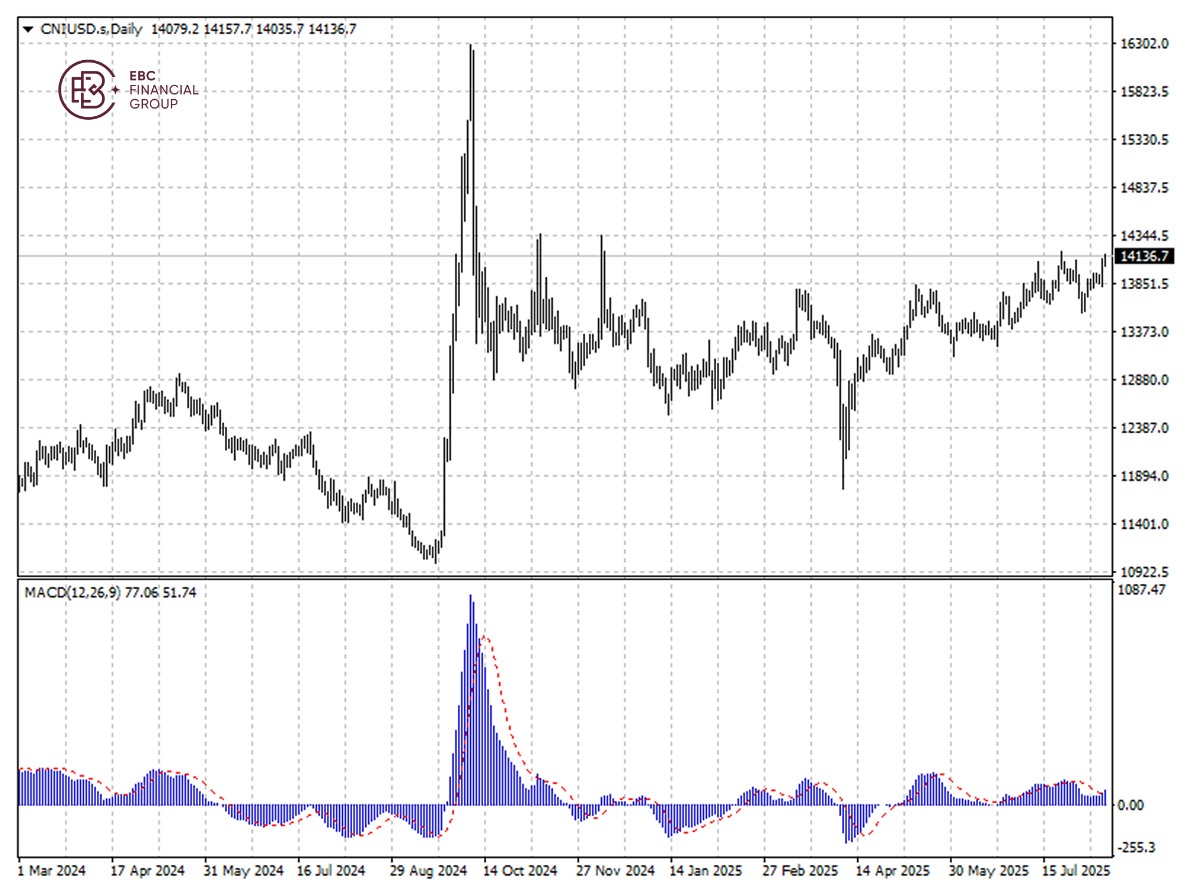

EBC Markets Briefing | A50 hits 2025 peak, led by chip stocks

China's A50 index set a fresh yearly high on Wednesday amid trade optimism. The latest extension will give more time for further negotiations about "remedying trade imbalances" and "unfair trade practices", the White House said.

Foreign inflows to Chinese stocks will probably continue after the summer, as a regulatory push to boost shareholder returns and appealing valuations lure investors, according to Morgan Stanley.

Long-only funds poured $2.7 billion into the market in July. That came despite holdings reductions by some large actively managed mutual funds focused on Asia excluding Japan, the report said.

China has told companies to refrain from using Nvidia 's H20 chips after the chipmaker recently received approval to resume shipping the less-advanced artificial intelligence product, Bloomberg reported.

Shares of Chinese chipmakers therefore surge this week. China has been seeking to strengthen its domestic semiconductor industry and reduce reliance on foreign suppliers since trade tensions mounted.

Still, sceptics argue that the rally is unlikely to sustain without a meaningful recovery in earnings and economic prospects. Evergrande's plan to delist from Hong Kong also underlines housing market predicament.

The A50 saw a sharp rebound in the second half of 2025, but bearish MACD divergence indicates weaker upside momentum. A push below 14,100 is likely around the corner.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.