EBC Markets Briefing | OPEC+ meeting could jolt oil markets out of torpor

Oil prices fell early on Friday as investors responded to comments from Fed officials saying it was too soon to start considering rate cuts. A surprise build in US gasoline stocks also weighed on the market.

US crude oil inventories unexpectedly fell 4.2 million barrels in the week ending on 24 May, the EIA said. But gasoline inventories were up 2 million barrels, compared with expectations for a drop of 400k barrels.

Elsewhere, OPEC+ is working on a complex deal to be agreed at its meeting on Sunday that would allow the group to extend some of its deep oil production cuts into 2025, three sources said.

Several members have struggled to sell cargoes at their usual speed amid competition from US exports, causing prices to weaken thanks to a rebound in flows from the US Gulf to Europe.

The IMF on Wednesday raised its forecast for China’s growth this year to 5%, from 4.6% previously, due to “strong” first quarter figures and recent policy measures, but the demand outlook still looks murky.

Refining rates fell to the slowest pace since December in April and the number of supertankers headed to China fell to the lowest in seven weeks, according to Bloomberg data.

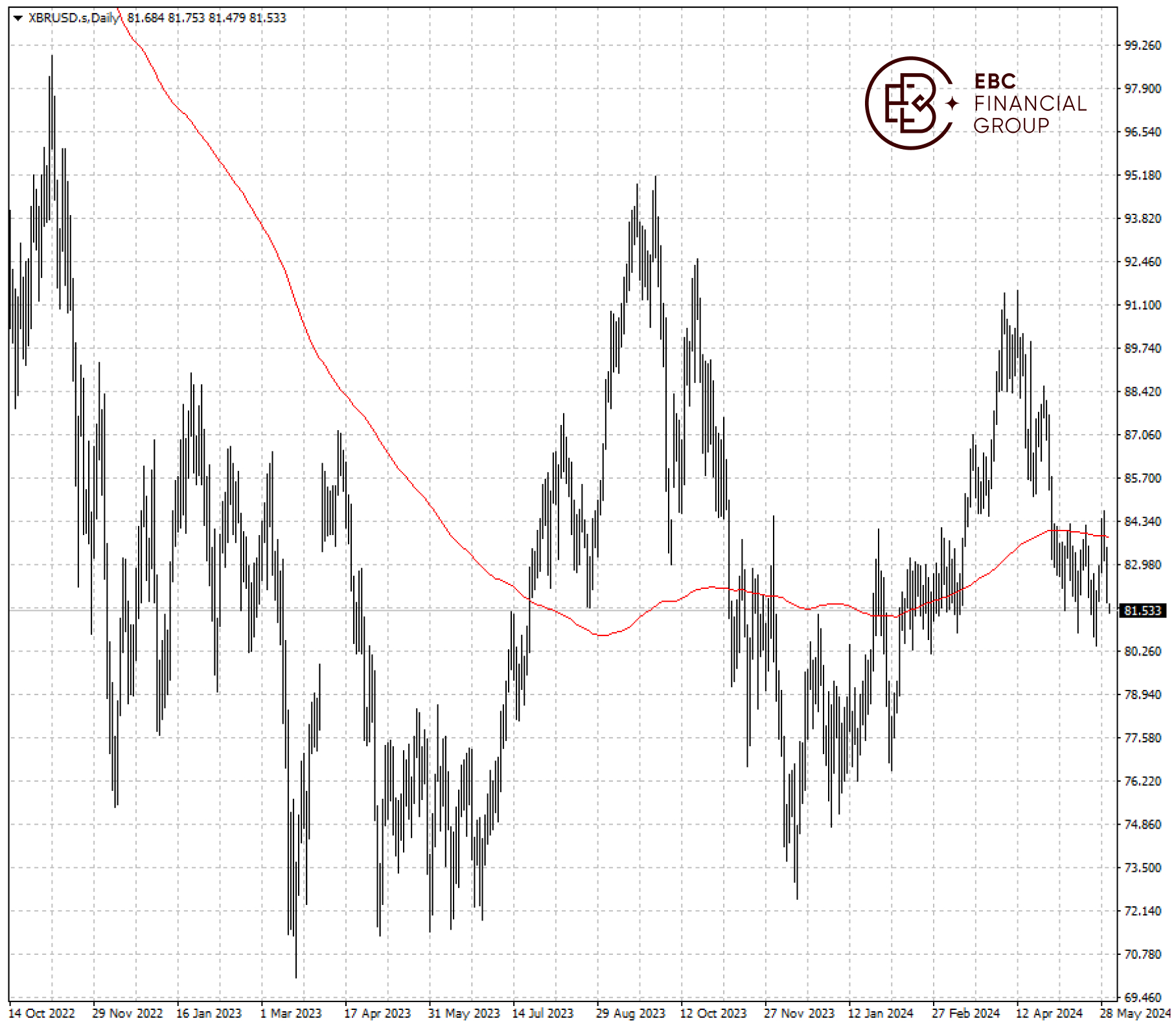

Brent crude snapped the rally mid-week and hovered around the support of $81.50. OPEC+’s decision may serve as a catalyst to push the price higher with 200 SMA to cap its gains.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Forex Trading Platform or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.