The Storm Before the Calm

Important Economic Events of the Week

The new week may serve as the market's final crescendo before a gentle lull sets in for the remainder of the year. Meanwhile, the significance of the latest batch of macroeconomic data cannot be overstated.

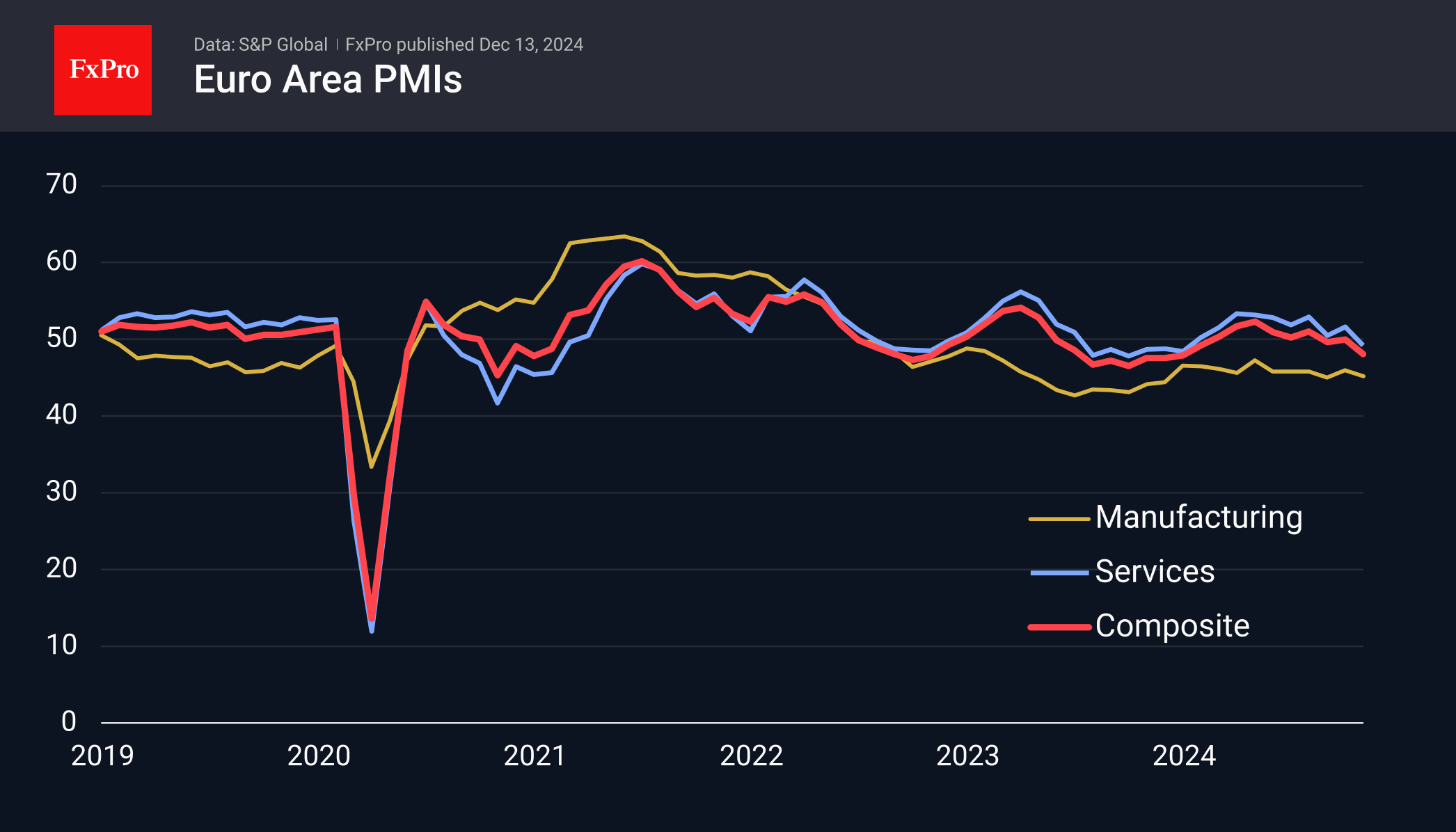

Monday's preliminary PMI business activity estimates for Europe offer the last chance for the region to end the year on a positive note. November's data was a disappointment, sending EURUSD below 1.05 at one point and showing an acceleration in the decline of business activity in the Eurozone. The ECB is taking a cautious approach to rate cuts, but the weak data has seen the Euro fall against the Dollar as traders are pricing in 4 ECB rate cuts over the next six months versus 2-3 for the Fed.

