Dollar extends gains, BoE and BoJ stand pat

Falling jobless claims corroborate Fed optimism on job market

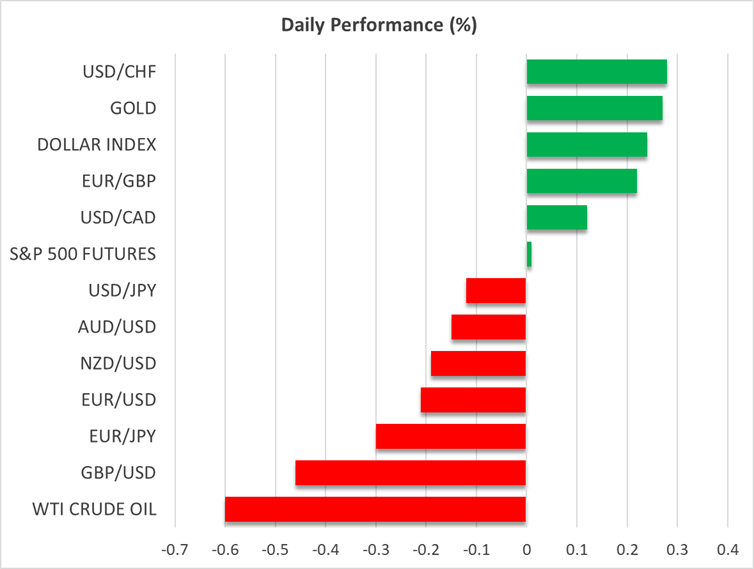

The US dollar gained ground against all its major peers yesterday, and it is extending the advance today versus all but the yen, which rose after a more-hawkish-than-expected BoJ decision.

The dollar rebounded in the aftermath of the Fed decision on Wednesday, which investors interpret as less-dovish-than-expected. The Committee lowered interest rates by 25bps, but at the press conference, Fed Chair Powell appeared in no rush to lower borrowing costs aggressively. Yes, the Committee’s projections showed another two rate cuts this year, but the median dot for 2026 suggested only one more, which comes in contrast with market expectations of another three.

What added extra fuel to the dollar’s engines yesterday may have been the bigger-than-expected decrease in initial jobless claims for last week. Despite the weakness revealed in the latest jobs report, the Fed upgraded its growth projections and saw the unemployment rate dropping throughout the forecast horizon. Therefore, yesterday’s claim data came in to corroborate that optimism.

Yet, although the dollar gained more ground, Fed fund futures suggest that investors remained adamant in expecting two more rate cuts this year – in October and December – and three additional in 2026. The divergence in expectations between the market and the Fed suggests that the dollar is unlikely to have a smooth ride hereafter. Should data continue to point to an improving labor market, investors may start taking some bets off the table and the dollar could continue gaining. The opposite may be true should more labor-market weakness is revealed.

Pound slides as two BoE members vote for rate cut

Yesterday, it was the turn of the Bank of England to decide on interest rates. British policymakers decided to keep interest rates unchanged via a 7-2 vote and to slowdown the pace of their government bond sales to 70bp pounds from 100bn.

The pound’s initial reaction was positive, perhaps due to the statement having a hawkish flavor, by reiterating the guidance that a gradual and careful approach to the further withdrawal of monetary policy remains appropriate. It was also added that the restrictiveness in policy has fallen, which could mean that not many additional reductions are needed.

However, sterling was quick to reverse those gains and drift lower. Perhaps due to two members voting for a rate cut instead of one as was expected. The rebound in the dollar on the initial jobless claims and comments by Governor Bailey later in the day that there will be further rate reductions, may have worsen the pound’s headache.

Yen rebounds as BoJ appears more hawkish than expected

During the Asian morning today, the central bank torch was passed to the Bank of Japan. Japanese policymakers also kept interest rates untouched via a 7-2 vote, but here the dissenters voted for a rate increase. The Bank announced it will begin selling ETF and J-REIT holdings, with the decision made by unanimous vote.

The yen rose instantly as traders were quick to add to their rate hike bets. According to Japan’s Overnight Index Swaps (OIS), the probability of a 25bps increase by the end of the year has risen to 70% from 65% ahead of the decision. There is even a 43% chance that the hike will be delivered in October, while another same-sized rate increase is baked into the cake for next year.

.jpg)