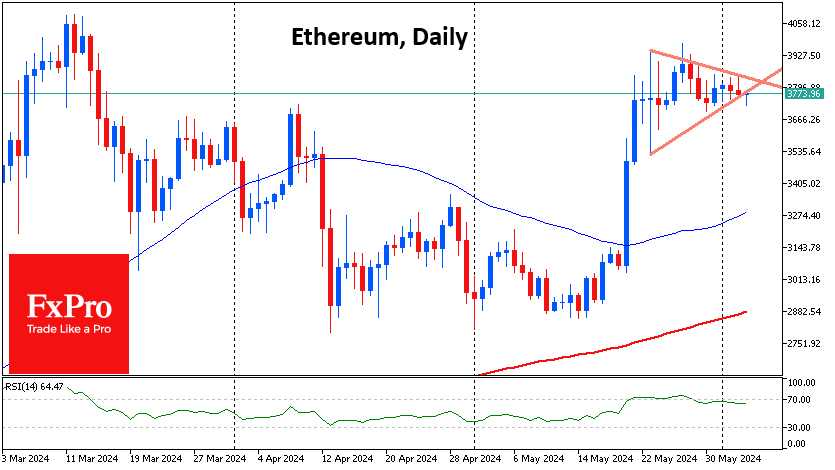

Ethereum's Bull Pennant needs confirmation

Market picture

The cryptocurrency market loses just over 0.5% in 24 hours, to $2.56 trillion. The moderate pressure is due to another failed attempt by Bitcoin to consolidate above $70K, which is now retreating 0.2%. Ethereum has pulled back 1.8% in the same time frame, while the top coins are moving without a single trend, from Dogecoin's 2.2% decline to Toncoin's 1.4% rise.

Ethereum may be forming a Bull Pennant (a triangle forming after a rapid rise). As a rule, such a consolidation is followed by a breakout of the upper boundary and subsequent growth. However, this scenario needs confirmation. A sustained advancement above $3900 will indicate a full-fledged realisation of growth in ETHUSD. A bearish scenario cannot be ruled out when a failure under the support at $3700 will trigger a steady decline.

According to CoinShares, crypto funds saw inflows of just $185 million last week after $1.05 billion a week earlier. Bitcoin investments were up $148 million, Ethereum investments were up $34 million, and Solana investments were up $6 million. Outflows from Grayscale's Bitcoin ETF rose sharply to $260 million for the week. Inflows into Ethereum continued for a second week after the SEC approved a spot ETF with an expected launch date of July 2024

News background

According to Cryptoquant, investors have withdrawn 797,000 ETH worth $3bn from exchanges to wallets following the approval of the Ethereum-ETF. Bitcoin shows a similar trend in the dynamics of available coins on the CEX.

BTC and ETH exchange balances are at multi-year lows. BTC's share [of total supply] has fallen to 11.6%, and Ethereum's share has fallen to 10.6%. Whales continue to accumulate while asset supply is shrinking, BtcEcho noted.

Australia's CBOE subsidiary will launch trading of a spot bitcoin ETF. This became possible after the issuer received AFS registration from the Securities and Investments Commission of Australia.

MicroStrategy and its founder, Michael Saylor, have reached a $40 million settlement with the U.S. Attorney's Office for the District of Columbia (USA) in a tax evasion case.

Michael van de Poppe expects the approval of a spot Ethereum-ETF could spark an altcoin rally. He named five altcoins that he said he is "buying right now." In his view, they are Optimism (OP), Arbitrum (ARB), WO Network (WO), Wormhole (WORM) and Dogecoin (DOGE).

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)