EBC Markets Briefing | Trade Trump's play is still effective

The Swiss franc is still up more than 10% this year, only next to the euro among G7 currencies, despite higher risk appetite following a series of major deals between the US and its trading partners.

The currency has maintained a positive correlation with another safe-have asset – gold. The yellow metal gains an edge over Treasurys that are mired in rising federal debts and potential inflation upsurge due to Trump's policies.

Gold does not bear interests, and similarly, the franc is low-yielding. The SNB cut its interest rate to zero in June and did not rule out returning borrowing costs to negative territory in future.

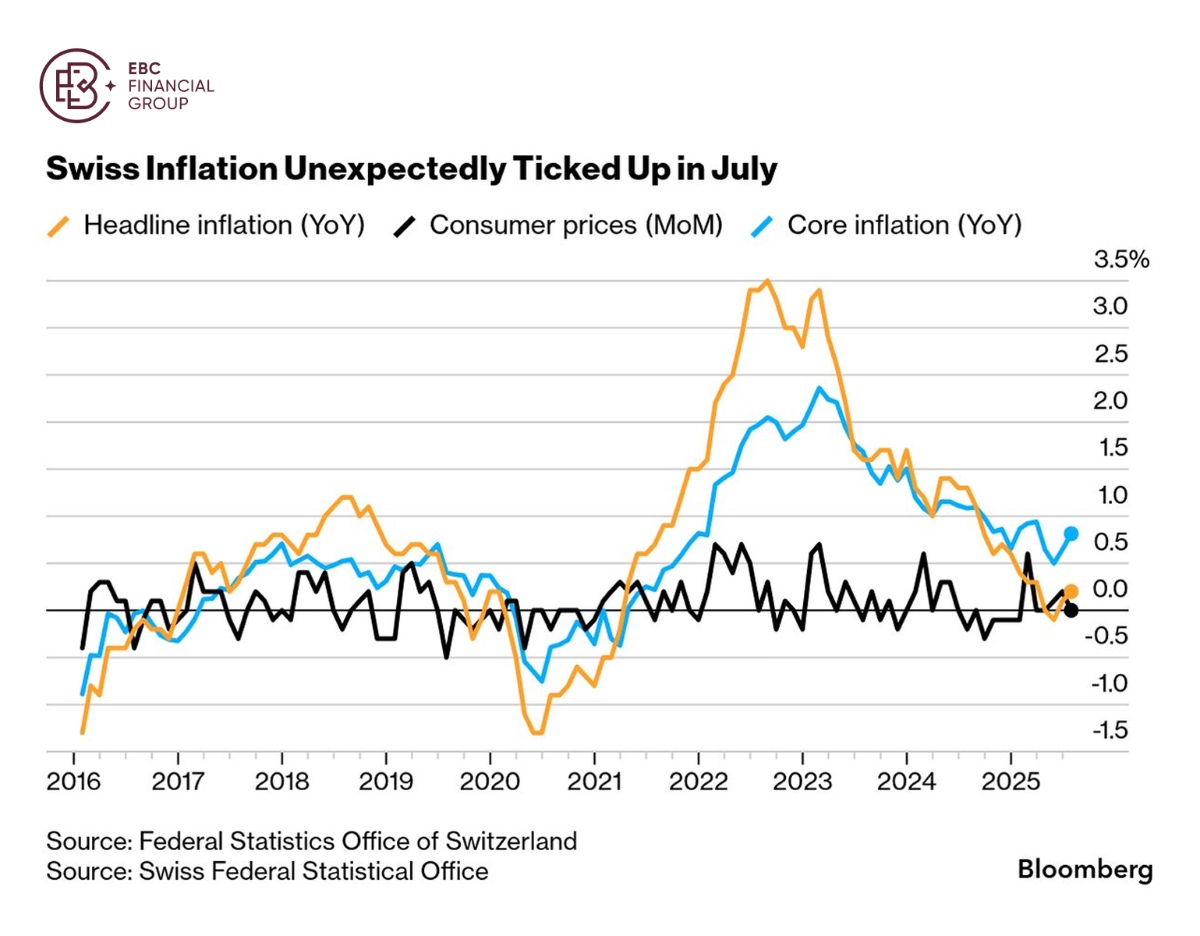

While many other nations continue to battle stubborn price growth, Switzerland faces deflation again, with consumer prices averaging an annual 0.1% for the past three months.

The economy will prove resilient enough to largely shake off the shock of US tariffs over the next year or so, according to a Bloomberg survey. Its GDP expansion is estimated to be 1.4% in 2025.

Bern is keeping up efforts to negotiate with Washington raising the prospect that it could yet change. Meanwhile Trump has also threatened to tax pharmaceutical imports, which would be a further shock.