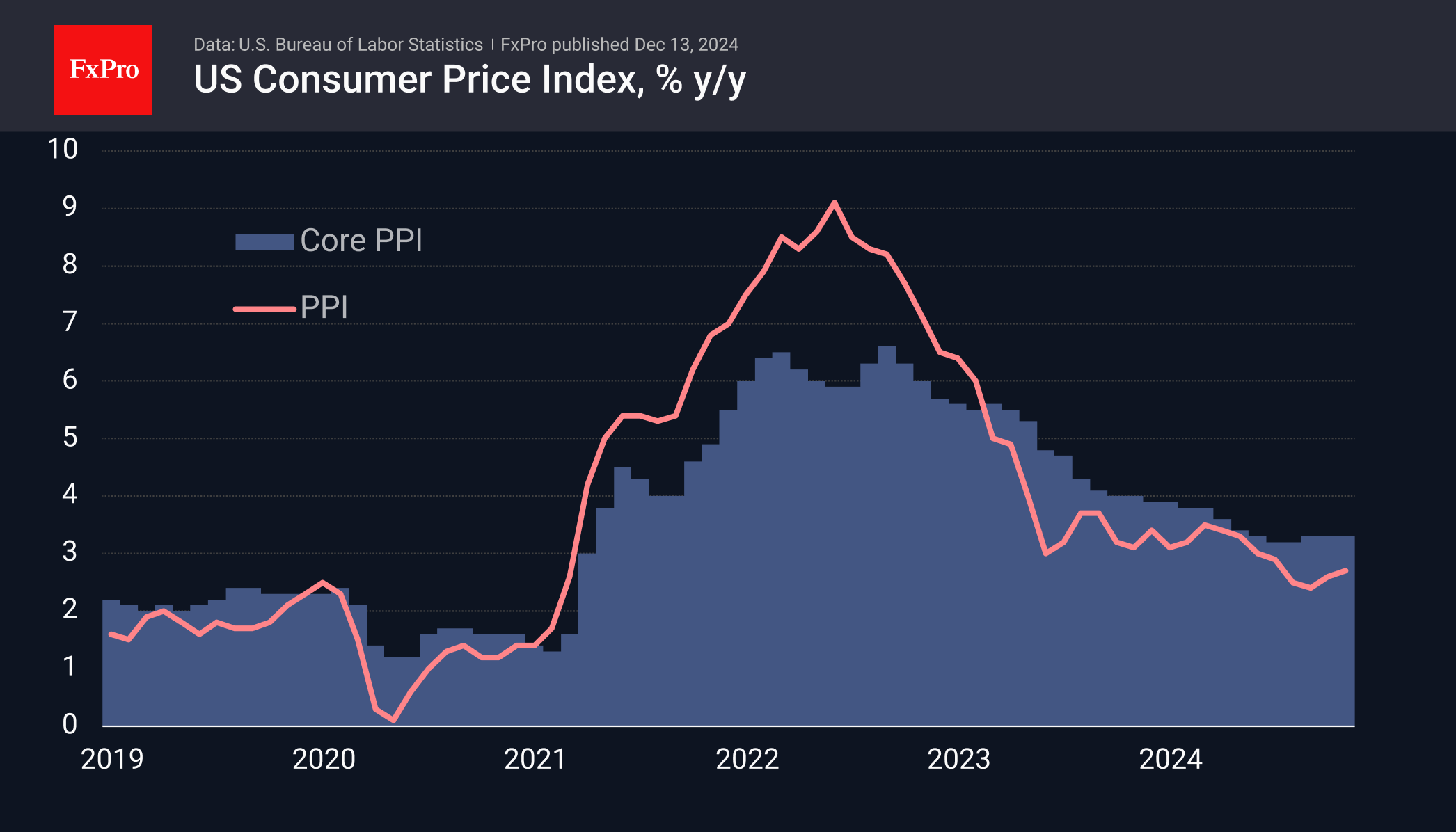

On Tuesday, we will see the release of US retail sales and industrial production figures. While retail sales have risen smoothly without causing concern, the industrial production index has fallen in three out of the last four months.

