Crypto market slows down, nearing a top

Crypto market slows down, nearing a top

Market Picture

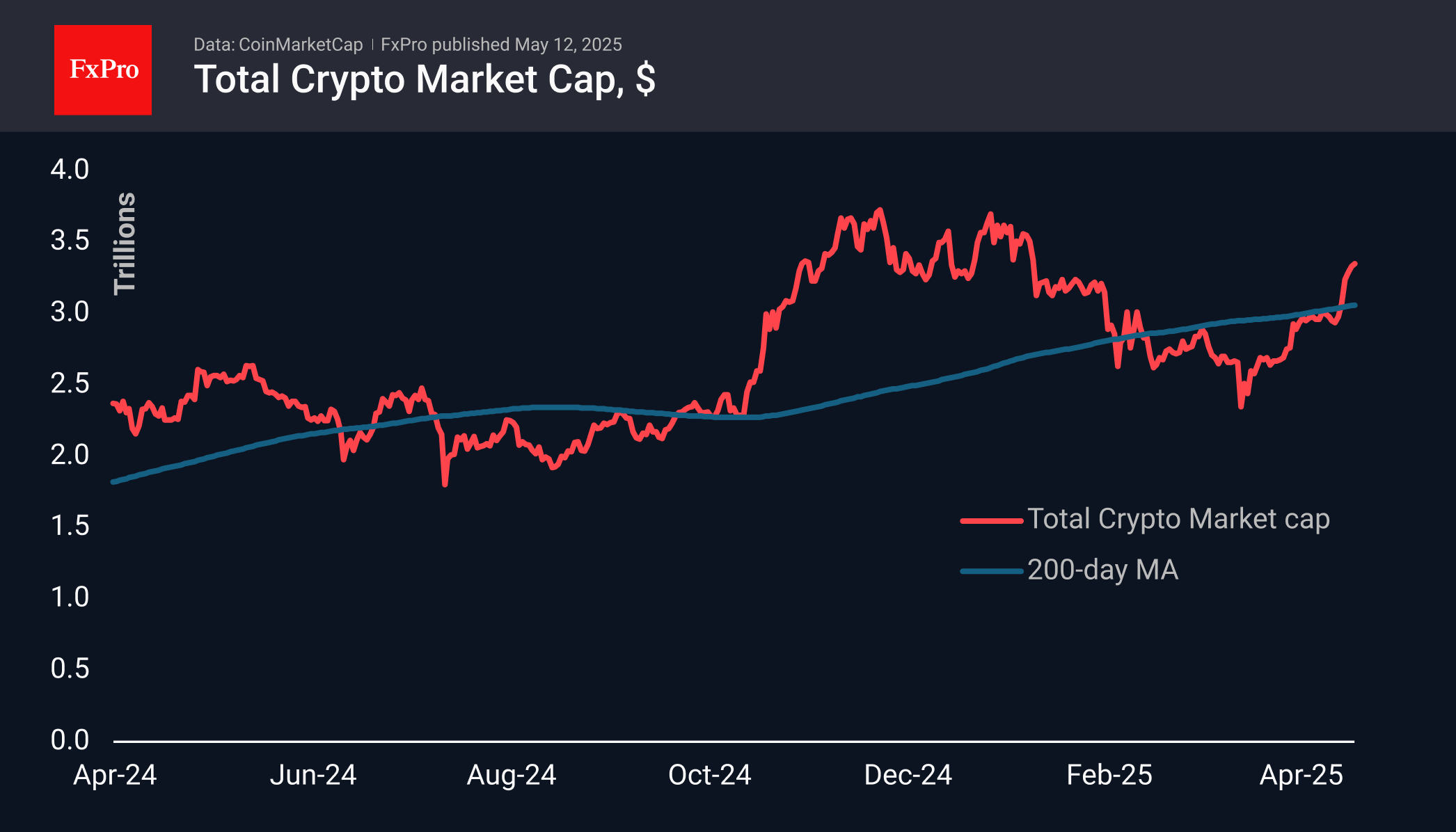

The crypto market slowed down but continued to move upwards over the weekend, reaching $3.35 trillion. For the past few days, it has been trading in the region of the highs since early February. Ethereum and Dogecoin have been the stars of this movement, adding around 40% in seven days, although the former's contribution is certainly more significant.

The crypto market's sentiment is consolidating in the greed zone, leaving the corresponding index at 70 for the last three days. This is a good basis for continued gains: not too hot to take profits and not too cold to leave traders on the sidelines.

Bitcoin rallied above $105.5k on Monday morning, entering the area of highs where it has twice failed to hold over the past six months. The impressive corrective pullback from late January to early April, in our opinion, created substantial margin for a new wave of growth. Therefore, we will not be surprised if, along with the positive dynamics of stocks, BTCUSD will move to the renewal of historical highs already this week.

News Background

On the weekly bitcoin chart, after the upward breakout of the ‘bull flag’ pattern, a further rise to $182,000 is possible, given the growth before the downward consolidation. Cointelegraph presented such a scenario.

Significant inflows into spot bitcoin ETFS in the US continued for the third week in a row. According to SoSoValue data, weekly net inflows into spot BTC-ETFS totalled $921 million, bringing the total to $41.16 billion since bitcoin-ETFS were approved in January 2024.

Inflows into spot Ethereum-ETFS in the US broke after two weeks, recording a small net outflow of $38.2 million to $2.47 billion since last July.

Cryptoquant noted that the strategy firm's pace of bitcoin purchases exceeds the rate at which miners are issuing new coins. The firm's holdings alone imply an annual deflation of the asset of 2.23%.

Public mining companies sold about 70% of mined bitcoins in April against a falling mining profitability, TheMinerMag calculated. Since March, miners seemed to be moving away from the HOLDing strategy that had prevailed last year.

Over the years, Coinbase has considered investing a significant portion of its savings in bitcoin, following the example of Strategy, but abandoned the idea because of the risks, said Brian Armstrong, head of the exchange.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)