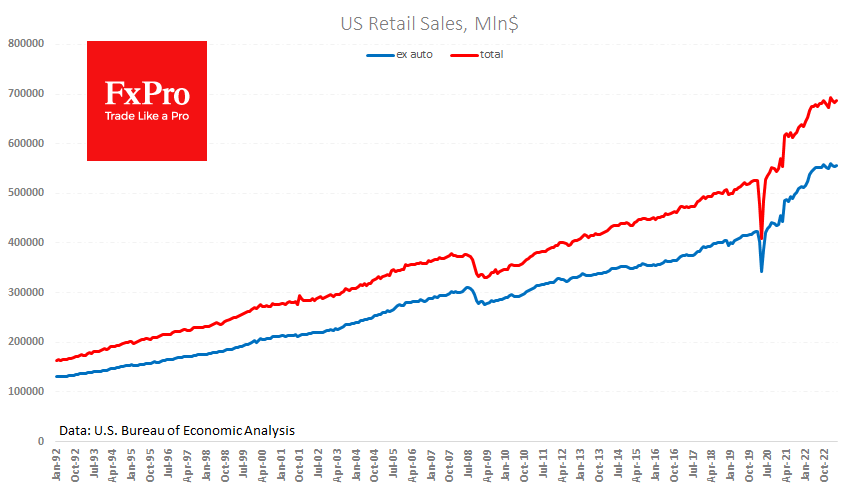

Dangerously stagnant US retail sales

US retail sales rose 0.4% in April after falling 0.7% in the previous month, half as much as expected. Sales were 1.6% higher than a year earlier, well below the 4.9% inflation rate for the period, suggesting a decline in consumption.

Sales excluding cars were also up 0.4% m/m (+0.5% expected) after a 0.5% decline a month earlier. More importantly, however, this figure has been flat for 11 months. Given that prices have risen by almost 5% in the meantime, this means that consumption has actually fallen.

So, US retail sales show a decline in real consumption, an important warning signal from the economy. However, the market quickly shrugged off the caution after releasing strong industrial production data and hawkish comments from Fed members.

It is worth paying closer attention to the dynamics of consumer spending in the coming weeks, as there could be more nasty surprises than the markets are prepared for.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)