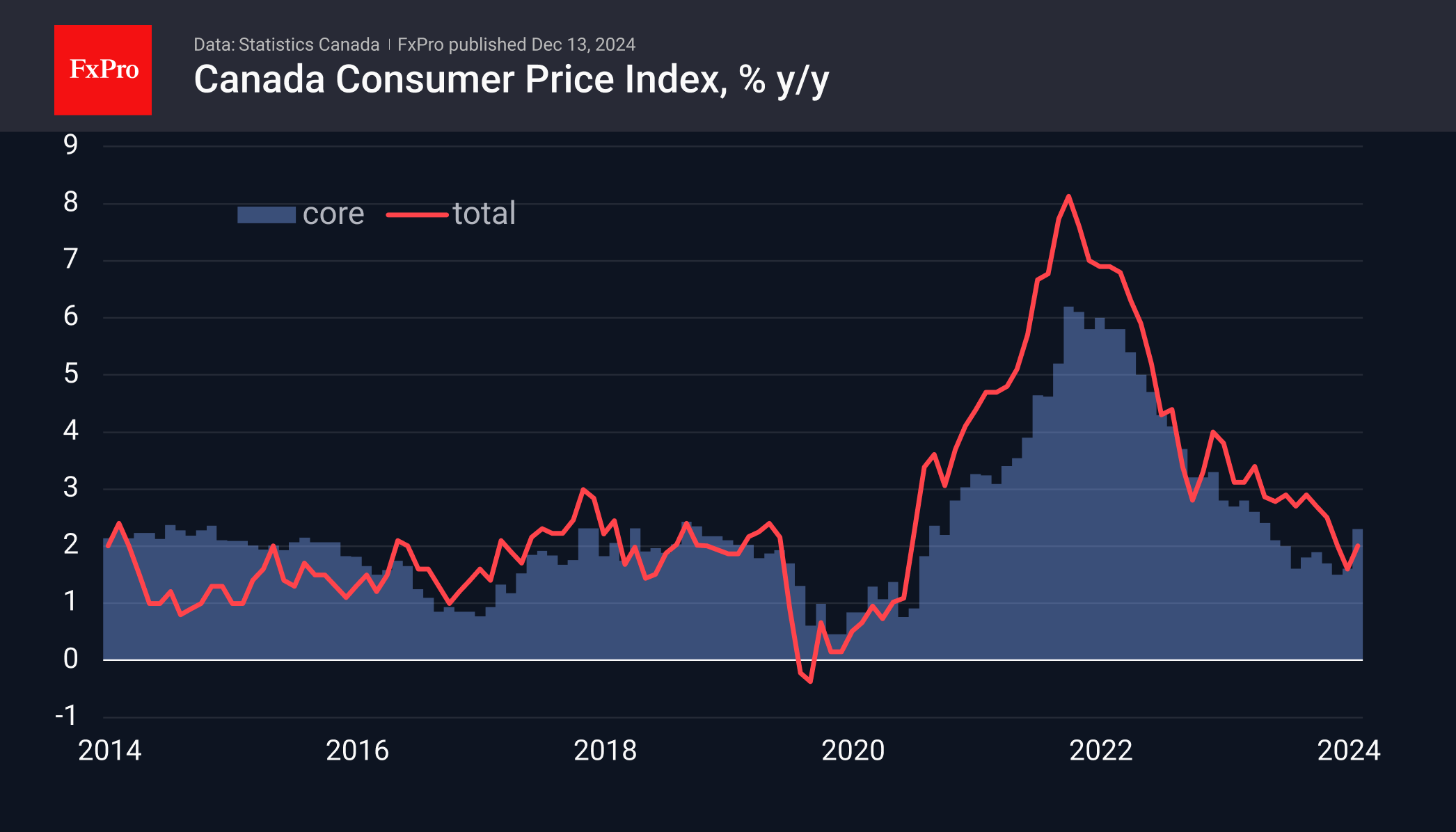

At the same time, Canadian inflation data will be released. It has stabilised at 2%, but there could be surprises. CAD weakness creates upside risks, while the economic slowdown creates downside risks.

