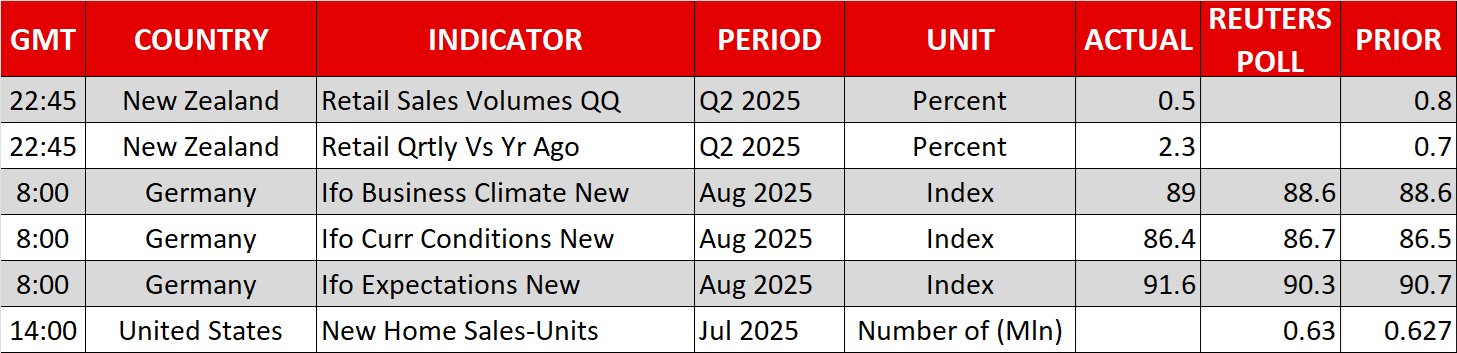

Investors started selling dollars soon after Fed Chair Powell hinted at a September rate cut while speaking at the Jackson Hole Economic Symposium in Wyoming on Friday. The Fed Chief said that while the labor market appears to be in balance, it is "a curious kind of balance" that results from significant slowing in both supply and demand for workers. This implies downside risks. “And if those risks materialize, they can do so quickly,” he added.

That said, he also said that it will be up to the data to determine the pace and depth of future rate cuts. This means that the rate path beyond September may not be as steep as many investors believe.

Thus, although the market interpreted Powell’s message as dovish, some degree of caution may be needed. After all, Fed fund futures are pointing to around an 85% chance of a September 25bps rate cut and a total of 54bps worth of reductions by the end of the year, which marks a little change compared to the pricing before Powell’s speech, when the US dollar was gaining ground due to the PPI data injecting fears of tariff-induced inflation.

Maybe the US economy is headed towards stagflation, where growth experiences a significant slowdown, but inflation remains sticky. The Fed may need to balance its choices wisely. Even if they cut interest rates in September, anything suggesting that they should proceed very slowly from there onwards due to increasing inflation risks, may allow the US dollar to rebound.

Today, the influential New York Fed President John Williams will step up to the rostrum and investors may be very interested in hearing what he has to say about the future path of monetary policy.

Wall Street gains, Dow hits record high

On Wall Street, all three of the major indices gained more than 1.5%, with the Dow Jones and the Nasdaq nearing gains of 2% as investors cheered the prospect of lower borrowing costs. The Dow hit a fresh all-time high, while the S&P 500 fell short of testing its own record by less than 10 points. The small-cap and rate-sensitive Russell 2000 surged 4.1% to a year-to-date high.

Despite the uncertainty surrounding US President Trump’s policies, optimism about trade deals, better-than-expected earnings results and the prospect of interest rate cuts have constituted a cocktail of developments adding fuel to Wall Street's engines.

However, concerns remain that Trump could punish any nation whose policies do not align with his views with higher trade duties. What’s more, later this week on Friday, the PCE inflation data will be released. The core PCE rate is the Fed’s favorite inflation metric and, thus, any signs of acceleration could prompt investors to take some basis points worth of Fed rate cuts off the table.

BoJ’s Ueda expects higher wages, fuels rate hike speculation

Another central bank chief that attracted attention at Jackson Hole was BoJ Governor Kazuo Ueda. Ueda said that wage hikes are spreading beyond large firms and that they are likely to continue accelerating amidst a tight labor market, signaling his optimism that the conditions for another rate hike are falling into place.

Although the yen is on the back foot today after dollar/yen rebounded from the key support zone of 146.60, Ueda’s remarks kept the probability of a 25bps rate increase by the end of the year high at 72%.

.jpg)