US durable goods orders slumped

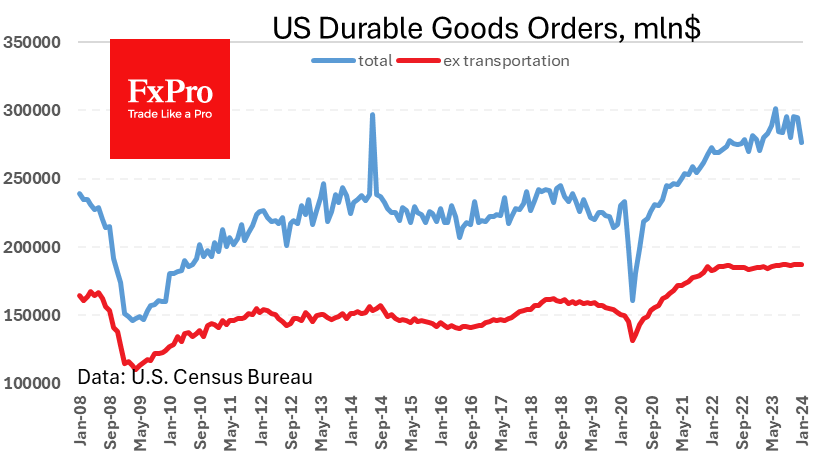

US durable goods orders decreased 6.1% in January after falling 0.3%. The cost of total orders in January was the lowest since September 2022, although it has been quite volatile in recent months due to transportation orders. This was worse than the average forecast of a 4.9% fall.

Excluding transport, the decline in new orders was a modest 0.3%, the smallest since July 2023. The average forecast was for growth of 0.2%, but this figure is flat with just 2.2% over 2 years.

This stagnation stands in stark contrast to a tight labour market and record highs in the stock market. But it would be simplistic to see this as an early sign of recession. For example, the headline and core indices had been contracting since the last quarter of 2018, but it was only the sharp acceleration of the decline in the first lockdown that triggered a recession.

The release halted dollar weakness, adding 0.1% to the greenback and briefly taking 0.2% off the Nasdaq100, as the new report did not add to expectations of a US economic expansion.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)