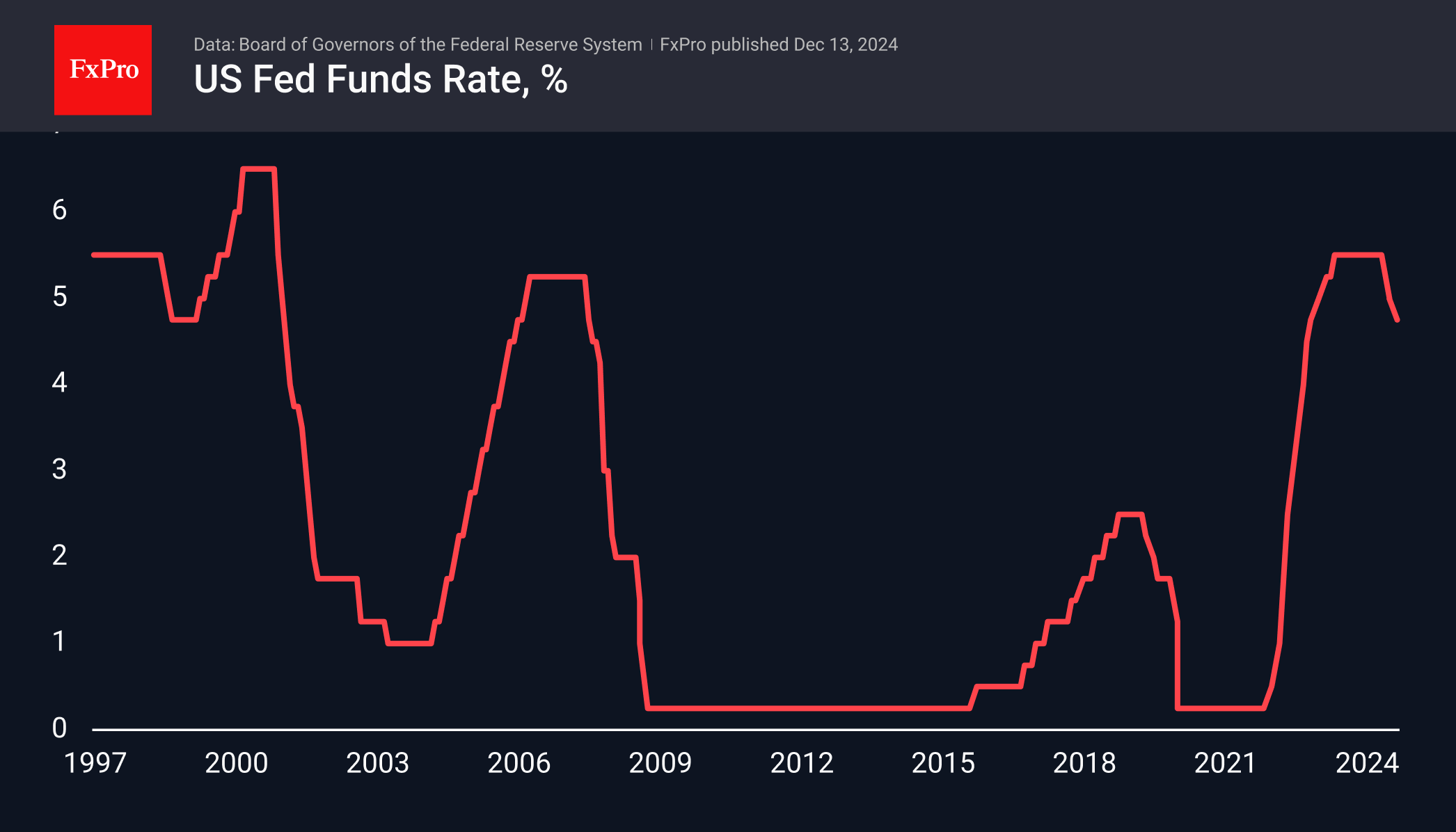

On Wednesday evening, all eyes will be on the Fed. A 25-point rate cut is a foregone conclusion. The main trigger will be the Fed's forecast of its next steps and its assessment of the economic outlook. This event has the highest potential for volatility and could set the trend for the following weeks.

