Gold needs correction before another leg up

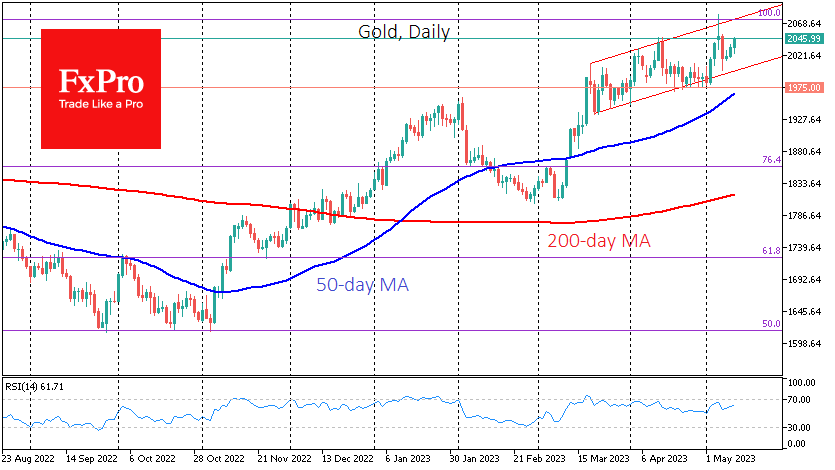

Gold showed very high volatility on Thursday and Friday, rising to $2081 and falling below $2000 in less than 48 hours. However, the price remained within the uptrend that has been in place since the second half of March.

The sharp rise and fall in gold at the end of last week had a close inverse correlation with US regional banks. Their problems triggered a short squeeze after the close of the regular session on Wednesday. However, the rapid recovery of the banks on Friday caused a sharp pullback.

Banks, by their very nature, are vulnerable to public sentiment. And from that point of view, it is unlikely that the outflow of deposits from regional banks will stop without outside intervention, so the list of bankruptcies is not yet final.

The much more difficult question is whether gold will continue to be in demand of bad news about banks. The gold rallies on the convulsions of regional credit institutions were more about a liquidity crisis, and gradually capital may flow back into dollar-denominated debt assets, which are currently offering impressive yields.

However, it is worth taking a step back to realise that the banks' problems are not the only driver for gold. Investors should also bear in mind the trend towards increasing purchases of gold as a reserve by emerging market central banks, which are also exposed to the risk of being hit by US or EU sanctions that block settlement in dollars and euros.

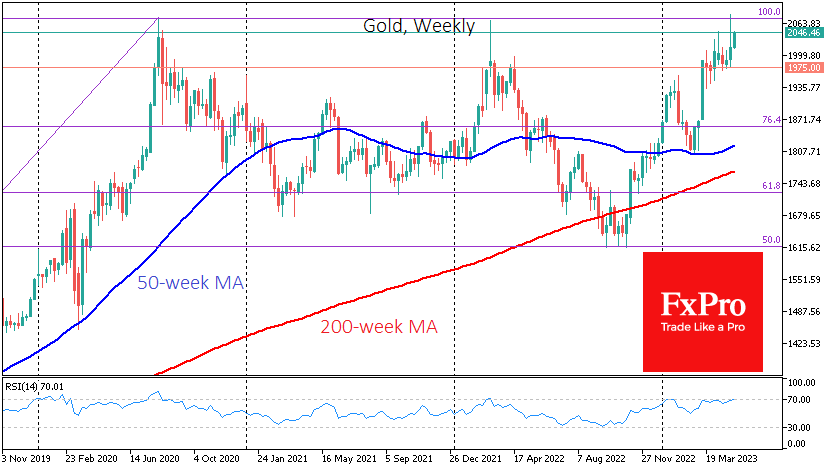

We also noted earlier a strong technical disposition in gold, whose price is approaching historical highs much more smoothly than in 2020 or 2022, leaving more strength for a breakout.

An important bullish signal for gold could be a weekly close above $2035, the highest close in history. However, a much smoother ride with a touch of the lower end of the uptrend range around $2000 is seen as a more likely scenario before the uptrend resumes.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)