The Fed is likely to pave the way for a rate cut in September

The Fed is likely to pave the way for a rate cut in September

The central event of the current week is the Fed meeting, which has the potential to create significant market movement and set the tone for the coming months. Although there is virtually no chance of a rate cut at the end of July, investors and traders will be closely watching for signals in an attempt to assess the likelihood of policy easing in September.

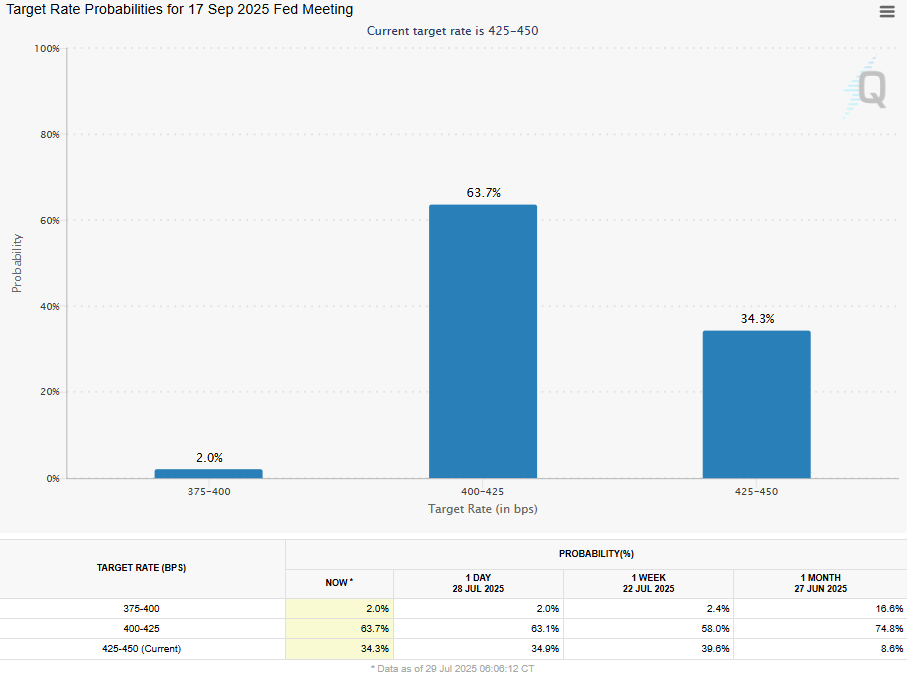

According to the latest estimates, the futures market is pricing in a 64% chance of a rate cut in September after it was held steady at the end of July. This disposition leaves plenty of room for market expectations to be adjusted, ultimately affecting dollar market dynamics. The Fed prefers to give clearer hints in advance, changing its official commentary at least one meeting in advance. Wednesday's decision promises to be a compromise between the three camps.

The doves prefer to cut now, noting the deterioration in the private sector employment situation. Two FOMC members have publicly voiced this position.

The largest camp of centrists is open to easing policy later this year. However, they want two more inflation reports confirming the slowdown.

There is also a small camp of hawks who want to see signs of a significant economic slowdown before supporting a rate cut. They note that many years of high inflation may have changed Americans' perception of the norm. In other words, they fear that inflation is not yet under control.

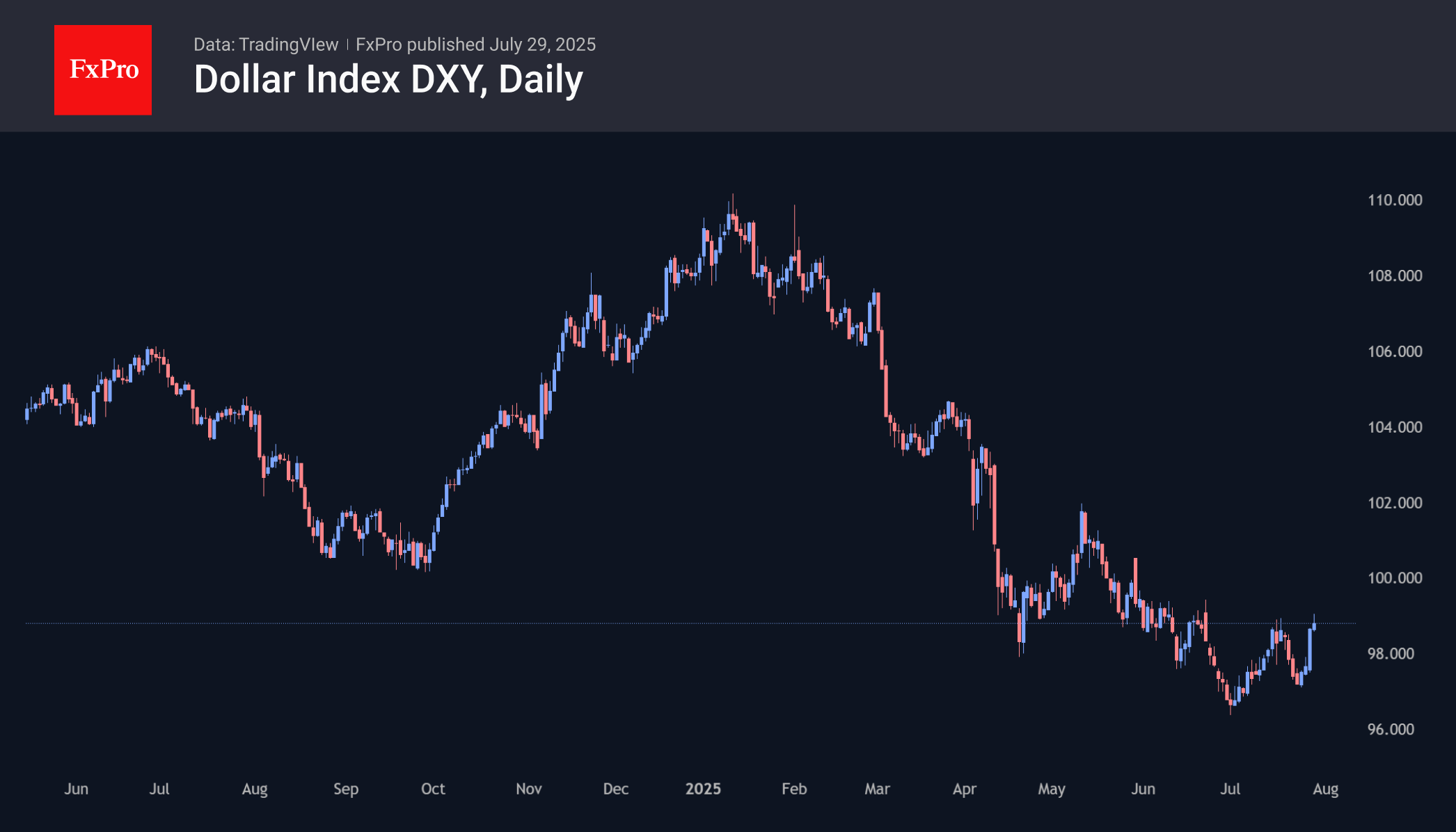

The most rational scenario seems to be preparing the markets for a rate cut in September, which could be met with a positive reaction from the debt and stock markets. For the dollar, this looks like a relatively neutral scenario, given its significant oversold condition.

However, a hawkish surprise could force a reassessment of expectations for the September or year-end rate. In this case, the stock and bond markets risk a sell-off, and the dollar will accelerate its growth.

There is also room for another surprise, such as Powell's sudden resignation or a mention of his readiness to do so during the subsequent press conference. This would be a real black swan event with unpredictable consequences for the markets, where the dollar promises to be the main loser now.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)