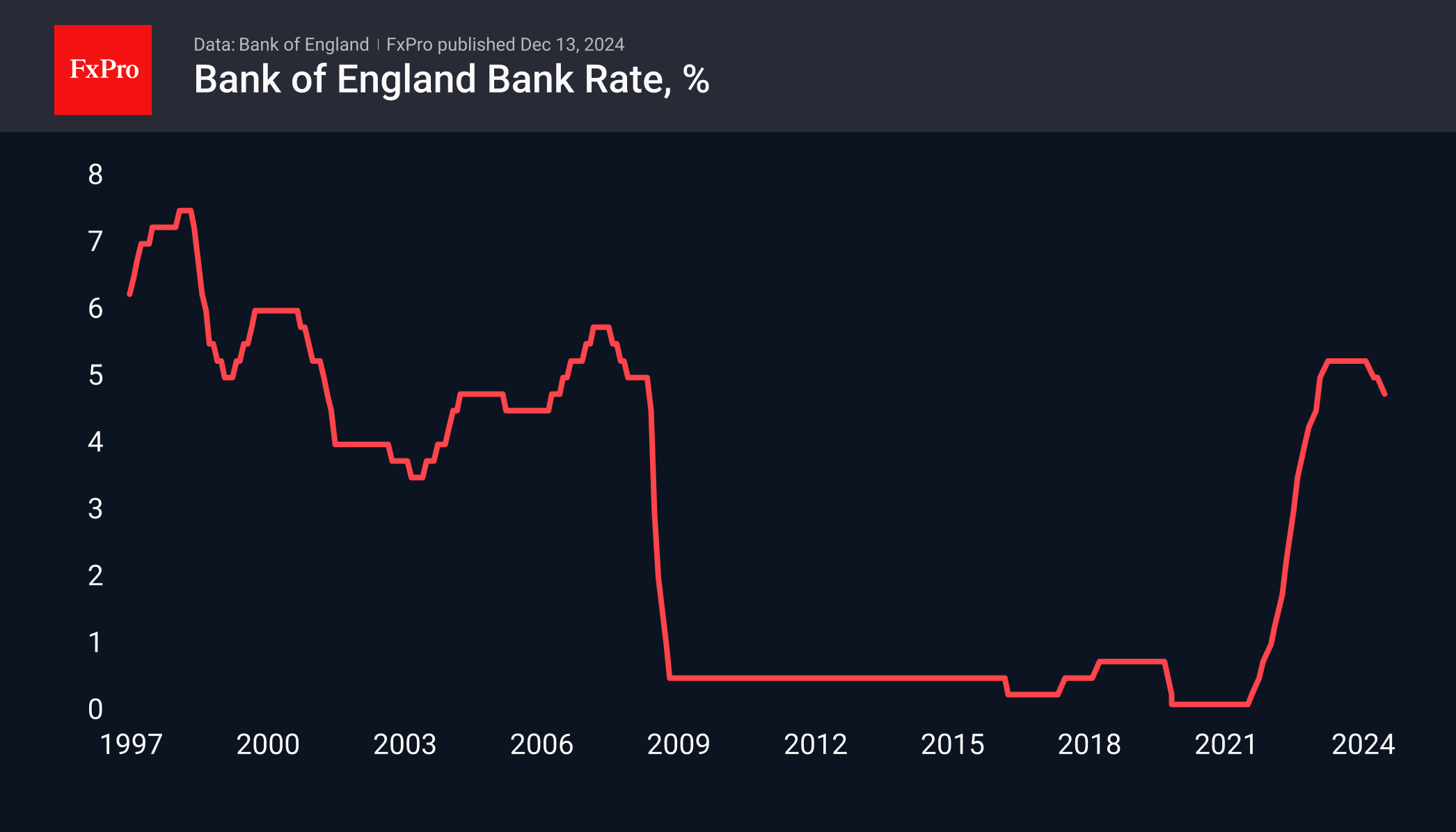

On Thursday, the Bank of England's key interest rate will be in focus. Analysts expect the central bank, which has decided to cut rates every other meeting, to hold off on easing this time. However, we see the potential for volatility in the event of an 'unexpected' cut.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)