China's weak trade surplus is no cause for disappointment

China's weak trade surplus is no cause for disappointment

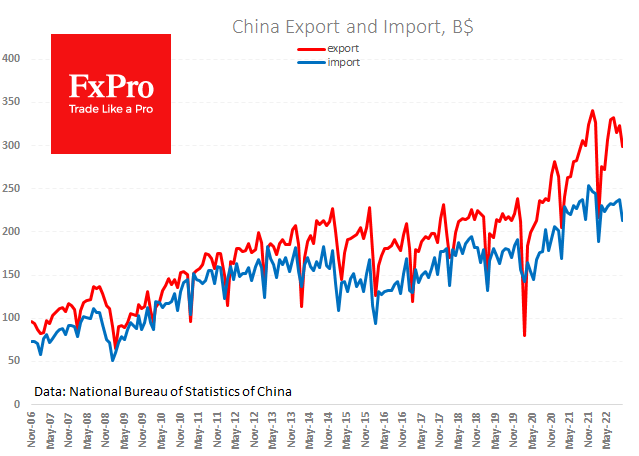

China's exports contracted by 0.4% YoY in October, while imports lost 0.7% YoY in dollar terms. The foreign trade surplus rose to $85.7bn, lower than expected at $96bn.

Most observers saw these figures as a signal of a slowdown in the second-world economy. At the same time, it is worth bearing in mind that the dollar has appreciated by 18% against the DXY index (a basket of the six popular currencies) over the past year and by more than 12% against the CNY.

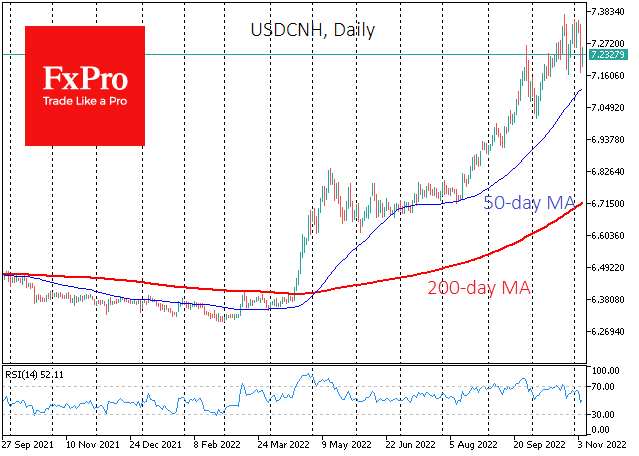

The renminbi has weakened in two waves this year: in April-May and from August until the end of October. In the first wave, we saw the USDCNY gain 5%; in the second wave, the renminbi weakened by around 7.5%. The second wave of weakening has a chance to reinvigorate foreign trade.

China is facing a relatively indirect impact from the energy crisis. It is more affected by the slump in the global economy than by the energy price hikes that Europe and Japan are facing. A relatively measured weakening of the national currency would probably work to maintain the competitiveness of Chinese goods on global markets.

If we are correct, the Chinese economy is now close to its lows for a coming couple of quarters, as production and consumer activity will pick up further. Added to this is the recovery in the Chinese markets, which has been evident since the start of the month. At current levels, global investors may be taking a closer look at Chinese assets, which would also help the renminbi in addition to the work that the PBC is doing to contain the weakening of its currency.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)