"Our base-case assumption is that US tariffs will return to 15% in the foreseeable future — the worst case is that there won't be a deal in the next few weeks but only next year," said Matteo Mosimann, an economist at UBS.

Tangled thread

Ties between the world's two biggest economies remain vulnerable to uncertainty even though Trump extended tariff pause for another three months, according to a senior researcher at the Ministry of Commerce in Beijing.

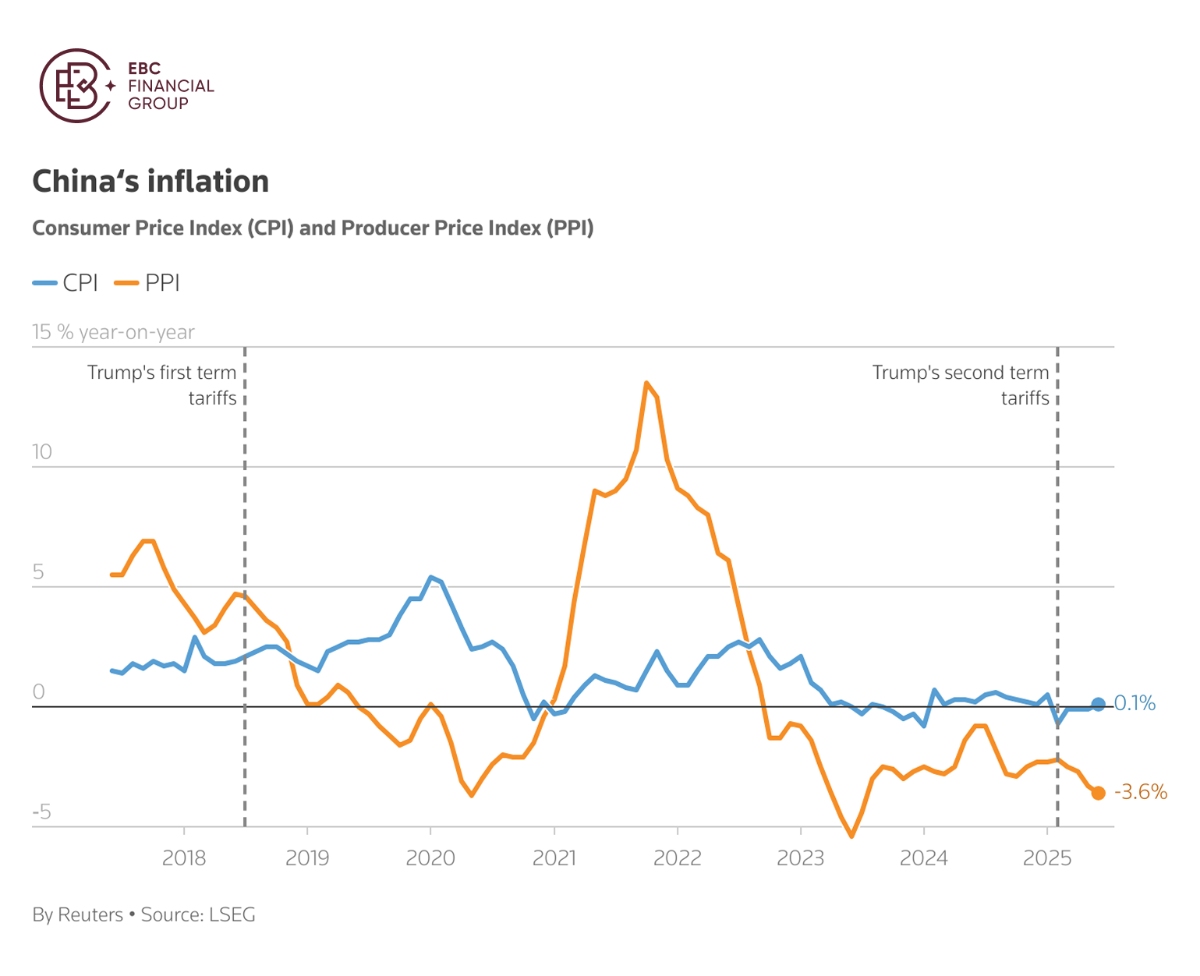

US tariffs on Chinese goods are already at 55% on average, much higher than the rates imposed on other countries. Ideally, China will bring the rate to the level prior to Trump's first presidential term.

China's consumer price index was largely unchanged in July, while producer prices fell more than expected. The so-called "anti-involution" policy measures have been rolled out to combat deflation.

Trump has confirmed that he and Vladimir Putin will discuss "land swapping" when they meet on Friday in Alaska for a feel out summit on the Ukraine war, though a deal may not be possible.

