Bears stick to the 200-day MA

Bears stick to the 200-day MA

Market picture

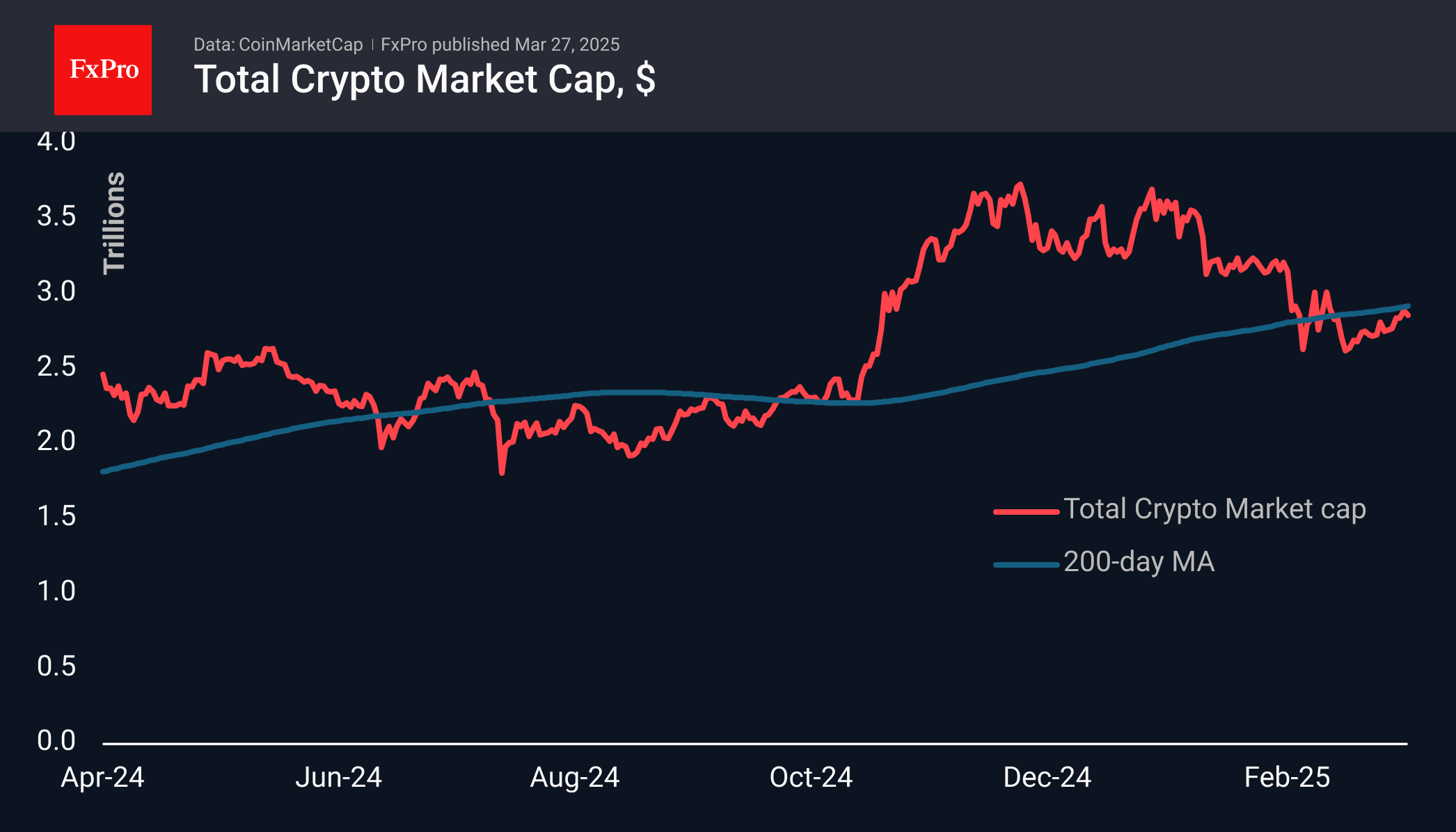

The crypto market gained around 1.8% last week to $2.86 trillion. The strong rally on Sunday and Monday was replaced by a stall just below the 200-day moving average. This line acts as a long-term trend reference for large funds, which tend to sell below it and buy when the price is higher. The bears clearly don't want to give up last month's gains and are keeping the market from moving higher.

Bitcoin has been dancing around its 200-day MA for the past three weeks but has been trading steadily higher for the past few days despite preferring to stay in its shadow. This is a very positive sign of a change in long-term market sentiment. We also note that negative news from the stock market has become less of a concern for Bitcoin. At the same time, we believe that the acceleration in the growth of the first cryptocurrency should not be expected before a consolidation above the 50-day moving average. This acts as a medium-term trend signal line, passing close to 90,000. A consolidation above it could accelerate price growth and attract new buyers.

News background

Investor sentiment reflects the funding rate in perpetual bitcoin futures. Even after BTC rebounded above $87,000, the rate remains in the negative zone. This means that traders are not willing to pay a premium to open long positions.

The cost of borrowing stablecoins on lending platforms has fallen to around 4%, reflecting a reduced appetite for leverage and other strategies that require lending, confirming the market's uncertain outlook.

The US SEC has closed its case against blockchain game developer Immutable. The firm received a Wells notice in October 2024. The regulator's claims related to the company, its CEO, and its IMX ecosystem fund.

USDC's stablecoin capitalisation exceeded $60bn for the first time, reaching a new all-time high. The figure has doubled over the year. USDC remains the second most popular stablecoin.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)