BTCUSD Analysis: Bitcoin to Break through Key Levels

Fundamental Analysis of BTCUSDBTCUSD Key Takeaways

- US legislation: On Monday, US time, the Arizona State Legislature passed a bill allowing up to 10% of public funds to be invested in Bitcoin and digital assets. If this move is signed by the governor, Arizona will become the first state in the United States to officially establish a Bitcoin reserve.

- Risk sentiment returns: US Secretary of Commerce Lutnick announced that some tariff negotiations will be reached soon, and investors’ optimistic expectations pushed US stocks to a new high during the day. Risk sentiment may push Bitcoin higher in the short term.

Technical Analysis of BTCUSD

BTCUSD Daily Chart Insights

- Stochastic oscillator: After the indicator sends a short signal in the oversold area, the fast line will cross the slow line again, and the short-term oscillation adjustment trend may end. There is a probability of a rapid rise in the intraday trend.

- Resistance area: After breaking through $94,000, the market price has adjusted for nearly 5 trading days. If the market price finally breaks through this week’s high, the next target of Bitcoin price will be around 98,800, the upper edge of the previous oscillation range.

BTCUSD 2-hour Chart Analysis

- Stochastic oscillator: The indicator sends a long signal again above the 50 median line, suggesting that there is a bullish trading opportunity, and pay attention to the breakthrough of Bitcoin price.

- Waiting for breakthrough resistance: The market price is currently forming an ascending triangle trend, and the lows are constantly rising. There is a probability that the exchange rate will break through and rise rapidly. Pay attention to the price pattern near the previous high of 95,731.

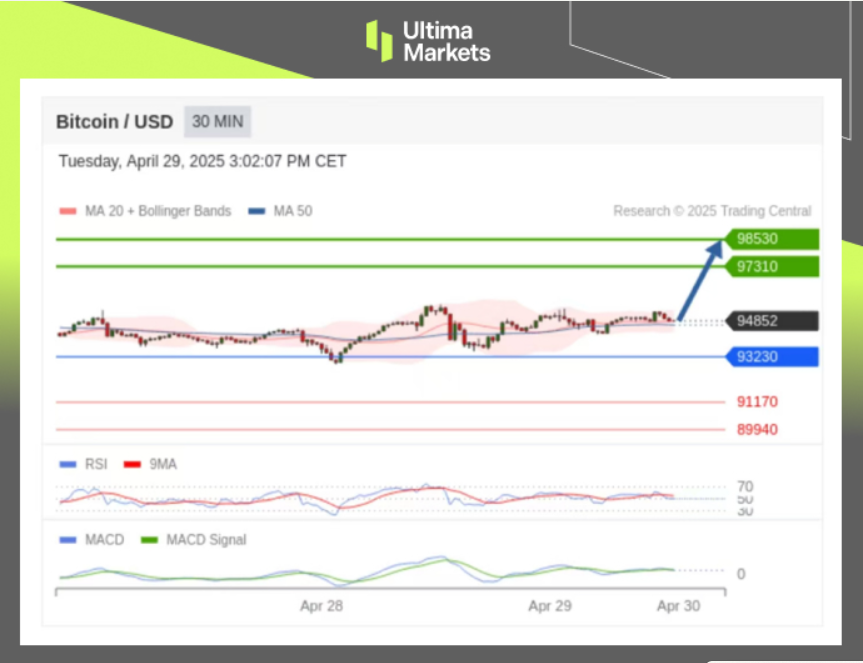

BTCUSD Pivot Indicator

- According to the trading central in Ultima Markets APP, the central price of the day is established at 93230,

- Bullish Scenario: Bullish sentiment prevails above 93230, first target 97310, second target 98530;

- Bearish Outlook: In a bearish scenario below 93230, first target 91170, second target 89940.

How to Navigate the Crypto Market with Ultima MarketsTo navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.For personalized guidance tailored to your specific financial situation, please do not

hesitate to contact Ultima Markets.Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

Learn more: https://bit.ly/4gWTyEA

—–

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius. Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.