Gold is back, but not for long

Gold has experienced increased volatility over the past seven days, falling 4.4% from Friday's high to Monday's low and then rising 2.5% from the low. Much of gold's recovery on Thursday was in tandem with a massive rally in equities in response to some improvement in weekly jobless claims.

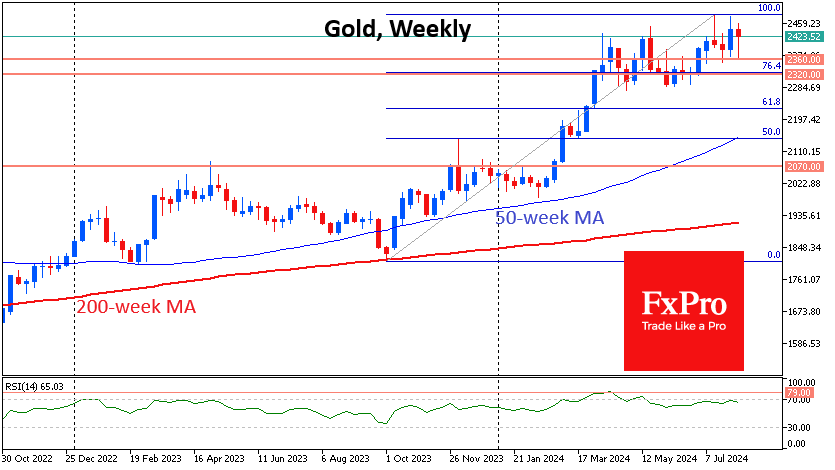

Technically, gold was able to find some quick buyer support after touching its 50-day moving average. It is worth noting that in late July, the price did not bounce until the next day, and in June, it spent a long time lower, although the bulls managed to halt the downward spiral. So, the importance of this curve in the short term is growing.

On the other hand, the price peak in early August was lower than the July record. Moreover, in all cases where the price peaked, gold fell in the following three days, which indirectly indicates a prolonged selling overhang. However, it is so muted that it does not technically disrupt the bullish picture.

Partial profit taking or giving up in a bull market? The dynamics of the coming week will answer this question, with a potential climax in the release of inflation statistics and possibly retail sales.

The direction of the exit from the prolonged $2360-$2460 consolidation will help determine market sentiment towards gold in the near term. And a move within this range, while still massive, looks like market noise.

Looking at the weekly timeframe, there is a better chance that the range exit will be to the downside, as the last higher price peak came at a lower RSI level. This is a signal that growth momentum is running out.

While lower interest rates are theoretically positive for gold, in practice, the acceleration of QE in September 2012 triggered a bear market for the next three years. Later, at the end of 2015, gold reached a cyclical low on the day of the first Fed tightening. So, we should not be surprised if the start of Fed easing turns out to be negative for gold, as it would be a sign of a weak market, not a bloodless victory over inflation.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)