The US president has been increasingly impatient with Russia's stalling tactic in recent months. If Putin remains reluctant to make concessions for peace, secondary tariffs seem inevitable in the end.

China said last week its imports of Russian oil are justified, pushing back against US threats of new tariffs. A meaningful cut in purchase amount is rightly off the table, putting the economy at high stake.

Elsewhere India-US relationship faces serious crisis over Trump's 50% tariffs. Geopolitical tensions may flare up on signs that Modi is drawing closer to BRICS which is defined as "un-American".

Low gear

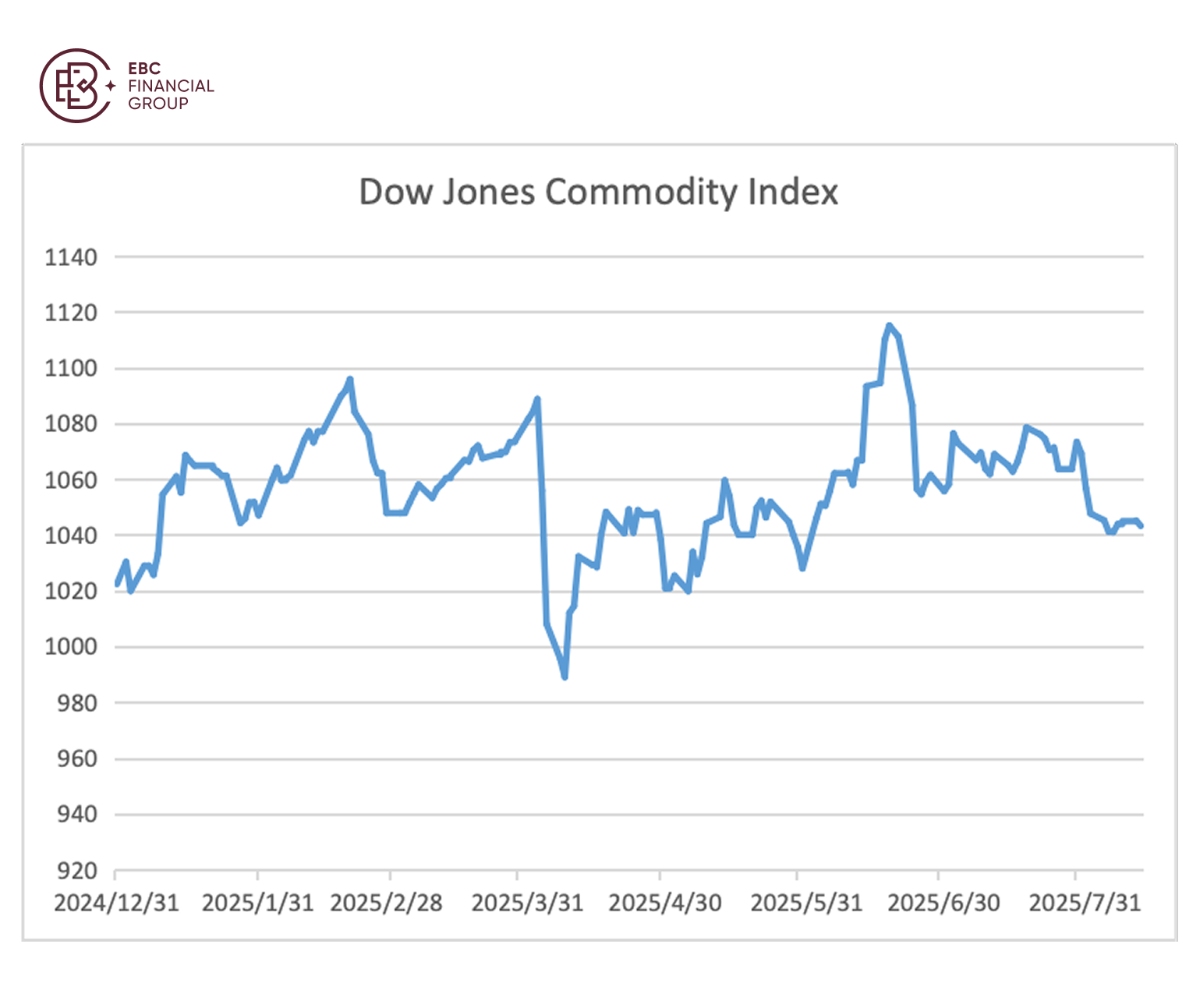

The Australian dollar and Canadian dollar are among the worst performing major currencies as factory demand jitters weigh. Dow Jones Commodity Index has gained 2% so far.

The two currencies reversed their downtrend against the franc after the end of June, but the rally looks shaky given narrowing interest rate differentials and shaky trade deals.

The RBA on Tuesday lower interest rates by 25 bps and slashed its forecasts for economic growth as it downgraded the outlook for productivity, implying lower living standards and incomes.

Swaps imply just a 34% probability that the central bank would follow up with a September cut, although two more rate cuts by early next year are fully priced in.

The financial market believes the BOC will push ahead with loosening cycle by the end of 2025 and then hold it there for all of 2026, according to a survey released by the central bank on Monday.

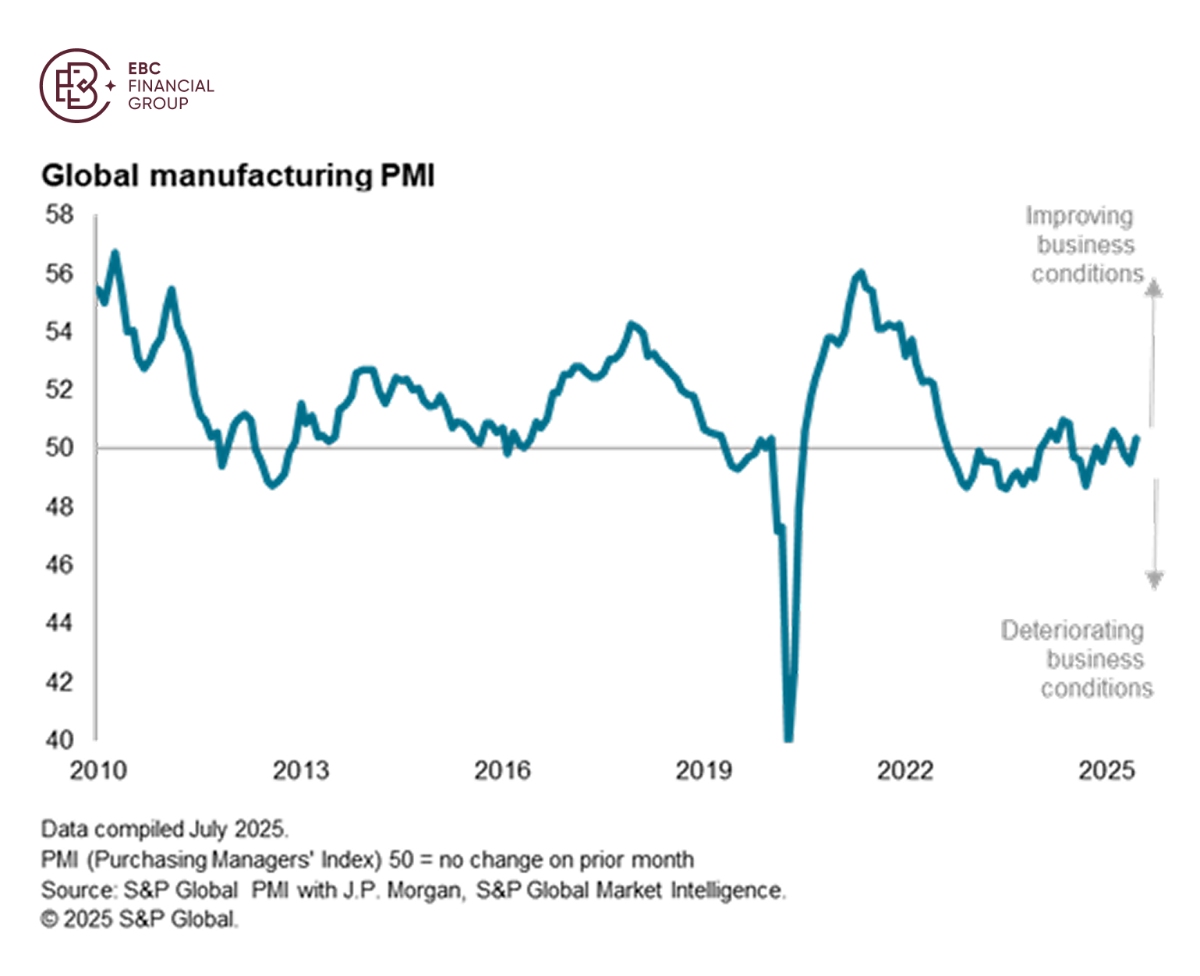

Worldwide manufacturing output growth rebounded in June from a decline in May, according to the latest PMI surveys, in part reflecting unusually high inventory building.

Business confidence remained subdued, so there are downside risks to output in the coming months. As long as Trump wields the tariff stick, safe-haven currencies are bound to eclipse their commodity peers.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.